Get the free Division of Income – Independent Student - stfrancis

Show details

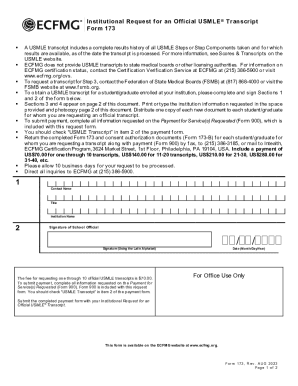

This form is used by independent students who are divorced, separated, or widowed to clarify the division of income reported on their financial aid application based on their previous year's IRS tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign division of income independent

Edit your division of income independent form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your division of income independent form via URL. You can also download, print, or export forms to your preferred cloud storage service.

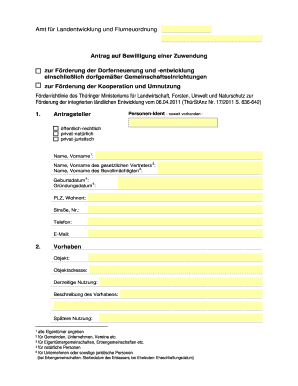

Editing division of income independent online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit division of income independent. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

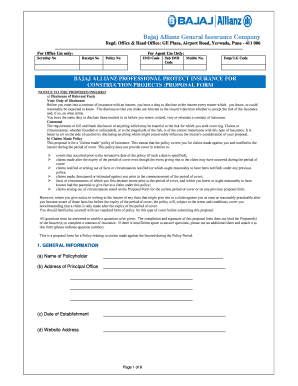

How to fill out division of income independent

How to fill out Division of Income – Independent Student

01

Gather all sources of income for the past year, including wages, investments, and any other income.

02

Fill out your personal information at the top of the form, ensuring accuracy.

03

List each source of income in the designated sections, specifying the amount earned from each source.

04

Include any tax-exempt income as directed by the form.

05

Calculate the total income by summing all reported amounts.

06

Review the form for completeness and accuracy before submitting.

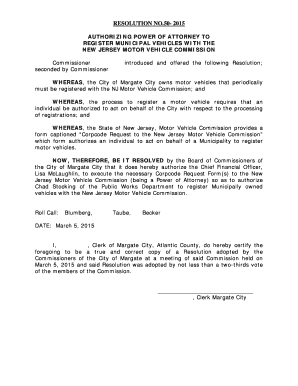

Who needs Division of Income – Independent Student?

01

Independent students applying for financial aid who have their own sources of income.

02

Students who do not qualify for parental financial information.

03

Individuals seeking to demonstrate their financial situation to aid in tuition funding.

Fill

form

: Try Risk Free

People Also Ask about

Do you get more money being independent or dependent?

Independent students can typically apply for income-based grants more easily than dependent students. If you make less money than your parents, filing for financial aid as an independent should increase the amount received for awards such as the Pell Grant. Independent students can also take out private loans.

What does it mean for a student to be independent?

An independent student is someone who is financially self-sufficient and does not rely on their parents or guardians for support. On the other hand, dependent students rely on their parents or guardians for financial assistance and must include their family's financial information in the FAFSA.

Do unusual circumstances prevent the student from contacting their parents or would contacting their parents pose a risk to the student?

Unusual circumstances may prevent a student from contacting their parents or pose risks in doing so. These situations often include family conflicts or safety concerns. It's important for schools to provide support systems to ensure the student's safety and well-being.

What is the professional Judgement policy?

Professional Judgment refers to the authority of a school's financial aid administrator to make adjustments to the data elements on the FAFSA and to override a student's dependency status.

Do independent students get more?

As the Department of Education notes: "If you're an independent student, you only need to include your income and assets (and those of your spouse if you're married)." This exclusion of parental resources can lead to higher aid for independent students, as parents often have higher incomes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

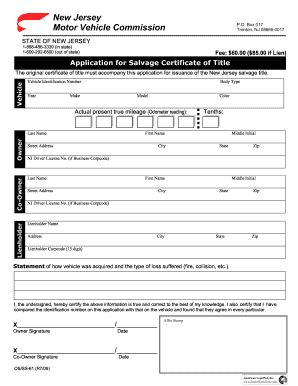

What is Division of Income – Independent Student?

The Division of Income – Independent Student is a financial document used to report the income of independent students for the purpose of determining financial aid eligibility.

Who is required to file Division of Income – Independent Student?

Independent students who are applying for financial aid or scholarships that require an assessment of their personal income are required to file the Division of Income – Independent Student.

How to fill out Division of Income – Independent Student?

To fill out the Division of Income – Independent Student, gather all relevant tax documents, report your income sources, and follow the specific instructions provided by the financial aid office or the institution's guidelines.

What is the purpose of Division of Income – Independent Student?

The purpose of the Division of Income – Independent Student is to provide a clear account of an independent student's financial situation, which is necessary for calculating their eligibility for financial aid.

What information must be reported on Division of Income – Independent Student?

The Division of Income – Independent Student must report total income, sources of income (such as employment, investments, and other earnings), and any deductions or adjustments applicable to the independent student's financial situation.

Fill out your division of income independent online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Division Of Income Independent is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.