Get the free Business/Farm Supplement - yale

Show details

This document provides instructions for completing the Business/Farm Supplement required for financial aid applications, detailing how to report business and farm income, expenses, and ownership information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign businessfarm supplement - yale

Edit your businessfarm supplement - yale form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your businessfarm supplement - yale form via URL. You can also download, print, or export forms to your preferred cloud storage service.

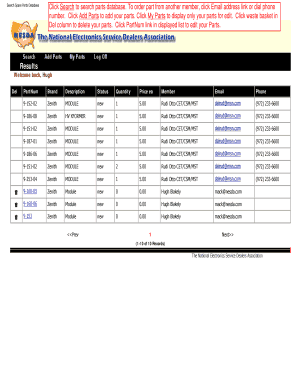

Editing businessfarm supplement - yale online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit businessfarm supplement - yale. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out businessfarm supplement - yale

How to fill out Business/Farm Supplement

01

Obtain the Business/Farm Supplement form from the relevant authority.

02

Carefully read the instructions provided on the form.

03

Fill in your business or farm name and contact information in the designated sections.

04

Indicate the type of business or farming operation you have.

05

Provide details on your business or farm activities, including income sources and major expenses.

06

Include your business or farm identification number, if applicable.

07

Attach any required documentation, such as financial statements or proof of operation.

08

Review the completed form for accuracy before submission.

09

Submit the form by the specified deadline to the appropriate agency.

Who needs Business/Farm Supplement?

01

Business owners seeking to report operational details.

02

Farmers applying for agricultural grants or assistance.

03

Individuals looking to claim tax deductions related to business and farming activities.

04

Businesses seeking compliance with local or federal regulations.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between a hobby farm and a business farm?

The IRS considers several factors to determine if a farming operation is a for-profit business or merely a hobby. A farm classified as a hobby cannot deduct losses against other income, whereas a business farm can. The primary difference lies in the intent to make a profit.

What is farm in business?

A firm is a business organization that seeks to make a profit through the sale of goods and services. The term firm is synonymous with business or company. Firms can operate under several different structures, including sole proprietorships and corporations.

What qualifies a farm as a business?

A farmer is an individual who is engaged in farming per the definition found above (IRS Publication 225, page 1, “You are in the business of farming if you cultivate, operate, or manage a farm for profit, either as an owner or tenant”).

What is a business farm?

Farm businesses are farms with annual gross cash farm income (GCFI), annual income before expenses, equal to or greater than $350,000, or operations with less than $350,000 in annual gross cash farm income but that report farming as the operator's primary occupation.

What is the difference between a hobby farm and a business farm?

The IRS considers several factors to determine if a farming operation is a for-profit business or merely a hobby. A farm classified as a hobby cannot deduct losses against other income, whereas a business farm can. The primary difference lies in the intent to make a profit.

How many acres to be considered a farm?

To qualify for agricultural assessment: Must have 7 acres or more of land in production for sale of crops, livestock or livestock products. The same farmer must farm the land for at least 2 years.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Business/Farm Supplement?

The Business/Farm Supplement is a form used to report income and expenses related to a business or farming activity for tax purposes. It provides additional details that might not be captured on the standard tax return.

Who is required to file Business/Farm Supplement?

Individuals who have self-employment income from a business or farming activity are typically required to file the Business/Farm Supplement along with their tax return.

How to fill out Business/Farm Supplement?

To fill out the Business/Farm Supplement, one should report all relevant income earned and expenses incurred during the tax year, ensuring to keep accurate records and use the appropriate forms provided by the tax authority.

What is the purpose of Business/Farm Supplement?

The purpose of the Business/Farm Supplement is to provide detailed information about the financial performance of a business or farming operation, allowing tax authorities to accurately assess taxes owed.

What information must be reported on Business/Farm Supplement?

The Business/Farm Supplement must include information such as gross income, operating expenses, cost of goods sold, and other relevant details that reflect the financial activities of the business or farm.

Fill out your businessfarm supplement - yale online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Businessfarm Supplement - Yale is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.