Get the free UTSA EDUCATION LOAN FORGIVENESS PROGRAM - education utsa

Show details

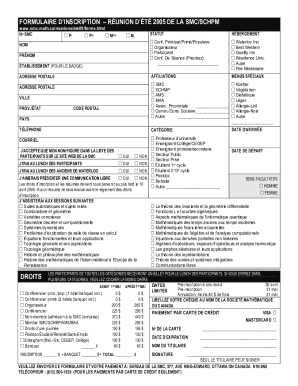

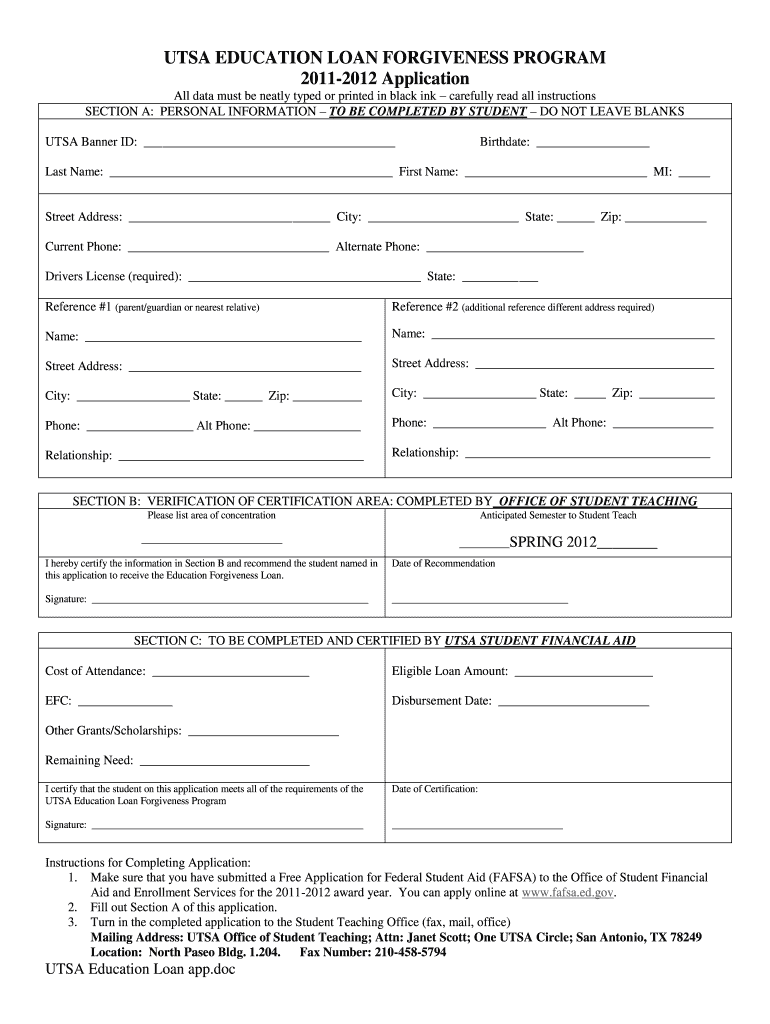

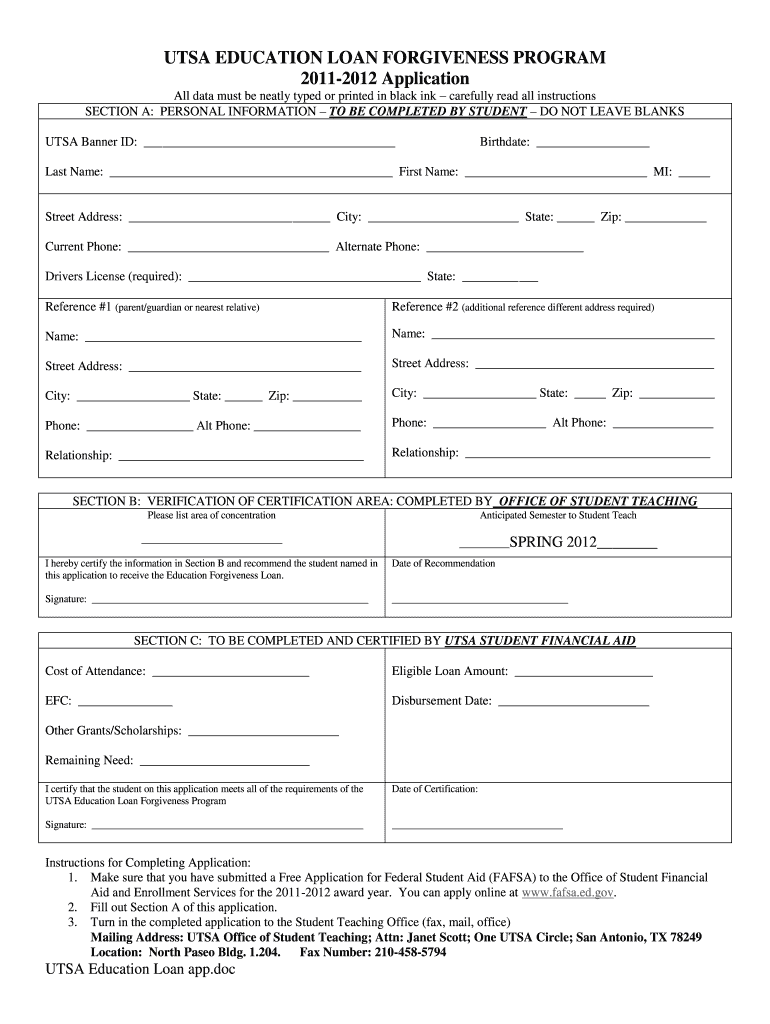

Application for the UTSA Education Loan Forgiveness Program, including sections for personal information, verification of certification, and financial aid certification.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign utsa education loan forgiveness

Edit your utsa education loan forgiveness form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your utsa education loan forgiveness form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing utsa education loan forgiveness online

Follow the steps down below to take advantage of the professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit utsa education loan forgiveness. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out utsa education loan forgiveness

How to fill out UTSA EDUCATION LOAN FORGIVENESS PROGRAM

01

Gather all necessary documentation, including your loan information and employment history.

02

Visit the UTSA Education Loan Forgiveness Program webpage to review eligibility requirements.

03

Complete the application form, providing accurate and detailed information.

04

Submit any additional documents required, such as proof of employment or residency.

05

Review your application carefully before submission to ensure all information is correct.

06

Submit your application before the deadline indicated on the website.

07

Follow up with the UTSA office to check the status of your application and provide any further information if requested.

Who needs UTSA EDUCATION LOAN FORGIVENESS PROGRAM?

01

Recent graduates with student loans who work in eligible public service positions.

02

Individuals employed by non-profit organizations that qualify for loan forgiveness.

03

Teachers working in low-income schools or specific educational roles.

04

Healthcare professionals serving in underserved communities.

05

Any person who has significant student loan debt and seeks relief through forgiveness options.

Fill

form

: Try Risk Free

People Also Ask about

How do I get my education loan forgiveness?

Public Service Loan Forgiveness (PSLF) The PSLF Program forgives the remaining balance on your Direct Loans after you've made the equivalent of 120 qualifying monthly payments while working full time for a qualifying employer.

Is there a deadline for student loan forgiveness?

To benefit, you must apply to consolidate your privately owned FFEL Program Loans into the Direct Loan Program by June 30, 2024. (Update: deadline has been extended to June 30, 2024.)

How long does it take to hear back about student loan forgiveness?

Once we've received all of the documentation needed to determine whether you qualify for loan forgiveness, you'll be notified. A final review of your account will be done to process forgiveness, which will take at least 90 business days.

Who qualifies for the student loan forgiveness program?

If you work or have worked in public service such as government (federal, U.S. Military, state, local, or tribal) or certain non-profit organizations, you might be eligible for the PSLF Program. Visit the Department of Education's website for the latest PSLF guidance.

Will student loans resume in September?

NCUA LETTER TO CREDIT UNIONS Federal student loan interest resumed on September 1, 2023, and payments restart in October 2023. As federal student loan payments restart, some credit union members may have difficulty meeting their repayment obligations.

When can I expect my student loan to be forgiven?

If you work full time for a government or nonprofit organization, you may qualify for forgiveness of the entire remaining balance of your Direct Loans after you've made 120 qualifying payments — i.e., at least 10 years of payments.

Will I be notified if I qualify for student loan forgiveness?

Your loan servicer will notify you when your forgiveness has been applied. It may take some time for your account with your servicer to reflect this change.

Is there still time to apply for student loan forgiveness?

Student loan forgiveness is still available in 2025, but only if you qualify. PSLF, IDR forgiveness, Teacher Loan Forgiveness, and Borrower Defense are still active. The SAVE plan is blocked, but other IDR plans still count. If you're on IBR, ICR, or PAYE, your payments still qualify.

Will student loan forgiveness happen automatically?

Any borrower with ED-held loans that have accumulated time in repayment of at least 20 or 25 years will see automatic forgiveness, even if the loans are not currently on an IDR plan. Borrowers with FFELP loans held by commercial lenders or Perkins loans not held by ED can benefit if they consolidate into Direct Loans.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is UTSA EDUCATION LOAN FORGIVENESS PROGRAM?

The UTSA Education Loan Forgiveness Program is a financial assistance initiative designed to forgive a portion or all of a borrower's education loan debt based on specific eligibility criteria and service requirements.

Who is required to file UTSA EDUCATION LOAN FORGIVENESS PROGRAM?

Individuals who have taken out education loans and meet certain criteria related to their employment, service in designated fields, or other qualifications set by the program are required to file for the UTSA Education Loan Forgiveness Program.

How to fill out UTSA EDUCATION LOAN FORGIVENESS PROGRAM?

To fill out the UTSA Education Loan Forgiveness Program application, applicants should gather necessary documentation regarding their loan details, employment information, and any service obligations, then follow the application instructions provided by the UTSA.

What is the purpose of UTSA EDUCATION LOAN FORGIVENESS PROGRAM?

The purpose of the UTSA Education Loan Forgiveness Program is to alleviate the financial burden of educational debt for borrowers who serve in certain professions or meet other qualifying criteria, thus encouraging public service and employment in essential fields.

What information must be reported on UTSA EDUCATION LOAN FORGIVENESS PROGRAM?

Applicants must report information such as their loan details, employment history, qualifying service commitments, and any other financial or personal data as required by the UTSA to assess eligibility for loan forgiveness.

Fill out your utsa education loan forgiveness online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Utsa Education Loan Forgiveness is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.