Get the free BUSINESS BANKRUPTCY: REORGANIZATIONS - joe2 law utah

Show details

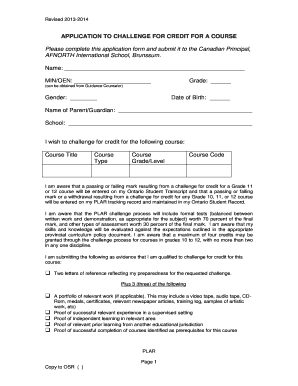

This document outlines the course structure, requirements, and schedule for the Business Bankruptcy: Reorganizations class, detailing the course objectives, required materials, and key assignments,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign business bankruptcy reorganizations

Edit your business bankruptcy reorganizations form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your business bankruptcy reorganizations form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing business bankruptcy reorganizations online

To use the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit business bankruptcy reorganizations. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out business bankruptcy reorganizations

How to fill out BUSINESS BANKRUPTCY: REORGANIZATIONS

01

Gather all financial documents, including balance sheets, income statements, and cash flow statements.

02

List all debts, assets, and creditors, detailing amounts owed and contact information.

03

Prepare a reorganization plan that outlines how the business intends to restructure its debts and operations.

04

File the bankruptcy petition with the appropriate court, including the reorganization plan and financial documents.

05

Pay the required filing fee or request a fee waiver if eligible.

06

Attend the creditors' meeting as scheduled by the court to discuss the reorganization plan.

07

Make any necessary amendments to the reorganization plan based on feedback from creditors or the court.

08

Obtain court approval for the reorganization plan after addressing creditor concerns.

Who needs BUSINESS BANKRUPTCY: REORGANIZATIONS?

01

Businesses that are unable to meet their debt obligations and seek a structured way to reorganize their finances.

02

Companies looking to retain control while negotiating with creditors to restructure existing debts.

03

Businesses that want to avoid liquidation and are looking for a viable path to recovery and ongoing operations.

Fill

form

: Try Risk Free

People Also Ask about

What's the difference between liquidation and administration?

Where liquidation signals the ultimate end of a company, administration on the other hand is often focussed on saving the business by restructuring its operations and/or finances.

What is the restructuring plan for bankruptcy?

In the restructuring plan, the debtor describes how they will repay the creditors and meet other financial obligations such as payroll and other taxes. The creditors review the plan and vote to approve it. Then, the court can approve the restructuring plan, and the debtor can begin implementing it.

What is the difference between liquidation and restructuring?

Liquidation often leads to asset selloffs at reduced values and job losses. Conversely, restructuring offers a chance to preserve relationships, protect jobs, and rebuild trust within the market.

What is the difference between a liquidation and a reorganization?

A Clackamas Chapter 11 attorney can help determine the best path, whether working out a new payment plan or selling off assets to settle debts. Reorganizing allows a business to stay open and adjust how it pays what it owes, while liquidation helps wrap things up when staying open isn't possible.

What happens when a business declares bankruptcy?

Companies can file for either Chapter 7 or Chapter 11 bankruptcy if they're unable to pay their debts. Under Chapter 7, a company closes and the trustee liquidates its assets. Chapter 11 allows the business to continue to operate under a reorganization plan.

What does reorganization mean in bankruptcy?

Background. A case filed under chapter 11 of the United States Bankruptcy Code is frequently referred to as a "reorganization" bankruptcy. Usually, the debtor remains “in possession,” has the powers and duties of a trustee, may continue to operate its business, and may, with court approval, borrow new money.

What is the difference between restructuring and reorganization?

Restructuring often involves changes in the organizational structure, while reorganization usually only involves changes in the process or workflow. 4. When considering which word to use, think about the scope of the change and the intended outcome.

What is the difference between liquidation and reorganization?

Reorganizing allows a business to stay open and adjust how it pays what it owes, while liquidation helps wrap things up when staying open isn't possible. Each choice has pros and cons, so understanding the differences is important.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is BUSINESS BANKRUPTCY: REORGANIZATIONS?

Business bankruptcy reorganizations refer to a legal process where a financially troubled company restructures its debts and obligations while continuing its operations. This process is primarily facilitated under Chapter 11 of the U.S. Bankruptcy Code.

Who is required to file BUSINESS BANKRUPTCY: REORGANIZATIONS?

Any business entity, including corporations, partnerships, and sole proprietorships that are facing financial distress and are unable to meet their debt obligations may file for bankruptcy reorganization. This is typically initiated by the debtor themselves.

How to fill out BUSINESS BANKRUPTCY: REORGANIZATIONS?

Filing for business bankruptcy reorganization involves completing several forms that include financial statements, schedules of assets and liabilities, and a proposed reorganization plan. It's advisable to consult with a bankruptcy attorney to ensure accurate completion and compliance with the law.

What is the purpose of BUSINESS BANKRUPTCY: REORGANIZATIONS?

The main purpose of business bankruptcy reorganizations is to allow companies to restructure their debts, renegotiate contracts, and recover financially while avoiding liquidation. This aims to preserve jobs, maintain business operations, and maximize return to creditors.

What information must be reported on BUSINESS BANKRUPTCY: REORGANIZATIONS?

Individuals filing for business bankruptcy reorganizations must report comprehensive financial information, including a list of creditors, a schedule of assets and liabilities, income statements, cash flow projections, and a detailed reorganization plan outlining how they intend to address their debts.

Fill out your business bankruptcy reorganizations online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Business Bankruptcy Reorganizations is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.