Get the free Goods & Services - f2 washington

Show details

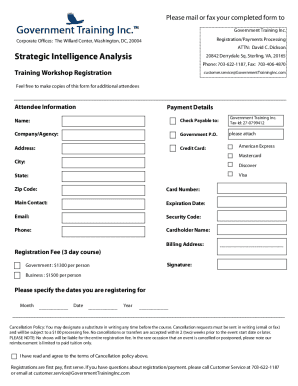

A form used to justify the sole source procurement of goods or services when the cost is $5000 or greater, documenting the unique requirement and efforts made to identify other suppliers.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign goods services - f2

Edit your goods services - f2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your goods services - f2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing goods services - f2 online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit goods services - f2. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out goods services - f2

How to fill out Goods & Services

01

Start by gathering all necessary information about your goods and services.

02

Identify the categories your goods and services fall into.

03

Fill out the description of each good or service, including features and benefits.

04

Specify pricing details for each item.

05

Include any relevant codes or classifications related to your goods and services.

06

Review and double-check all entered information for accuracy.

07

Submit the completed form according to the guidelines provided.

Who needs Goods & Services?

01

Businesses seeking to sell products or services.

02

Entrepreneurs starting a new venture.

03

Individuals filing for permits or licenses.

04

Companies looking to comply with legal and tax obligations.

05

Tax professionals assisting clients with their filings.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a good and a service example?

Goods are items that are usually (but not always) tangible, such as pens or apples. Services are activities provided by other people, such as teachers or barbers. Taken together, it is the production, distribution, and consumption of goods and services which underpins all economic activity and trade.

What is the meaning of goods and services?

A good is a tangible or physical product that someone will buy, tangible meaning something you can touch, and a service is when you pay for a skill. A service is something intangible, which can't be physically touched or stored.

What is the difference between different types of goods and services?

Goods are products your customers purchase from you, such as bicycles or candles. Services are activities performed for the benefit of someone other than you or your company, such as bicycle repair services or catering.

What are 5 differences between goods and services?

Key Differences between Goods and Services Goods can be seen, touched, and stored, whereas services are perishable and consumed at the time of production. Goods are manufactured or produced, while services are generated or performed. Goods can be owned and transferred, whereas services cannot be owned or transferred.

What are 5 differences between goods and services in business?

Key Differences between Goods and Services Goods can be seen, touched, and stored, whereas services are perishable and consumed at the time of production. Goods are manufactured or produced, while services are generated or performed. Goods can be owned and transferred, whereas services cannot be owned or transferred.

How can you differentiate services from goods?

Goods and services are two important types of purchases people make. A good is a tangible or physical product that someone will buy, tangible meaning something you can touch, and a service is when you pay for a skill. A service is something intangible, which can't be physically touched or stored.

What are the 4 types of goods and services?

There are four different types of goods in economics, which can be classified based on excludability and rivalrousness: private goods, public goods, common resources, and club goods. Private Goods are products that are excludable and rival. Public goods describe products that are non-excludable and non-rival.

What is included in goods and services?

Goods are items that are usually (but not always) tangible, such as pens or apples. Services are activities provided by other people, such as teachers or barbers. Taken together, it is the production, distribution, and consumption of goods and services which underpins all economic activity and trade.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Goods & Services?

Goods & Services refer to the products and services provided by a business to fulfill customer needs. Goods are tangible items, while services are intangible benefits.

Who is required to file Goods & Services?

Typically, businesses engaged in the sale of goods or services above a certain threshold must file Goods & Services declarations, depending on local tax laws.

How to fill out Goods & Services?

To fill out Goods & Services, gather all relevant sales data, categorize the types of goods and services provided, and complete the official filing form as per guidelines provided by the tax authority.

What is the purpose of Goods & Services?

The purpose of Goods & Services filing is to ensure accurate tax reporting, assist in the collection of sales taxes, and provide governmental authorities with essential business information.

What information must be reported on Goods & Services?

Information that must be reported typically includes total sales revenue, breakdown of goods and services sold, applicable taxes collected, and any deductions or exemptions applicable.

Fill out your goods services - f2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Goods Services - f2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

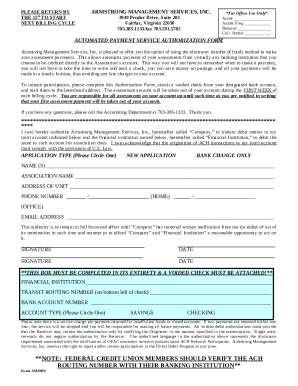

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.