Get the free AUDIT FORM - law cuny

Show details

This document outlines the process and requirements for students who wish to audit a course, including registration, attendance, and approvals needed from professors and academic deans.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign audit form - law

Edit your audit form - law form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your audit form - law form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit audit form - law online

To use our professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit audit form - law. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out audit form - law

How to fill out AUDIT FORM

01

Obtain the AUDIT FORM from the designated source.

02

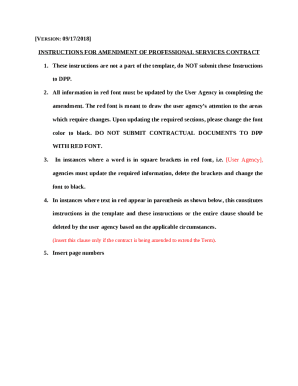

Read the instructions provided at the top of the form carefully.

03

Fill out personal information such as name, date, and contact details in the required fields.

04

Respond to all questions regarding your habits and history accurately.

05

Check the boxes or write in the appropriate responses as instructed.

06

Review the completed form for any errors or missing information.

07

Sign and date the form at the bottom after ensuring all sections are filled out.

Who needs AUDIT FORM?

01

Individuals seeking to assess their alcohol consumption.

02

Healthcare professionals conducting screenings.

03

Researchers collecting data on alcohol use.

04

Organizations providing support or intervention for alcohol-related issues.

Fill

form

: Try Risk Free

People Also Ask about

What is an audit form?

An audit form is a simple interface that's used to carry out an assessment of something against defined criteria. Generally speaking, audit forms comprise a combination of two types of questions: Closed-ended questions - for instance, pass/fail criteria.

What is the main purpose of an audit?

Audit documentation is the principal record of auditing procedures applied, evidence obtained, and conclusions reached by the auditor in the engagement.

What is the meaning of audit in English?

an official examination and verification of accounts and records, especially of financial accounts. a report or statement reflecting an audit; a final statement of account.

What is the verb form of audit?

audit verb [T] (BE AT CLASS) I audited some of her seminars.

What is called as audit?

An audit is a systematic review of a company's financial records conducted by professional accountants. External audits should be unbiased assessments of a company's financial health, while internal audits are used to improve the organization's internal controls.

What is the verb for audit?

Verb They audit the company books every year. The Internal Revenue Service audited him twice in 10 years. I audited an English literature class last semester.

What is the form of audit?

An IRS audit is a review/examination of an organization's or individual's books, accounts and financial records to ensure information reported on their tax return is reported correctly ing to the tax laws and to verify the reported amount of tax is correct. Why am I being selected for an audit? How am I notified?

What does auditable mean?

The most common types of audits are - internal audit, external audit, tax audit, statutory audit and compliance audit. These auditing types are directly linked to business finances and detecting fraud in the firm.

What is an audit document?

First, the IRS is motivated to audit returns for the purpose of finding unreported income. To do this, they conduct both random and strategic audits. The IRS examines a taxpayer's lifestyle to determine if income has been reported properly.

What is audit called in English?

au·dit ˈȯ-dət. Synonyms of audit. 1. a. : a formal examination of an organization's or individual's accounts or financial situation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is AUDIT FORM?

The AUDIT FORM is a standardized document used to collect and assess information related to financial audits or compliance evaluations.

Who is required to file AUDIT FORM?

Organizations and individuals that are subject to audit requirements, typically including businesses, non-profits, and government entities, are required to file the AUDIT FORM.

How to fill out AUDIT FORM?

To fill out the AUDIT FORM, gather necessary financial documents, ensure all sections are completed accurately, and provide supporting documentation as required before submitting to the appropriate authority.

What is the purpose of AUDIT FORM?

The purpose of the AUDIT FORM is to provide a clear and structured way to report financial data, identify discrepancies, and ensure compliance with applicable laws and regulations.

What information must be reported on AUDIT FORM?

The AUDIT FORM must typically report financial statements, accounting practices, compliance with regulations, and any other relevant information required by the auditing body.

Fill out your audit form - law online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Audit Form - Law is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.