Get the free Federal Loan Adjustment Form - cel cmich

Show details

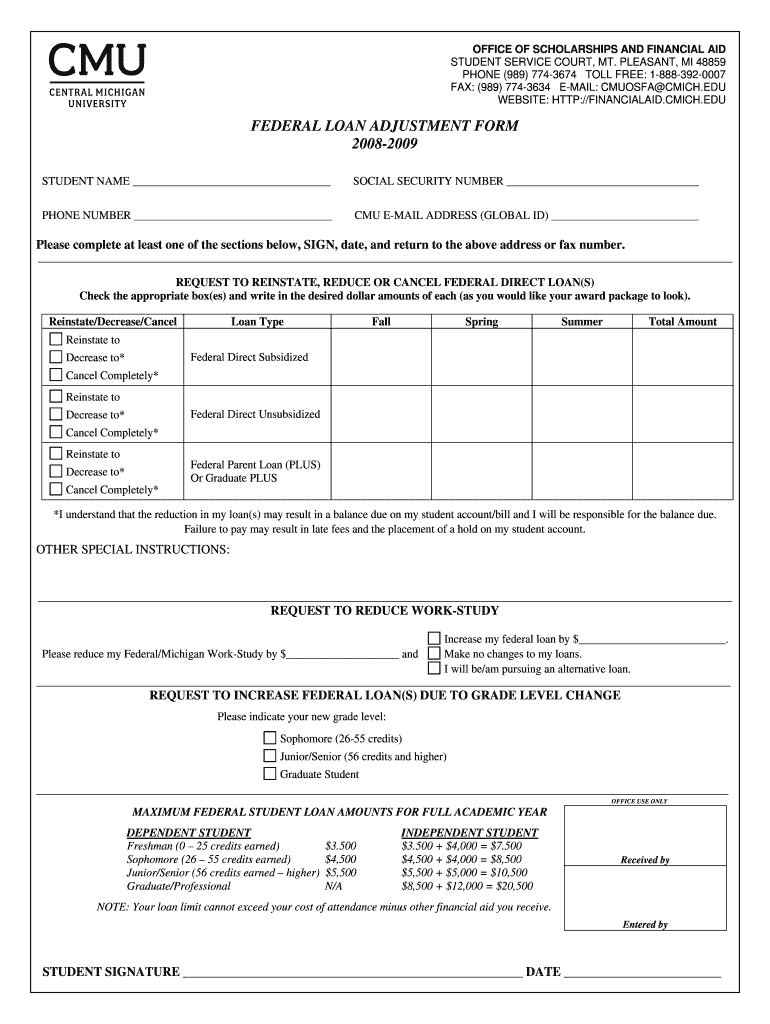

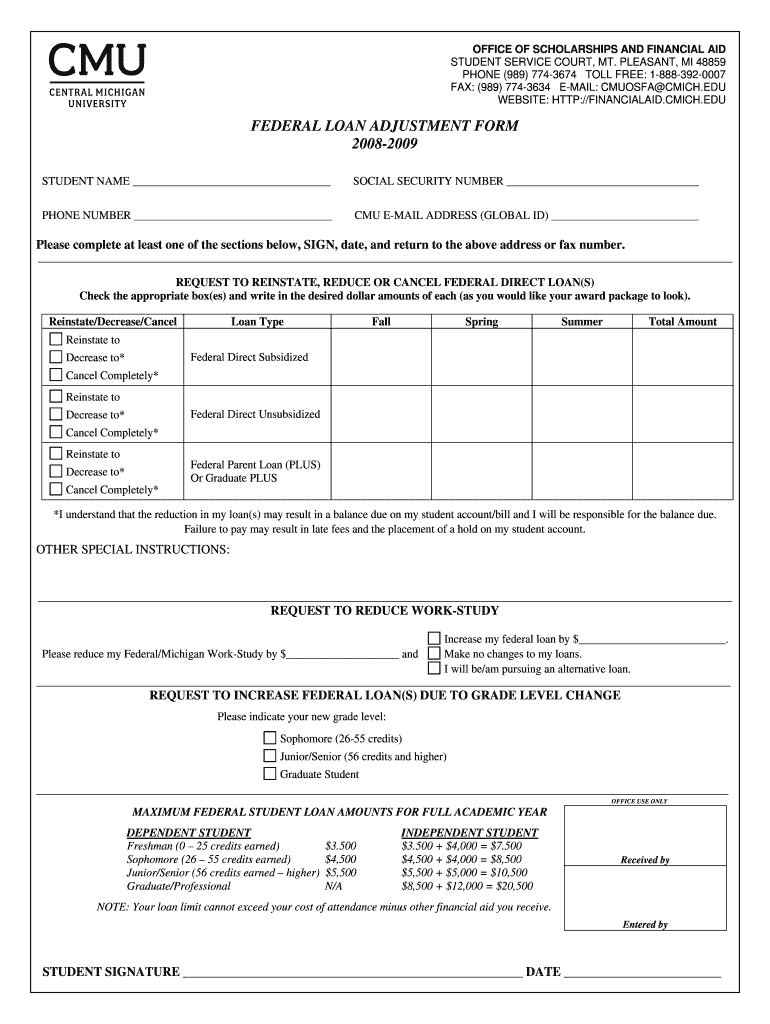

This form is used by students to request changes to their federal loan amounts, including reinstating, reducing, or canceling loans, as well as adjustments related to work-study and grade level changes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign federal loan adjustment form

Edit your federal loan adjustment form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal loan adjustment form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing federal loan adjustment form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit federal loan adjustment form. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out federal loan adjustment form

How to fill out Federal Loan Adjustment Form

01

Obtain the Federal Loan Adjustment Form from the official website or your loan servicer.

02

Read the instructions carefully to understand the requirements.

03

Fill out your personal information, including your name, address, and contact details.

04

Provide your loan information, including the loan type, account number, and any relevant details.

05

Specify the reason for the adjustment request in the designated section.

06

Attach any supporting documentation, if required, to substantiate your request.

07

Review the form for accuracy and completeness.

08

Sign and date the form where indicated.

09

Submit the completed form to your loan servicer as per the provided instructions, either by mailing it or submitting it online.

Who needs Federal Loan Adjustment Form?

01

Borrowers who have federal student loans and need to adjust their loan terms, repayment plan, or seek a deferment or forbearance.

02

Individuals who have incorrect information on their loan account that needs to be rectified.

03

Students transitioning from one enrollment status to another that affects their loan repayment.

Fill

form

: Try Risk Free

People Also Ask about

Is the one time IDR adjustment still happening?

We're working to apply changes announced in April 2022 as part of the payment count adjustment. These changes mean that borrowers may still see an increase in their payment counts toward income-driven repayment (IDR) forgiveness and Public Service Loan Forgiveness (PSLF). We expect updated counts in fall 2024.

What is a loan modification and how does it work?

In simple terms, a loan modification is just like it sounds. It is a negotiation with your mortgage lender to create a new agreement that modifies the original terms of your mortgage. If you have a long-term inability to pay your mortgage, a loan modification could be an option if you wish to keep your home.

What is a change of loan term?

Loan modification is a change made to the terms of an existing loan by a lender. It may involve a reduction in the interest rate, an extension of the length of time for repayment, a different type of loan, or any combination of the three.

What is a loan change form?

Use the Direct Loan Change Form to reinstate a previously declined Federal Direct Loan or to increase/decrease a loan amount you have already accepted.

What is a loan agreement form?

A loan agreement is a formal contract between a borrower and a lender. These counterparties rely on the loan agreement to ensure legal recourse if commitments or obligations are not met. Sections in the contract include loan details, collateral, required reporting, covenants, and default clauses.

Do student loans get forgiven after 20 years?

If you repay your loans under an IDR plan, the end of term balance on your student loans may be forgiven after you make a certain number of payments over 20 or 25 years (240 or 300 monthly payments). Use Loan Simulator to compare plans, estimate monthly payment amounts, and see if you're eligible for an IDR plan.

What is the purpose of the loan form?

The form allows the bank to collect detailed information about the borrower's financial situation, including their income, assets, debts, and credit history, which helps the bank to assess the borrower's ability to repay the loan.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Federal Loan Adjustment Form?

The Federal Loan Adjustment Form is a document used by borrowers to request changes or adjustments to their federal student loans, including deferments, forbearances, or repayment plan changes.

Who is required to file Federal Loan Adjustment Form?

Anyone who has federal student loans and wishes to request an adjustment to their repayment terms or loan status may be required to file the Federal Loan Adjustment Form.

How to fill out Federal Loan Adjustment Form?

To fill out the Federal Loan Adjustment Form, borrowers must provide personal information, loan details, and the specific adjustments being requested. It is important to follow instructions carefully and submit any required documentation.

What is the purpose of Federal Loan Adjustment Form?

The purpose of the Federal Loan Adjustment Form is to facilitate the process of modifying the terms of federal student loans, helping borrowers manage their repayment plans to better suit their financial situations.

What information must be reported on Federal Loan Adjustment Form?

The form typically requires personal identification information, details about the loans in question, the nature of the adjustment being requested, and any supporting documentation necessary to process the request.

Fill out your federal loan adjustment form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Loan Adjustment Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.