Get the free Student Aid Eligibility Worksheet - utb

Show details

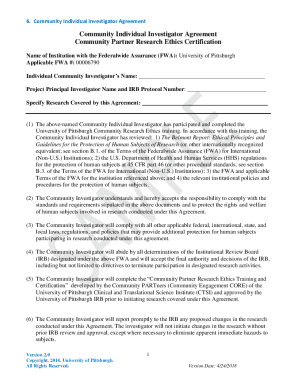

This worksheet is used to determine a student's eligibility for federal student aid if they have reported a conviction for possessing or selling illegal drugs on their FAFSA application.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign student aid eligibility worksheet

Edit your student aid eligibility worksheet form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your student aid eligibility worksheet form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing student aid eligibility worksheet online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit student aid eligibility worksheet. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out student aid eligibility worksheet

How to fill out Student Aid Eligibility Worksheet

01

Gather all necessary financial documents, such as tax returns and income statements.

02

Obtain a copy of the Student Aid Eligibility Worksheet from your educational institution or its website.

03

Complete the personal information section, including your name, address, and student ID.

04

Fill out the income section with your and your family's income details as required.

05

List any additional financial support or benefits you receive.

06

Follow the instructions for reporting assets and any other financial information requested.

07

Review the completed worksheet for accuracy and ensure all information is provided.

08

Submit the worksheet by the specified deadline to your school's financial aid office.

Who needs Student Aid Eligibility Worksheet?

01

Students who are applying for financial aid to help cover educational expenses.

02

Students who wish to determine their eligibility for needs-based financial assistance.

03

Students who may not qualify for federal aid but still need to assess potential school-specific aid options.

04

Families who need to clarify the financial situation for aid consideration.

Fill

form

: Try Risk Free

People Also Ask about

What is the maximum income to qualify for FAFSA?

There are no income limits to apply, and many state and private colleges use the FAFSA to determine your financial aid eligibility.

What is the maximum financial aid I can get?

$20,500 (unsubsidized only). $31,000-No more than $23,000 of this amount may be in subsidized loans. $57,500 for undergraduates-No more than $23,000 of this amount may be in subsidized loans. $138,500 for graduate or professional students-No more than $65,500 of this amount may be in subsidized loans.

What is the maximum amount of student loans you can get?

For federal direct student loans, undergraduates can borrow up to $12,500 annually and up to $57,500 total. Graduate students can borrow up to $20,500 annually and $138,500 total, including their undergraduate borrowing. Federal PLUS loans are capped at your school's total cost of attendance.

What is the minimum credits for student aid?

Full-time status 12 credit hours or more- receive full Pell Grant award amount. 3/4 time status 9-11 credit hours- receive 3/4 of Pell Grant award amount. 1/2 time status 6-8 credit hours- receive 1/2 of Pell Grant award amount. 1/4 time status 1-5 credit hours- receive 1/4 of Pell Grant award amount.

What is the maximum amount of student aid?

$57,500 for undergraduates-No more than $23,000 of this amount may be in subsidized loans. $138,500 for graduate or professional students-No more than $65,500 of this amount may be in subsidized loans. The graduate aggregate limit includes all federal loans received for undergraduate study.

What's the highest student loan I can get?

What's available Student's living arrangementsMaximum Maintenance Loan for the 2024/25 academic year Living with parents £8,610 Studying in London and not living with parents £13,348 Studying outside London and not living with parents £10,227 Living and studying abroad for at least one term as part of their UK course £11,713

What is the maximum student allowance you can get?

If you're under 40, you can get a Student Allowance for 200 weeks of tertiary study (around 5 years). If you're over 40, you can get a Student Allowance for 120 weeks of tertiary study (around 3 years). This includes any weeks of Student Allowance you've had before.

What is the #1 most common FAFSA mistake?

Some of the most common FAFSA errors are: Forgetting to sign and date: If you're filling out the paper FAFSA, be sure to sign it. Sending in a copy of your income tax returns: You do not need to include a copy of your tax returns with your FAFSA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Student Aid Eligibility Worksheet?

The Student Aid Eligibility Worksheet is a document used to determine a student's eligibility for federal student aid programs. It assists in calculating the Expected Family Contribution (EFC) based on financial information provided.

Who is required to file Student Aid Eligibility Worksheet?

Students who are applying for federal student aid, particularly those who have unusual financial circumstances that are not reflected in the Free Application for Federal Student Aid (FAFSA), are required to file the Student Aid Eligibility Worksheet.

How to fill out Student Aid Eligibility Worksheet?

To fill out the Student Aid Eligibility Worksheet, you must complete sections that collect personal and financial information, report income, list household members, and provide any necessary documentation that supports the information provided.

What is the purpose of Student Aid Eligibility Worksheet?

The purpose of the Student Aid Eligibility Worksheet is to give financial aid administrators a clearer picture of a student's financial situation, allowing them to make informed decisions about awarding aid based on the student's actual need.

What information must be reported on Student Aid Eligibility Worksheet?

The information that must be reported includes income details (both student and parent if applicable), household size, number of family members in college, any special circumstances regarding finances, and other relevant financial data.

Fill out your student aid eligibility worksheet online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Student Aid Eligibility Worksheet is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.