Get the free 457_401k_SPD.indd - qcc cuny

Show details

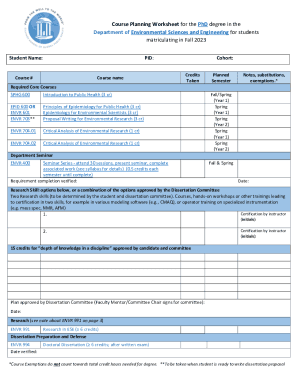

This document describes the City of New York Deferred Compensation Plan, detailing tax-favored retirement savings options such as the 457 Plan and the 401(k) Plan, along with their contributions,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 457_401k_spdindd - qcc cuny

Edit your 457_401k_spdindd - qcc cuny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 457_401k_spdindd - qcc cuny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 457_401k_spdindd - qcc cuny online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 457_401k_spdindd - qcc cuny. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 457_401k_spdindd - qcc cuny

How to fill out 457_401k_SPD.indd

01

Open the 457_401k_SPD.indd file using an appropriate application (e.g., Adobe InDesign).

02

Carefully read through the document to understand the sections and requirements.

03

Begin filling out the personal information section, including name, address, and contact details.

04

Complete the employment information section with your job title, department, and employer details.

05

Fill in your contribution amounts for both 457 and 401(k) plans as per your financial goals.

06

Review the beneficiary designation section and provide the required information.

07

Double-check all entries for accuracy and completeness.

08

Save your changes and export the document in the required format for submission.

Who needs 457_401k_SPD.indd?

01

Employees participating in a 457 or 401(k) retirement plan.

02

Human resources personnel who manage employee benefits.

03

Financial advisors assisting clients with retirement planning.

04

Anyone needing to understand their retirement plan options and obligations.

Fill

form

: Try Risk Free

People Also Ask about

What is the English equivalent of a 401k?

In UK terms, the equivalent of a 401k is the UK workplace pension or the SIPP (self-invested personal pension).

What does SPD stand for in a 401k plan?

More In Retirement Plans The Employee Retirement Income Security Act (ERISA) requires plan administrators to give to participants and beneficiaries a Summary Plan Description (SPD) describing their rights, benefits, and responsibilities under the plan in understandable language.

What is a 401K plan in the UK?

The 401(k) is similar to the workplace pension scheme in the United Kingdom. Every citizen in the United Kingdom has the right to a workplace pension plan that is paid for jointly by the employer and the employee. Both the employee and the employer contribute to the 401K plan in the United States.

What is a 401k plan in English?

A 401(k) plan is a qualified plan that includes a feature allowing an employee to elect to have the employer contribute a portion of the employee's wages to an individual account under the plan. The underlying plan can be a profit-sharing, stock bonus, pre-ERISA money purchase pension, or a rural cooperative plan.

What is the British version of the 401K?

In UK terms, the equivalent of a 401k is the UK workplace pension or the SIPP (self-invested personal pension).

What is a 401K plan in English?

A 401(k) plan is a qualified plan that includes a feature allowing an employee to elect to have the employer contribute a portion of the employee's wages to an individual account under the plan. The underlying plan can be a profit-sharing, stock bonus, pre-ERISA money purchase pension, or a rural cooperative plan.

Do British people have a 401K?

In the UK, most people are on “defined contribution” pensions, which are similar to the 401 (k) in the USA. A Roth IRA is an individual retirement account (IRA) in which you pay taxes on money going into the account, and then all future withdrawals of earnings are free from tax and penalty.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 457_401k_SPD.indd?

457_401k_SPD.indd is a specific document related to 457 and 401(k) retirement plans that outlines the Summary Plan Description (SPD) for participants.

Who is required to file 457_401k_SPD.indd?

Employers that offer 457 or 401(k) retirement plans are required to file the 457_401k_SPD.indd to provide necessary information to plan participants.

How to fill out 457_401k_SPD.indd?

To fill out 457_401k_SPD.indd, employers must include accurate plan details, contribution rates, investment options, and eligibility requirements as specified by the Department of Labor.

What is the purpose of 457_401k_SPD.indd?

The purpose of 457_401k_SPD.indd is to inform employees about their retirement plan benefits, rights, and responsibilities, ensuring compliance with federal regulations.

What information must be reported on 457_401k_SPD.indd?

The 457_401k_SPD.indd must report information such as plan name, type of plan, eligibility criteria, vesting schedule, benefit calculation methods, and participant rights.

Fill out your 457_401k_spdindd - qcc cuny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

457_401K_Spdindd - Qcc Cuny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.