Get the free 2012-2013 LOAN DISCHARGE THROUGH DISABILITY - financialaid calpoly

Show details

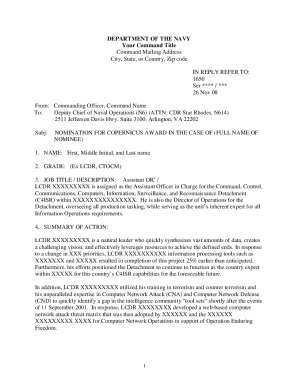

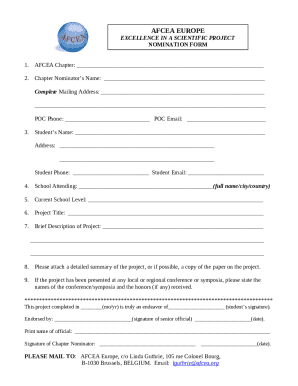

This form is used for students who wish to apply for a discharge of federal student loans due to a disability. It requires information about the student and certification from a physician.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2012-2013 loan discharge through

Edit your 2012-2013 loan discharge through form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2012-2013 loan discharge through form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 2012-2013 loan discharge through online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit 2012-2013 loan discharge through. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2012-2013 loan discharge through

How to fill out 2012-2013 LOAN DISCHARGE THROUGH DISABILITY

01

Obtain the 2012-2013 Loan Discharge Through Disability application form from the relevant financial institution or website.

02

Carefully read the instructions provided with the application form to understand the requirements.

03

Fill out the borrower information section, including your name, address, and loan details.

04

Complete the disability documentation section by providing information on the nature of your disability.

05

Obtain a physician's certification, if required, confirming the severity and permanence of your disability.

06

Attach any required supporting documentation, such as medical records or evidence of elapsed time since the disability began.

07

Review the entire application for accuracy and completeness before submitting it.

08

Submit the application to the appropriate address, as specified in the instructions.

09

Keep a copy of the submitted application and any correspondence for your records.

Who needs 2012-2013 LOAN DISCHARGE THROUGH DISABILITY?

01

Individuals who have a permanent disability that prevents them from maintaining gainful employment.

02

Borrowers who have federal student loans taken out during the 2012-2013 academic year.

03

Those who can provide medical evidence of their disability that meets the criteria for discharge.

Fill

form

: Try Risk Free

People Also Ask about

How long does it take for a TPD discharge to be approved?

It typically takes less than 30 days to review the total and permanent disability (TPD) discharge application. If your discharge application is incomplete or if a physician's response is held up, it can cause delays in the review process. In case of a delay, we'll notify you by mail.

How to get a TPD discharge?

To qualify for a TPD discharge, you must complete and submit a TPD discharge application, along with documentation showing that you meet our requirements for being considered totally and permanently disabled, to Nelnet, the servicer that assists the U.S. Department of Education with the TPD discharge process.

Is it hard to get a TPD payout?

Yes, it can be difficult to get a TPD payout. The criteria for Total and Permanent Disability (TPD) can be hard to meet, and insurers don't always play fair. If you're asking 'is TPD hard to get? ', it is in your best interest to speak with a knowledgeable lawyer as soon as possible.

How do you qualify for TPD?

To be eligible for a TPD claim, you generally need to meet certain conditions, including: You Have TPD Insurance Coverage. You Can No Longer Work Due to Injury or Illness. Your Condition Is Severe and Permanent. You Have Stopped Working for a Certain Period. You Meet Your Super Fund's Specific Criteria.

How to get loans discharged?

Your loan can be discharged only under specific circumstances, such as school closure, a school's false certification of your eligibility to receive a loan, a school's failure to pay a required loan refund, or because of total and permanent disability, bankruptcy, identity theft, or death.

Can a discharged student loan be reinstated?

"If you have a letter from the Department of Education saying that your loans have been forgiven and that your loan balance is now zero, they really can't claw that back," said Mark Kantrowitz, a financial aid and student loan expert.

How to get 100% permanent disability?

Eligibility Criteria: To qualify for a 100% rating, veterans must demonstrate that their service-connected disabilities are totally disabling. This means that the disabilities must severely impair the veteran's ability to work and perform daily activities.

Do US student loans get written off?

Loan Forgiveness Timeline: Federal student loans can be forgiven after 10 years through Public Service Loan Forgiveness (PSLF) or after 20-25 years under Income-Driven Repayment (IDR) plans.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2012-2013 LOAN DISCHARGE THROUGH DISABILITY?

The 2012-2013 LOAN DISCHARGE THROUGH DISABILITY is a program that allows borrowers who are unable to work due to a total and permanent disability to have their federal student loans discharged, relieving them of repayment obligations.

Who is required to file 2012-2013 LOAN DISCHARGE THROUGH DISABILITY?

Borrowers who have a total and permanent disability that prevents them from working and who wish to have their federal student loans discharged must file for the 2012-2013 LOAN DISCHARGE THROUGH DISABILITY.

How to fill out 2012-2013 LOAN DISCHARGE THROUGH DISABILITY?

To fill out the 2012-2013 LOAN DISCHARGE THROUGH DISABILITY application, borrowers need to provide personal information, details about their loans, and documentation from a qualified physician that confirms their disability status.

What is the purpose of 2012-2013 LOAN DISCHARGE THROUGH DISABILITY?

The purpose of the 2012-2013 LOAN DISCHARGE THROUGH DISABILITY is to provide financial relief to borrowers who are unable to repay their federal student loans due to a total and permanent disability, helping them avoid financial burden.

What information must be reported on 2012-2013 LOAN DISCHARGE THROUGH DISABILITY?

Information that must be reported includes the borrower's personal details, loan information, proof of disability from a qualified medical professional, and any other relevant documentation required by the Department of Education.

Fill out your 2012-2013 loan discharge through online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2012-2013 Loan Discharge Through is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.