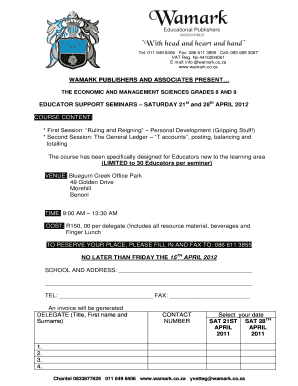

Get the free 2008-2009 Parent Tax Non-Filing Statement - law yale

Show details

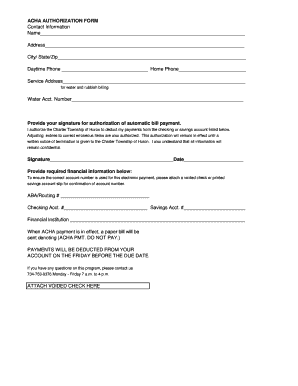

This document is a form for parents to declare their non-filing status for tax purposes related to their child's education financing.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2008-2009 parent tax non-filing

Edit your 2008-2009 parent tax non-filing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2008-2009 parent tax non-filing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2008-2009 parent tax non-filing online

In order to make advantage of the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 2008-2009 parent tax non-filing. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2008-2009 parent tax non-filing

How to fill out 2008-2009 Parent Tax Non-Filing Statement

01

Obtain the 2008-2009 Parent Tax Non-Filing Statement form from the relevant institution or website.

02

Fill in personal information at the top of the form, including the parent's name, address, and Social Security Number.

03

Indicate the tax year for which you're declaring non-filing status (2008 or 2009).

04

Provide information about the parent's employment status during the year, including any income or lack thereof.

05

Complete any required sections detailing the reasons for non-filing, such as lack of taxable income.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form to the institution requesting it, ensuring you keep a copy for your records.

Who needs 2008-2009 Parent Tax Non-Filing Statement?

01

Parents who did not file a tax return for the years 2008 and 2009 but need to provide proof of non-filing status for financial aid applications.

02

Parents whose children are applying for federal student aid and whose financial support needs to be documented.

Fill

form

: Try Risk Free

People Also Ask about

Can I fill out FAFSA if my parents didn't file taxes?

You can't submit your FAFSA without your parent's tax info unless you are homeless, emancipated, married, or over the age of 24 and considered independent. Contact your financial aid office for guidance on your situation.

How do you do FAFSA if your parent didn't file taxes?

If no tax return was filed, the taxpayer's W-2 and 1099 statements and/or the last pay stub could be used to complete the FAFSA. A signed statement confirming the adjusted gross income may be used if the taxpayer is self-employed.

How do I get a non filing statement?

Mail or fax the completed IRS Form 4506-T to the address (or FAX number) provided on page 2 of Form 4506-T. If the 4506-T information is successfully validated, tax filers can expect to receive a paper IRS Verification of Non-filing Letter at the address provided on their request within 5 to 10 days.

What is a parent non-filer?

Article. If your parents are not required to file a federal or national tax return, they should send a signed statement listing all sources and annual amounts of income for their household. Each non-filer must print and complete a tax non-filer statement and submit it to IDOC with the rest of your application materials

What is a non filer tax statement?

A signed statement indicating the person was not required to file taxes for that year by their tax authority and the name of the country where he/she resided. Documentation of all of the individual's earned income for the specified year. Each non-filer listed on the verification worksheet must provide a statement.

How does FAFSA work if your mom doesn't claim you on taxes?

If your mom doesn't file 2023 taxes and the IRS requires her to file, you will be prevented from accessing federal need-based aid until she files. You also won't have access to state or institutional aid unless there's a way for those sources to verify income, which most of the time requires taxes to be filed.

Can I get FAFSA if my parents owe taxes?

The good news: Owing taxes does not automatically disqualify you from receiving federal student aid. Key requirements: When completing the Free Application for Federal Student Aid (FAFSA), you will need to provide income and tax information. However, this does not mean that unpaid taxes will prevent approval.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2008-2009 Parent Tax Non-Filing Statement?

The 2008-2009 Parent Tax Non-Filing Statement is a form used to declare that a parent did not file a federal tax return for the tax year 2008 or 2009. It is often required for financial aid applications.

Who is required to file 2008-2009 Parent Tax Non-Filing Statement?

Parents who did not earn enough income to require them to file a federal tax return for the tax years 2008 or 2009 are required to file the Parent Tax Non-Filing Statement.

How to fill out 2008-2009 Parent Tax Non-Filing Statement?

To fill out the Parent Tax Non-Filing Statement, parents should provide their personal information, including names, Social Security numbers, and indicate that they did not file a tax return for the specified tax years.

What is the purpose of 2008-2009 Parent Tax Non-Filing Statement?

The purpose of the 2008-2009 Parent Tax Non-Filing Statement is to provide verification for financial aid offices that the parents did not have a tax filing obligation for the specified years, which affects the financial aid eligibility of the student.

What information must be reported on 2008-2009 Parent Tax Non-Filing Statement?

The Parent Tax Non-Filing Statement must report the parent's names, Social Security numbers, indication of non-filing status, and could require additional income information where applicable.

Fill out your 2008-2009 parent tax non-filing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2008-2009 Parent Tax Non-Filing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.