Get the free Payor Distribution Form - research uthscsa

Show details

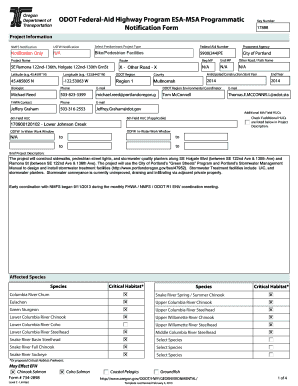

This form records the monetary value of cash and gift cards, or the count of gift items issued to a Payor or returned by a Payor, with separate lines for issued and returned transactions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign payor distribution form

Edit your payor distribution form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your payor distribution form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payor distribution form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit payor distribution form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out payor distribution form

How to fill out Payor Distribution Form

01

Obtain the Payor Distribution Form from the relevant agency or organization.

02

Fill in the date at the top of the form.

03

Provide your name and contact information in the designated section.

04

Enter the names and details of all payors involved in the distribution.

05

Specify the distribution amounts for each payor clearly.

06

Attach any necessary supporting documents, such as agreements or invoices.

07

Review the form for completeness and accuracy.

08

Sign and date the form at the bottom.

09

Submit the completed form to the required department or individual.

Who needs Payor Distribution Form?

01

Individuals or businesses that receive payments from multiple sources.

02

Accountants or financial professionals managing payor distributions.

03

Organizations that need to report and allocate funds to various payors.

04

Tax professionals preparing tax documentation for clients receiving distributions.

Fill

form

: Try Risk Free

People Also Ask about

Who is considered the payer?

Understanding Payers In a purchase agreement, the payer can be the person or company purchasing an item or service. The payee is the one receiving payment and often delivering that good or service.

What is an example of a payer?

Payers in the health care industry are organizations — such as health plan providers, Medicare, and Medicaid — that set service rates, collect payments, process claims, and pay provider claims. Payers are usually not the same as providers.

Who is called a payer?

A payor (also referred to as a “payer”) is the party that is submitting payment in a financial transaction or obligation. Payor is not to be confused with payee, which is the person or party who receives payment.

Who is a payor?

Payor is used interchangeably with “payer”. The person making the payment, satisfying the claim, or settling a financial obligation. For example, the person writing a check is the payor, or an employer paying their worker is the payor. [Last reviewed in August of 2020 by the Wex Definitions Team ]

What is an example of a payor?

The payor is a person who pays money in exchange for goods or services. Examples include paying for utilities, clothing, groceries, and mechanical work. For example, a corporation becomes a payor when writing paychecks or purchasing new equipment. The government is a payor when issuing tax refunds.

What is the IRS form for distributions?

More In Forms and Instructions File Form 1099-R for each person to whom you have made a designated distribution or are treated as having made a distribution of $10 or more from: Profit-sharing or retirement plans. Any individual retirement arrangements (IRAs).

What is a payer?

The definition of a payer (or payor) is an organization, entity, or person, that negotiates or sets rates for healthcare services supplied by providers, collects premiums and other payments from individuals and plan sponsors, processes claims, and pays providers using premiums.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Payor Distribution Form?

The Payor Distribution Form is a document used to report the distribution of payments made by payors to recipients, primarily for tax purposes.

Who is required to file Payor Distribution Form?

Entities or individuals that make reportable payments to another party, such as businesses and organizations that provide services or payments subject to tax reporting, are required to file the Payor Distribution Form.

How to fill out Payor Distribution Form?

To fill out the Payor Distribution Form, follow these steps: 1. Provide the payor's information, including name and tax identification number. 2. Enter the recipient's information. 3. Detail the types and amounts of payments made. 4. Sign and date the form before submission.

What is the purpose of Payor Distribution Form?

The purpose of the Payor Distribution Form is to ensure accurate reporting of payments made to individuals or entities for tax compliance, helping both payors and recipients fulfill their tax obligations.

What information must be reported on Payor Distribution Form?

The Payor Distribution Form must report information such as the payor's and recipient's names, addresses, tax identification numbers, payment amounts, and the nature of the payment.

Fill out your payor distribution form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Payor Distribution Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.