Get the free Parent Asset Form - media1 biola

Show details

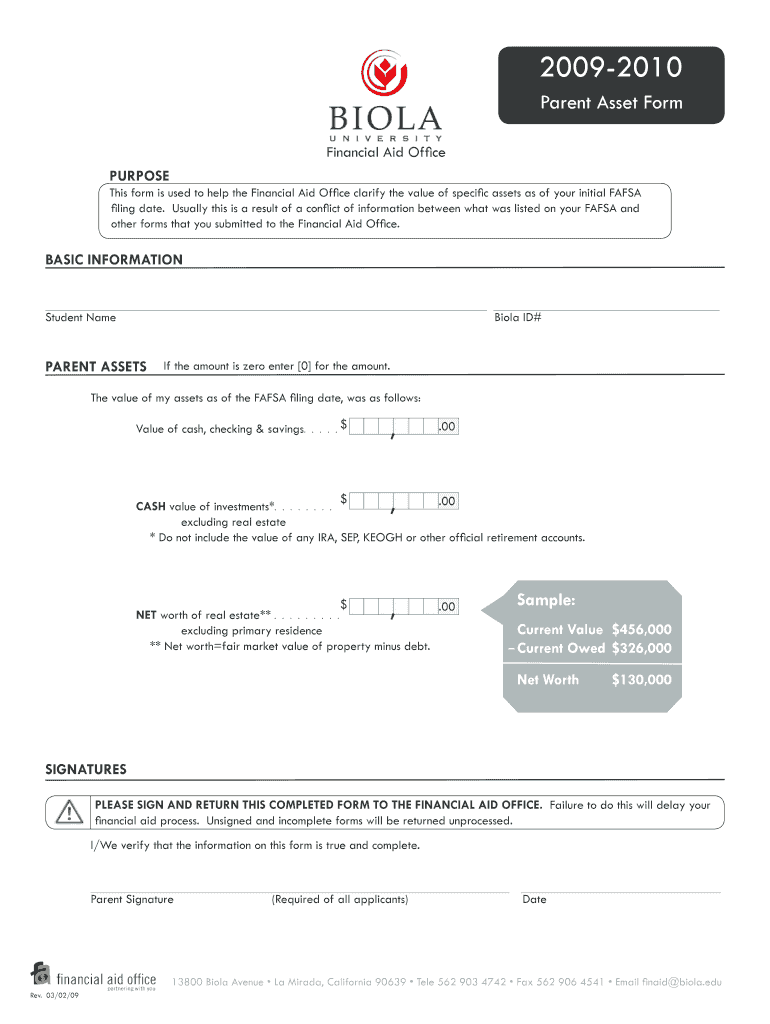

This form is used to help the Financial Aid Office clarify the value of specific assets as of your initial FAFSA filing date, typically due to conflicting information between FAFSA and other submitted

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign parent asset form

Edit your parent asset form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your parent asset form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

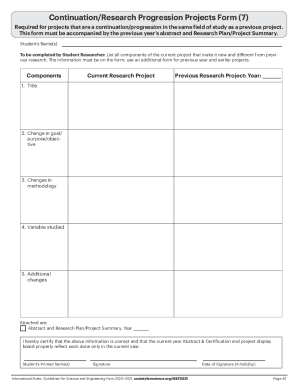

How to edit parent asset form online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit parent asset form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out parent asset form

How to fill out Parent Asset Form

01

Collect all necessary financial documents, including bank statements and income records.

02

Download the Parent Asset Form from the designated website or obtain a physical copy from the relevant office.

03

Fill out personal information fields such as name, contact information, and social security number.

04

List all assets owned, including savings accounts, investments, real estate, and other properties.

05

Provide current values for each asset listed, ensuring accuracy and completeness.

06

Report any debts or liabilities associated with the listed assets.

07

Review the entire form for completeness and accuracy before submission.

08

Sign and date the form certifying that the information provided is true and correct.

09

Submit the completed form to the appropriate office or department by the specified deadline.

Who needs Parent Asset Form?

01

Parents seeking financial assistance for their children’s education or programs.

02

Families applying for scholarships or financial aid that require disclosure of assets.

03

Institutions that need to assess eligibility based on financial criteria.

Fill

form

: Try Risk Free

People Also Ask about

What is a parent asset?

Parent assets on FAFSA refer to any money that's readily available or anything that can be converted to money in the future. This includes but isn't limited to: Cash and bank accounts — Savings, checking, and money market accounts.

How do you answer parent assets on FAFSA?

Assets you SHOULD include on the FAFSA Money in checking accounts, cash and savings accounts. Real estate. While FAFSA does not consider your parent's primary residence as an asset, you need to declare the net worth of any additional property.

Can I skip parents' assets questions on FAFSA?

You can't submit your FAFSA without your parent's tax info unless you are homeless, emancipated, married, or over the age of 24 and considered independent. Contact your financial aid office for guidance on your situation.

How to answer parent assets on FAFSA?

Assets you SHOULD include on the FAFSA Money in checking accounts, cash and savings accounts. Real estate. While FAFSA does not consider your parent's primary residence as an asset, you need to declare the net worth of any additional property.

What should I put for student assets on FAFSA?

Enter the total value of your (and your spouse's) investments, subtracting any debts. Enter the current value of your (and your spouse's) businesses and/or farms, (whatever their size) and subtract any debts owed on them.

Can you skip FAFSA questions about your parents' assets?

Can I skip questions about my parents' assets? The FAFSA uses skip logic, so you'll only see questions that apply to you when completing your portion of the application. Students eligible for the maximum Pell Grant award or those from families earning less than $60,000 a year won't need to report asset information.

What is the #1 most common FAFSA mistake?

Some of the most common FAFSA errors are: Forgetting to sign and date: If you're filling out the paper FAFSA, be sure to sign it. Sending in a copy of your income tax returns: You do not need to include a copy of your tax returns with your FAFSA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Parent Asset Form?

The Parent Asset Form is a document used to report the financial assets and resources of a student's parents for purposes of financial aid eligibility evaluation.

Who is required to file Parent Asset Form?

Typically, the Parent Asset Form is required to be filed by the parents of students who are applying for need-based financial aid for college or university.

How to fill out Parent Asset Form?

To fill out the Parent Asset Form, parents need to provide accurate financial information including income, savings, investments, and other assets, as per the guidelines provided in the form.

What is the purpose of Parent Asset Form?

The purpose of the Parent Asset Form is to assess the financial capability of a student's family to contribute towards the cost of the student's education, thereby determining eligibility for financial aid.

What information must be reported on Parent Asset Form?

The Parent Asset Form must report information including total income, savings accounts, real estate investments, stocks, bonds, and other financial assets owned by the parents.

Fill out your parent asset form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Parent Asset Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.