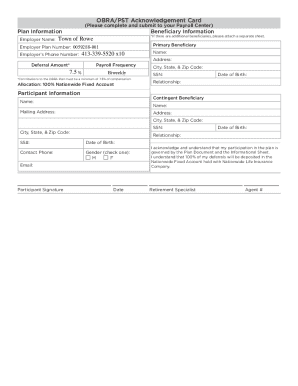

Get the free Pre-Retirement Checklist

Show details

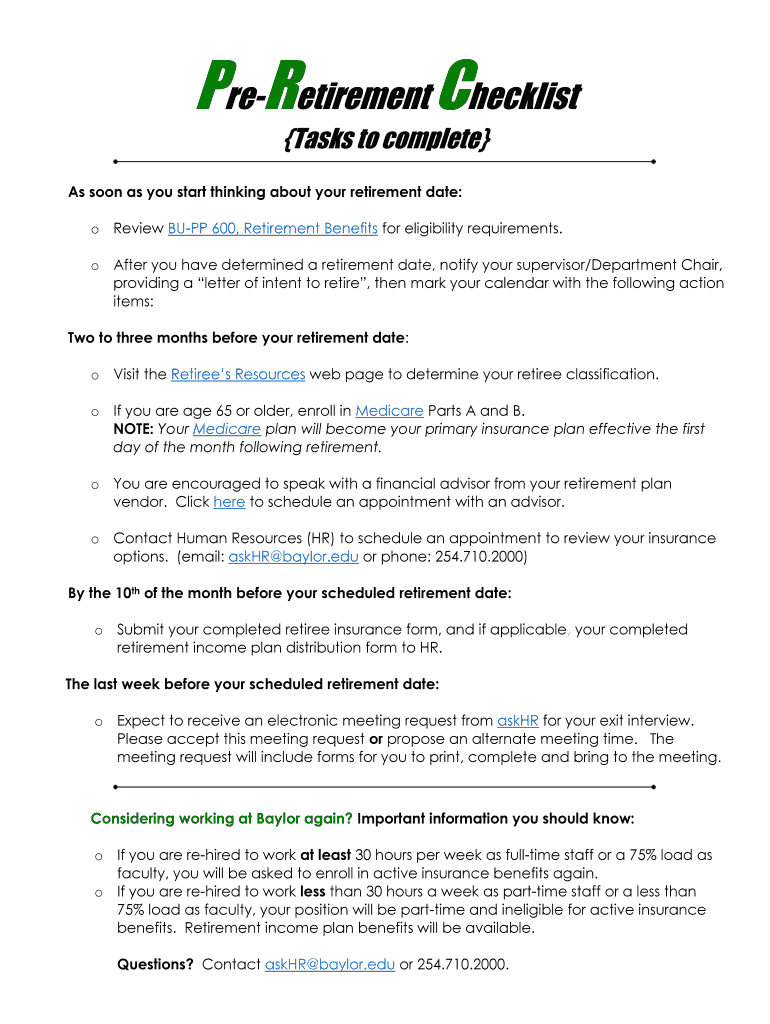

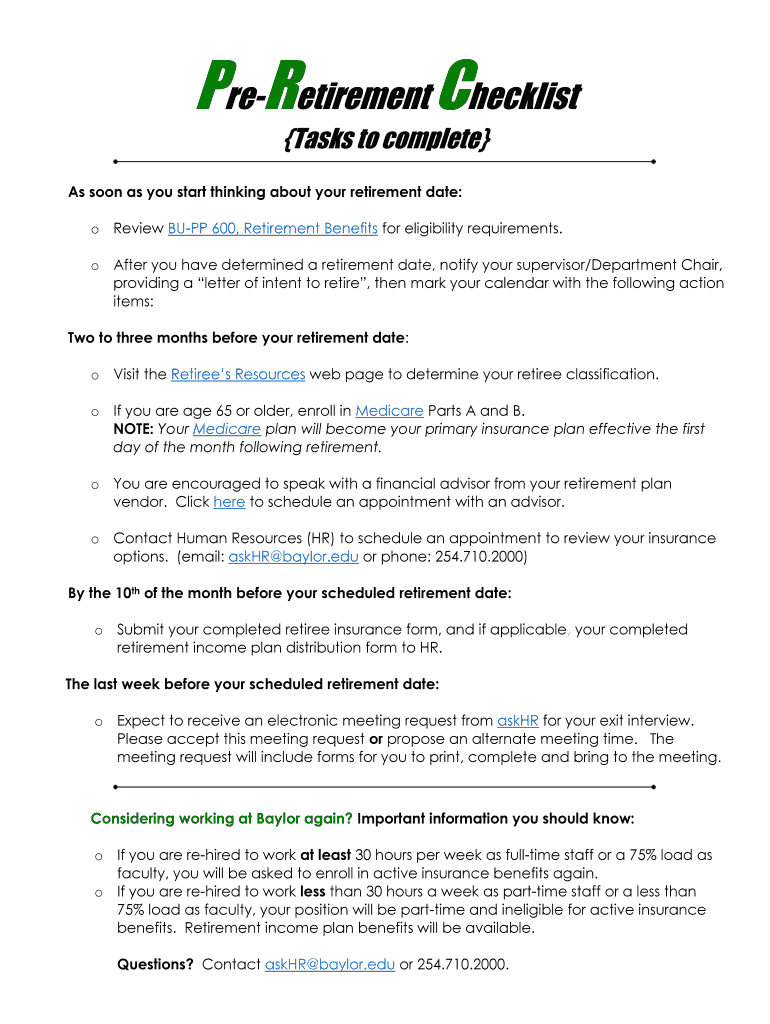

A checklist outlining the tasks and steps to complete as you approach retirement, including requirements for notifying supervisors, enrolling in Medicare, and reviewing insurance options.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign pre-retirement checklist

Edit your pre-retirement checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pre-retirement checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit pre-retirement checklist online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit pre-retirement checklist. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out pre-retirement checklist

How to fill out Pre-Retirement Checklist

01

Begin by gathering all necessary financial documents, including bank statements, investment accounts, and pension information.

02

List all sources of income you expect during retirement such as Social Security, pensions, and savings.

03

Estimate your retirement expenses including housing, healthcare, and daily living costs.

04

Determine your desired retirement age and any plans for transitioning into retirement.

05

Review your current savings and investments to assess how they align with your retirement goals.

06

Consult with a financial advisor to understand tax implications and withdrawal strategies.

07

Create a plan for healthcare coverage and consider long-term care options if necessary.

08

Set a timeline for achieving various retirement milestones and review your progress regularly.

Who needs Pre-Retirement Checklist?

01

Individuals approaching retirement age who want to ensure they are financially prepared.

02

Those who want to assess their savings and investments in relation to their retirement goals.

03

Anyone considering retirement who needs to understand their future financial situation.

04

Couples planning jointly for retirement to align their financial goals.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Pre-Retirement Checklist?

The Pre-Retirement Checklist is a document that helps individuals prepare for retirement by outlining key steps and considerations regarding their financial, legal, and personal readiness.

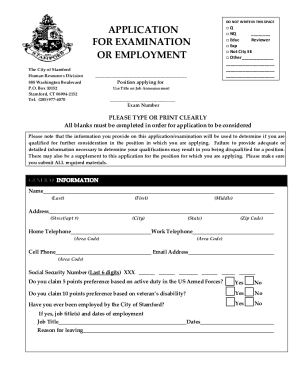

Who is required to file Pre-Retirement Checklist?

Typically, individuals nearing retirement age are required to file a Pre-Retirement Checklist. This may include employees in certain professions or those participating in retirement plans that require documentation.

How to fill out Pre-Retirement Checklist?

To fill out the Pre-Retirement Checklist, individuals should gather personal financial information, consider their retirement goals, and complete each section of the checklist by providing accurate and comprehensive information as requested.

What is the purpose of Pre-Retirement Checklist?

The purpose of the Pre-Retirement Checklist is to ensure that individuals have assessed their financial status, planned for healthcare needs, and addressed legal matters before transitioning into retirement.

What information must be reported on Pre-Retirement Checklist?

The information reported on the Pre-Retirement Checklist typically includes personal identification details, financial assets, retirement income sources, healthcare plans, and any legal documents such as wills or power of attorney.

Fill out your pre-retirement checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Pre-Retirement Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.