Get the free Letter of Agreement and Promissory Note - ate utsa

Show details

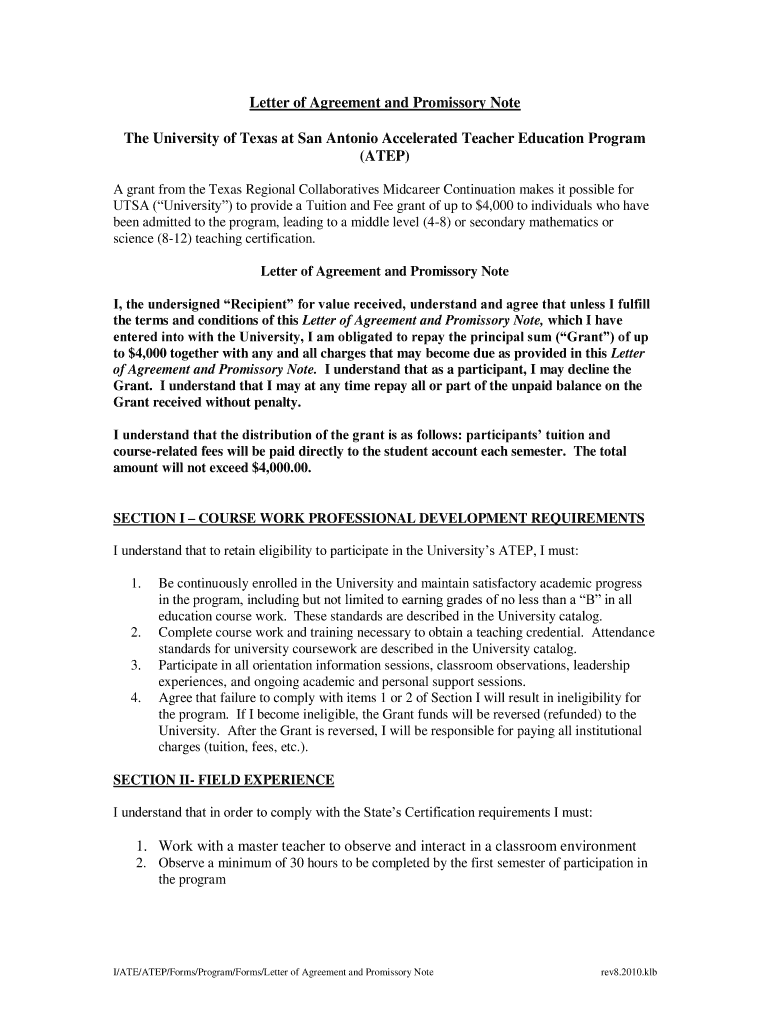

This document outlines the terms and conditions for recipients of the Tuition and Fee grant from the University of Texas at San Antonio's Accelerated Teacher Education Program, including eligibility

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign letter of agreement and

Edit your letter of agreement and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your letter of agreement and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit letter of agreement and online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit letter of agreement and. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out letter of agreement and

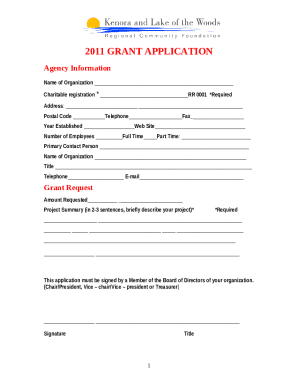

How to fill out Letter of Agreement and Promissory Note

01

Start with your personal information at the top, including your name and address.

02

Clearly state the date of the agreement.

03

Write the names and addresses of all parties involved.

04

Title the document as 'Letter of Agreement' or 'Promissory Note' as appropriate.

05

Define the purpose of the agreement or loan, including the amount involved.

06

Outline the terms of the agreement, including repayment schedule, interest rates, and any other relevant conditions.

07

Include a section for signatures to make the agreement legally binding.

08

Make copies for all parties involved for their records.

Who needs Letter of Agreement and Promissory Note?

01

Individuals or businesses entering into a loan agreement.

02

Clients and service providers formalizing the terms of a service agreement.

03

Parties involved in partnerships needing to delineate responsibilities.

04

Anyone needing a written record of financial transactions or commitments.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a promissory note and a contract?

The fundamental difference between promissory notes and contracts lies in their scope and purpose. While promissory notes are specifically designed to represent a promise to pay a fixed monetary amount, contracts can encompass a wide array of obligations and agreements, including non-monetary exchanges.

What is a promissory note classified as?

Loan contracts The term "loan contract" is often used to describe a contract that is lengthy and detailed. A promissory note is very similar to a loan. Each is a legally binding contract to unconditionally repay a specified amount within a defined time frame.

Is a promissory note a letter?

A promissory note is essentially a written promise to pay someone. This type of document is common in financial services and is something you've likely signed in the past if you've taken out any kind of loan.

How to write a promissory note in English?

But what exactly do you need to write a promissory note? Include their full legal names, addresses, and contact numbers — include any co-signers if applicable. The terms of this note should specify the amount borrowed, repayment terms (including interest rate, if applicable), and the due date or schedule of payments.

What is the difference between a promissory note and an agreement?

A promissory note is usually shorter and less formal than a loan agreement, as it only outlines the repayment terms while ignoring many specific contractual terms. You'll likely issue a promissory note to a borrower if you lend money to a family member or investor for real estate purposes.

What are the disadvantages of a promissory note?

Some possible disadvantages are: You will likely pay a higher interest rate than for a secured loan. If you are using a promissory note because you don't have a good credit rating, you will likely pay a higher interest rate than if you obtained a commercial business loan from a bank or other institution.

Is a promissory note a debt agreement?

A form of debt instrument, a promissory note represents a written promise on the part of the issuer to pay back another party. A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature.

Is a promissory note the same as a letter of credit?

A surety bond and letter of credit act as a promissory note that that guarantees payment to a third party, and they're used in business transactions to build trust and protect parties from losses.

Should I use a promissory note or a loan agreement?

A loan agreement is a contract between a borrower and a lender that specifies what each party has agreed to. A promissory note is where one party promises, in writing, to pay a set amount to the other ing to their agreement. While they're similar, loan agreements and promissory notes are not the same thing.

Is a promissory note the same as a letter of credit?

A surety bond and letter of credit act as a promissory note that that guarantees payment to a third party, and they're used in business transactions to build trust and protect parties from losses.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Letter of Agreement and Promissory Note?

A Letter of Agreement is a document that outlines the terms and conditions of a mutual understanding between parties, while a Promissory Note is a written promise to pay a specified amount of money to a person or entity at a predetermined time.

Who is required to file Letter of Agreement and Promissory Note?

Typically, parties involved in a financial transaction or agreement that requires legal documentation are required to file a Letter of Agreement and Promissory Note to formalize the terms.

How to fill out Letter of Agreement and Promissory Note?

To fill out these documents, include the names and addresses of all parties, the specific terms of the agreement or loan, payment amounts, due dates, and signatures of all parties involved.

What is the purpose of Letter of Agreement and Promissory Note?

The purpose is to provide a clear and legally binding record of the terms agreed upon by the parties involved, ensuring that both sides understand their obligations and rights.

What information must be reported on Letter of Agreement and Promissory Note?

Information that must be reported includes the names of the parties, date of the agreement, the principal amount, interest rate (if applicable), repayment schedule, and any terms regarding default or penalties.

Fill out your letter of agreement and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Letter Of Agreement And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.