Get the free Auxiliary Accounting - uec csusb

Show details

This document is used to request access to Office Depot and/or Office Max websites for placing office supply orders, including sections for end user information and account authorizer details.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign auxiliary accounting - uec

Edit your auxiliary accounting - uec form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your auxiliary accounting - uec form via URL. You can also download, print, or export forms to your preferred cloud storage service.

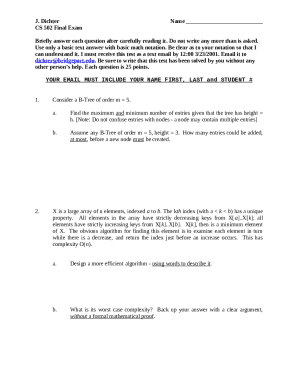

How to edit auxiliary accounting - uec online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit auxiliary accounting - uec. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out auxiliary accounting - uec

How to fill out Auxiliary Accounting

01

Gather all necessary financial documents such as invoices, receipts, and bank statements.

02

Organize the documents by category (e.g., income, expenses, assets).

03

Create a chart or table to track details for each entry, including date, amount, and description.

04

Enter the data into the accounting software or ledger systematically.

05

Review all entries for accuracy and ensure there are no missing transactions.

06

Reconcile the entries with bank statements to verify accuracy.

07

Generate financial reports based on the recorded data.

Who needs Auxiliary Accounting?

01

Small business owners who need to manage finances efficiently.

02

Freelancers to track income and expenses accurately.

03

Non-profit organizations for transparency in financial reporting.

04

Accountants who require detailed records for client reporting.

05

Individuals who want to monitor personal finances and budgeting.

Fill

form

: Try Risk Free

People Also Ask about

What is an auxiliary account in SAP?

What is Auxiliary Account? CO account assignment objects are used to collect the costs and revenues of a sales order and update them in CO. The system assigns the costs and revenues to different CO account assignment objects. In order to assign from SD into CO, there are many options.

What is auxiliary in English with example?

auxiliary noun (VERB) a verb that gives grammatical information not given by the main verb of a sentence: In the sentence "she has finished her book", "has" is an auxiliary. SMART Vocabulary: related words and phrases. Linguistics: verb forms, tenses & types of verbs. accusative.

What is an example of an auxiliary account?

Auxiliary Shares - Use auxiliary accounts to designate finances for particular budget reasons. For example, you can save for taxes, insurance, vacation, and home improvement without having to combine the funds.

What is an example of an auxiliary to trade?

Auxiliaries to trade refers to the factors that are essential for bringing the goods from the place of their production to the place of their consumption. In simple words, these are essential services and functions that assist the business.

What is an auxiliary account?

Auxiliary Account means the bookkeeping record of amounts allocated on behalf of a Participant under Section 28.2, adjusted for the net earnings or losses thereon.

What is an example of a financial auxiliary?

Financial auxiliaries facilitate financial transactions between third parties without becoming the legal counterparty. Examples include stock exchanges, managers of pension funds and mutual funds and insurance brokers.

What is an example of an auxiliary?

Am, is, are, was, were, will, have, has, had, may, might, can, could, shall, should, must, ought to, would, etc., are some examples of auxiliary verbs.

What do you mean by accounting in English?

1. : the system of recording and summarizing business and financial transactions and analyzing, verifying, and reporting the results. also : the principles and procedures of this system.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Auxiliary Accounting?

Auxiliary Accounting refers to a supplementary accounting system that is used to track specific types of transactions or details that are not captured in the main accounting records.

Who is required to file Auxiliary Accounting?

Entities or individuals who engage in activities that require detailed tracking of additional financial data, such as organizations with specific reporting obligations or businesses that maintain special funds, may be required to file Auxiliary Accounting.

How to fill out Auxiliary Accounting?

To fill out Auxiliary Accounting, you typically need to gather relevant financial data, ensure you have the correct forms, and accurately input the required information in the designated sections, usually involving detailed classifications of transactions.

What is the purpose of Auxiliary Accounting?

The purpose of Auxiliary Accounting is to provide detailed insights into certain financial aspects that are not sufficiently covered by standard accounting practices, enabling better tracking and financial analysis.

What information must be reported on Auxiliary Accounting?

Auxiliary Accounting must report specific data such as detailed transactional records, supplementary financial information, classifications of income and expenses, and any relevant notes or comments required by regulatory frameworks.

Fill out your auxiliary accounting - uec online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Auxiliary Accounting - Uec is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.