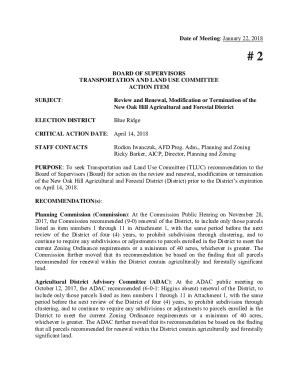

Get the free Cash and Receivables

Show details

This document explains the management and internal control of cash and receivables, including cash equivalents, reconciliation processes, and classification of cash items on balance sheets.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cash and receivables

Edit your cash and receivables form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cash and receivables form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing cash and receivables online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit cash and receivables. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cash and receivables

How to fill out Cash and Receivables

01

Open the Cash and Receivables section in your accounting software or financial statement form.

02

Identify the total cash balance from all sources, including petty cash, bank accounts, and cash equivalents.

03

List all accounts receivable, detailing each customer or client who owes money.

04

For each account receivable, include the amount owed, the due date, and any relevant invoices or documentation.

05

Summarize the total accounts receivable by calculating the sum of all outstanding amounts.

06

Input the summarized cash and receivables totals in their respective fields on the form.

07

Review for accuracy and completeness before finalizing the document.

Who needs Cash and Receivables?

01

Businesses looking to track their cash flow and outstanding payments.

02

Accountants and financial analysts managing company finances.

03

Investors evaluating the liquidity and financial stability of a company.

04

Banks and lending institutions assessing creditworthiness for loans.

Fill

form

: Try Risk Free

People Also Ask about

What is AP and AR?

Accounts payable (AP): Represents liabilities, money the company owes. Accounts receivable (AR): Represents assets, money the company is owed. This example demonstrates how both accounts payable and accounts receivable are essential to managing cash flow.

What is the difference between AP and AR aging?

A detailed AP aging report shows invoices with reference number, due date, payment terms, and balance due. The opposite of accounts payable aging report is an accounts receivable report, which outlines when a business can expect payment from their customers.

What is account receivable in English?

Accounts receivable (AR) is the term used to describe money owed to a business by its customers for purchases made on credit. It's listed as a current asset on the balance sheet, representing the total value of outstanding invoices for products or services sold but not yet paid for.

What is the difference between cash and receivables?

Here it's important to note that accounts receivable are technically considered cash. After all, you have the legal right to collect them from your clients and turn them into cash.

What is the difference between AP and AR?

A company's accounts payable (AP) ledger lists its short-term liabilities — obligations for items purchased from suppliers, for example, and money owed to creditors. Accounts receivable (AR) are funds the company expects to receive from customers and partners.

What is the AP and AR process?

?Key Differences Accounts Receivable ProcessAccounts Payable Process Generating an Invoice Sending the invoice Recording the invoice Monitoring payment Receiving payment Receiving an invoice Verifying the invoice Recording the invoice Scheduling payment Making Payment Jul 10, 2024

What is AP and AR position?

Accounts receivable (AR) and accounts payable (AP) roles are essential to maintaining an organization's financial health. These positions offer opportunities for growth, whether you're just starting in the accounting field or looking to advance your career.

What do receivables mean?

In accounting, receivable refers to the amounts owed to a company by its customers or clients for goods sold or services rendered on credit. The receivable entry in bookkeeping essentially represents the money a business is expected to receive in the future.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Cash and Receivables?

Cash and Receivables refers to the assets that a company holds in the form of cash or cash equivalents, and amounts owed to the company by customers for goods or services delivered, which are expected to be collected.

Who is required to file Cash and Receivables?

Businesses that prepare financial statements or are subject to auditing requirements typically need to file Cash and Receivables. This includes corporations, partnerships, and certain sole proprietorships.

How to fill out Cash and Receivables?

To fill out Cash and Receivables, list all cash balances held, including in bank accounts and petty cash, and detail all receivables, categorizing them by aging (e.g., current, 30 days, 60 days) and indicating any allowances for doubtful accounts.

What is the purpose of Cash and Receivables?

The purpose of Cash and Receivables is to provide a clear understanding of a company's liquidity and cash flow position. It assists in assessing financial health and ensuring that the company can meet its short-term obligations.

What information must be reported on Cash and Receivables?

The information reported on Cash and Receivables typically includes total cash balances, details of accounts receivable, their aging analysis, allowances for uncollectibles, and any notes on significant receivables.

Fill out your cash and receivables online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cash And Receivables is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.