Get the free Parent Asset Form

Show details

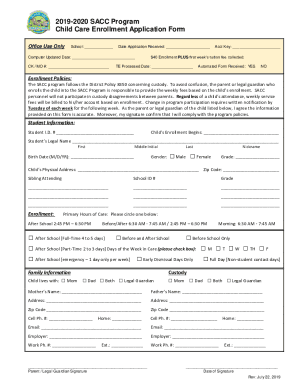

This form is used to help the Financial Aid Office clarify the value of specific assets as of your initial FAFSA filing date, usually due to conflicts between the FAFSA and other documents submitted.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign parent asset form

Edit your parent asset form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your parent asset form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing parent asset form online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit parent asset form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out parent asset form

How to fill out Parent Asset Form

01

Obtain the Parent Asset Form from the relevant authority or website.

02

Read the instructions provided at the top of the form carefully.

03

Fill in your personal information such as name, address, and contact details.

04

List all assets that fall under the category of 'parent assets' as defined by the guidelines.

05

Provide detailed descriptions of each asset, including purchase dates and current values.

06

Sign and date the form to certify that all information is true and complete.

07

Submit the completed form to the appropriate office or department.

Who needs Parent Asset Form?

01

Parents or guardians applying for financial assistance or benefits.

02

Individuals seeking to assess their financial situation for legal purposes.

03

Families applying for aid programs that require a declaration of assets.

Fill

form

: Try Risk Free

People Also Ask about

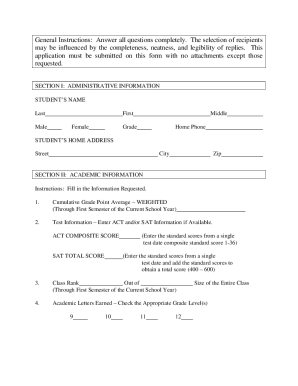

What is a parent asset?

Parent assets on FAFSA refer to any money that's readily available or anything that can be converted to money in the future. This includes but isn't limited to: Cash and bank accounts — Savings, checking, and money market accounts.

How do you answer parent assets on FAFSA?

Assets you SHOULD include on the FAFSA Money in checking accounts, cash and savings accounts. Real estate. While FAFSA does not consider your parent's primary residence as an asset, you need to declare the net worth of any additional property.

Can I skip parents' assets questions on FAFSA?

You can't submit your FAFSA without your parent's tax info unless you are homeless, emancipated, married, or over the age of 24 and considered independent. Contact your financial aid office for guidance on your situation.

How to answer parent assets on FAFSA?

Assets you SHOULD include on the FAFSA Money in checking accounts, cash and savings accounts. Real estate. While FAFSA does not consider your parent's primary residence as an asset, you need to declare the net worth of any additional property.

What should I put for student assets on FAFSA?

Enter the total value of your (and your spouse's) investments, subtracting any debts. Enter the current value of your (and your spouse's) businesses and/or farms, (whatever their size) and subtract any debts owed on them.

Can you skip FAFSA questions about your parents' assets?

Can I skip questions about my parents' assets? The FAFSA uses skip logic, so you'll only see questions that apply to you when completing your portion of the application. Students eligible for the maximum Pell Grant award or those from families earning less than $60,000 a year won't need to report asset information.

What is the #1 most common FAFSA mistake?

Some of the most common FAFSA errors are: Forgetting to sign and date: If you're filling out the paper FAFSA, be sure to sign it. Sending in a copy of your income tax returns: You do not need to include a copy of your tax returns with your FAFSA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

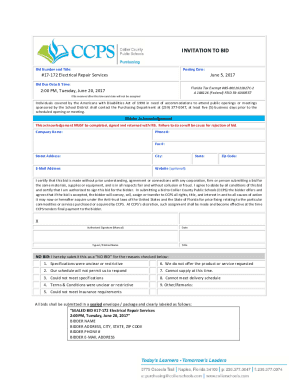

What is Parent Asset Form?

The Parent Asset Form is a financial document that collects information about a parent's assets for the purpose of determining eligibility for financial aid or assistance.

Who is required to file Parent Asset Form?

Parents of students applying for financial aid, particularly for college or university, are typically required to file the Parent Asset Form.

How to fill out Parent Asset Form?

To fill out the Parent Asset Form, provide accurate financial information including details about income, assets, savings, and investment accounts as instructed on the form.

What is the purpose of Parent Asset Form?

The purpose of the Parent Asset Form is to assess the financial capacity of a student's family to contribute to college expenses, helping institutions allocate financial aid accordingly.

What information must be reported on Parent Asset Form?

Information that must be reported on the Parent Asset Form includes total income, asset values, savings accounts, investments, real estate holdings, and any other relevant financial data.

Fill out your parent asset form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Parent Asset Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.