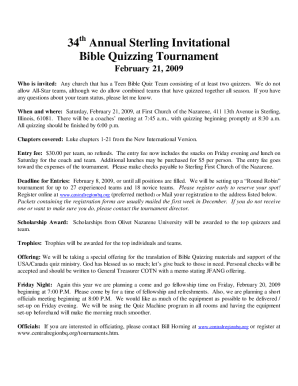

Get the free Independent Verification Form (E‐25) - sc

Show details

This form is used for the verification process of the 2012‐13 FAFSA, requiring students to provide information about their family and income status.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign independent verification form e25

Edit your independent verification form e25 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your independent verification form e25 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit independent verification form e25 online

Follow the steps below to benefit from a competent PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit independent verification form e25. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out independent verification form e25

How to fill out Independent Verification Form (E‐25)

01

Obtain the Independent Verification Form (E‐25) from the relevant authority or organization.

02

Fill out the header section with the necessary details such as your name, organization, and contact information.

03

Provide the specific details required in the body of the form, including the nature of the verification and any relevant dates.

04

Attach any supporting documents that may be required to substantiate the verification.

05

Review the form for completeness and accuracy before submission.

06

Submit the completed form according to the instructions provided, either electronically or by mail.

Who needs Independent Verification Form (E‐25)?

01

Individuals or organizations involved in projects requiring independent verification of activities or outcomes.

02

Regulatory bodies needing verification for compliance purposes.

03

Auditors reviewing programs for accuracy and reliability.

04

Funding agencies requiring verification for grant disbursement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

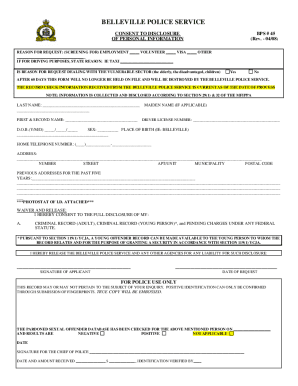

What is Independent Verification Form (E‐25)?

The Independent Verification Form (E‐25) is a document used to verify the accuracy and completeness of information submitted by a taxpayer or business in relation to their tax obligations.

Who is required to file Independent Verification Form (E‐25)?

Entities or individuals that engage in activities requiring third-party verification of tax-related information or compliance are typically required to file the Independent Verification Form (E‐25).

How to fill out Independent Verification Form (E‐25)?

To fill out the Independent Verification Form (E‐25), gather all necessary documentation related to tax records, follow the provided instructions on the form, provide accurate responses, and ensure all sections are completed before submission.

What is the purpose of Independent Verification Form (E‐25)?

The purpose of the Independent Verification Form (E‐25) is to provide a standardized way to confirm the information provided by taxpayers, ensuring transparency and compliance with tax regulations.

What information must be reported on Independent Verification Form (E‐25)?

The information that must be reported on Independent Verification Form (E‐25) typically includes taxpayer identification details, income statements, deductions, credits claimed, and any relevant supporting documentation.

Fill out your independent verification form e25 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Independent Verification Form e25 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.