Get the free Information and Forms Required for Payment to Non United States Citizens - payroll t...

Show details

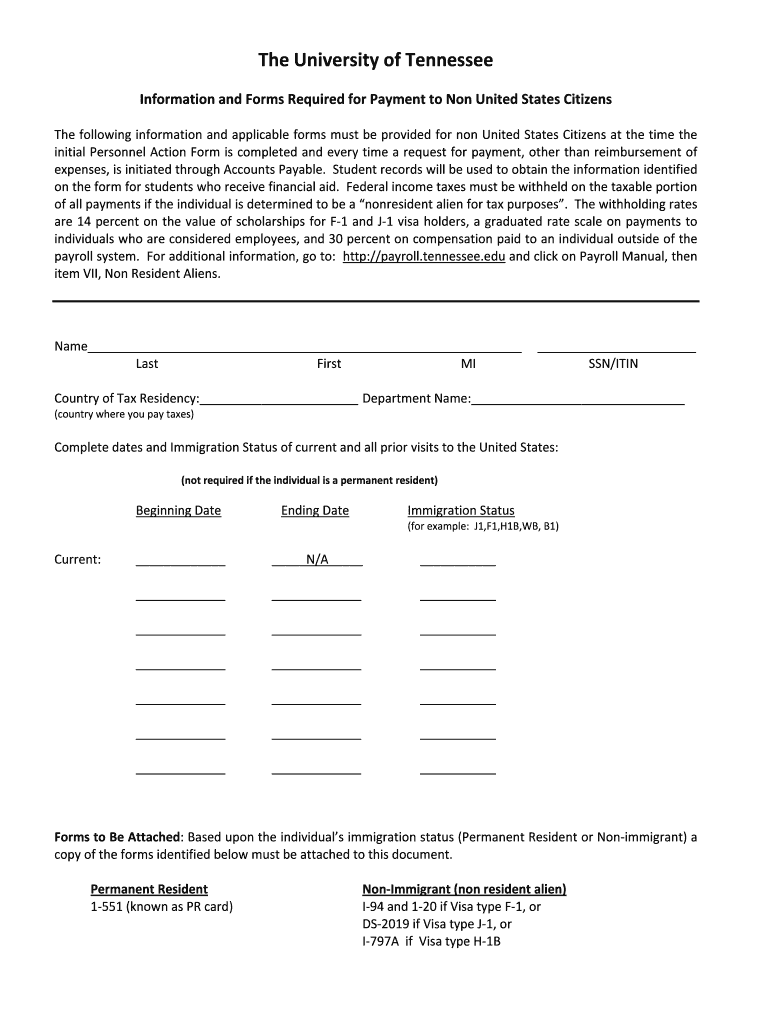

This document outlines the necessary information and forms required for making payments to non US citizens, including tax withholding details and forms based on immigration status.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign information and forms required

Edit your information and forms required form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your information and forms required form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit information and forms required online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit information and forms required. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out information and forms required

How to fill out Information and Forms Required for Payment to Non United States Citizens

01

Gather the necessary information about the non-U.S. citizen recipient, including their full name, address, and taxpayer identification number (if available).

02

Determine the type of payment being made and check if it qualifies for payment to a non-U.S. citizen.

03

Obtain and fill out IRS Form W-8BEN or W-8BEN-E, depending on whether the recipient is an individual or a business entity.

04

Ensure the form is signed and dated by the non-U.S. citizen recipient.

05

Submit the completed form along with any additional required documentation to your financial institution or the entity processing the payment.

06

Keep a copy of the completed forms and any correspondence for your records.

Who needs Information and Forms Required for Payment to Non United States Citizens?

01

Any business or individual making payments to non-U.S. citizens, including service providers, contractors, or vendors.

02

Taxpayers who are required to report payments made to foreign individuals or entities for compliance with U.S. tax laws.

Fill

form

: Try Risk Free

People Also Ask about

What forms do I need for taxes in the USA?

Forms W-2, 1099 or other information returns Form 1099-K for payments from payment cards and online marketplaces. Form 1099-G for government payments such as unemployment benefits. Form 1099-INT from banks and brokers showing interest you received. Form 1099-DIV for dividends and distributions paid to you.

What tax forms do non U.S. citizens need?

Nonresident aliens who are required to file an income tax return must use Form 1040-NR, U.S. Nonresident Alien Income Tax Return.

Do U.S. citizens need to pay taxes when living abroad?

Yes, if you are a U.S. citizen or a resident alien living outside the United States, your worldwide income is subject to U.S. income tax, regardless of where you live. However, you may qualify for certain foreign earned income exclusions and/or foreign income tax credits.

What form do I use for foreign income?

Form 2555. You must attach Form 2555, Foreign Earned Income, to your Form 1040 or 1040X to claim the foreign earned income exclusion, the foreign housing exclusion or the foreign housing deduction.

How do I report U.S. business payments to foreign individuals?

Withholding when U.S. source FDAP is paid to foreign persons, called "Chapter 3" or NRA withholding – IRC 1441–1443 and 1461–1464. You are required to report payments subject to NRA withholding on Form 1042-S and to file a tax return on Form 1042.

What is the difference between Form 1040 and 1040NR?

The choice between Form 1040 and Form 1040NR largely depends on your residency status, which influences both income reporting and deductions. For nonresident aliens, Form 1040NR should be used to report U.S.-sourced income only, while Form 1040 requires U.S. residents and citizens to report their worldwide income.

Do non-US citizens need a 1099?

Conversely, if the independent contractor is not a US person and did not perform any of their services within the US, you will not be required to issue Form 1099. Instead, the foreign contractor will have to complete and file Form W-8BEN.

Do non-US citizens have to file taxes?

You must file a return if you are a nonresident alien engaged or considered to be engaged in a trade or business in the United States during the year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Information and Forms Required for Payment to Non United States Citizens?

The Information and Forms Required for Payment to Non United States Citizens typically include tax forms and documentation that report payments made to non-U.S. residents and ensure compliance with U.S. tax laws.

Who is required to file Information and Forms Required for Payment to Non United States Citizens?

Any U.S. entity or individual making payments to non-U.S. residents, such as foreign contractors, vendors, or service providers, is required to file these forms.

How to fill out Information and Forms Required for Payment to Non United States Citizens?

To fill out these forms, one must gather relevant information about the payee, such as their identification details, the nature of the payment, and ensure correct application of tax withholding rates before submitting the forms to the IRS.

What is the purpose of Information and Forms Required for Payment to Non United States Citizens?

The purpose of these forms is to report income paid to non-U.S. persons and ensure that appropriate taxes are withheld, thereby complying with the Internal Revenue Code and preventing tax evasion.

What information must be reported on Information and Forms Required for Payment to Non United States Citizens?

Information that must be reported includes the payee's name, address, taxpayer identification number (TIN), the amount paid, and the nature of the services rendered or the income type.

Fill out your information and forms required online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Information And Forms Required is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.