Get the free Non-Citizen Form - web utk

Show details

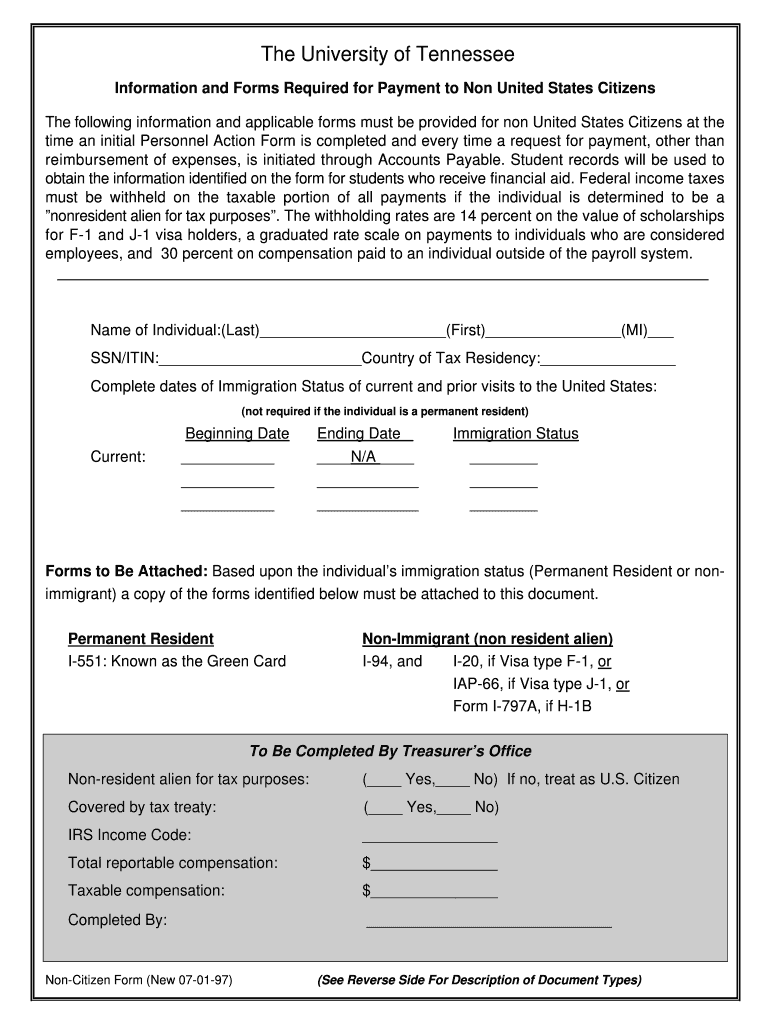

This document outlines the necessary information and forms required for non-U.S. citizens when requesting payments, detailing tax withholding requirements and immigration status documentation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign non-citizen form - web

Edit your non-citizen form - web form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your non-citizen form - web form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit non-citizen form - web online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit non-citizen form - web. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out non-citizen form - web

How to fill out Non-Citizen Form

01

Obtain the Non-Citizen Form from the appropriate government website or office.

02

Read the instructions carefully to understand the requirements.

03

Fill out your personal information, including your full name, date of birth, and country of origin.

04

Provide your current address and contact information.

05

Indicate your immigration status and attach any necessary documents to support your application.

06

Review the form for accuracy and completeness before submission.

07

Submit the form via the designated method (online, mail, or in-person) along with any required fees.

Who needs Non-Citizen Form?

01

Individuals who are not U.S. citizens but need to declare their status for legal or immigration purposes.

02

Residents who are applying for benefits, visas, or other services that require verification of non-citizen status.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a non-citizen?

Non-Citizen National: A person born in an outlying possession of the U.S. (e.g., American Samoa or Swain's Island) on or after the date the U.S. acquired the possession, or a person whose parents are U.S. non-citizen nationals. All U.S. citizens are U.S. nationals; however, not every U.S. national is a U.S. citizen.

What is another word for non-citizen?

In 2021, The Biden Administration began to seek the change of the word “alien” to “non-citizen” in recognition of the negative connotations behind the word. Currently the term most commonly used is “immigrant”.

What is a non-U.S. citizen called?

An alien is any individual who is not a U.S. citizen or U.S. national. A nonresident alien is an alien who has not passed the green card test or the substantial presence test.

What is the difference between citizen and non-citizen?

ing to Merriam Webster's Collegiate Dictionary, “a citizen is a member of a state to whom he or she owes allegiance and is entitled to its protection.” Hence, from this definition, it is implicit that a non-citizen is someone who is not a member of a state nor owes allegiance to the state he or she currently

Which person is a non-citizen?

The federal definition of a “foreign person/national” is a person who is NOT: Granted permanent U.S. residence, as demonstrated by the issuance of a permanent residence card, i.e., a "Green Card" Granted U.S. citizenship.

What is US eligible non-citizen?

The general requirement for eligible noncitizens is that they be in the U.S. for other than a temporary purpose with the intention of becoming a citizen or lawful permanent resident as evidenced by the United States Citizenship and Immigration Services (USCIS) in the Department of Homeland Security (DHS).

What is the meaning of non-citizen?

Meaning of noncitizen in English a person who is not a citizen (= a member of a particular country who has certain rights): Noncitizens cannot vote in national elections. As a non-citizen, she cannot get a job without a work permit.

What is the meaning of non-citizen in English?

Definitions of noncitizen. noun. a person who comes from a foreign country; someone who does not owe allegiance to your country. synonyms: alien, foreigner, outlander.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Non-Citizen Form?

The Non-Citizen Form is a document used by non-citizens to report their information for tax purposes or to comply with certain legal requirements in a country, especially in the context of the United States.

Who is required to file Non-Citizen Form?

Non-citizens who earn income in the country, are required to report their tax status, or need to provide information for legal compliance typically must file the Non-Citizen Form.

How to fill out Non-Citizen Form?

To fill out the Non-Citizen Form, individuals need to provide their personal information, details regarding their income, tax identification number if applicable, and any other requested information specifically related to their tax status.

What is the purpose of Non-Citizen Form?

The purpose of the Non-Citizen Form is to ensure that non-citizens fulfill their tax obligations, report their income accurately, and comply with regulatory requirements in the jurisdiction where they are earning income.

What information must be reported on Non-Citizen Form?

The information that must be reported on the Non-Citizen Form includes personal identification details, income sources, amounts earned, tax identification numbers, and other relevant financial data as required by the tax authorities.

Fill out your non-citizen form - web online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Non-Citizen Form - Web is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.