Get the free TIAA-CREF SUPPLEMENTAL RETIREMENT ANNUITY (SRA) PROGRAM - baruch cuny

Show details

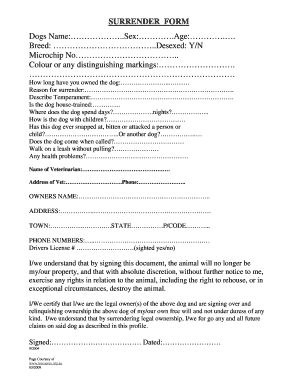

This document is a Salary Reduction Agreement enabling employees to specify a percentage of their salary to be contributed to a Supplemental Retirement Annuity Program with TIAA-CREF for the year

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tiaa-cref supplemental retirement annuity

Edit your tiaa-cref supplemental retirement annuity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tiaa-cref supplemental retirement annuity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tiaa-cref supplemental retirement annuity online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tiaa-cref supplemental retirement annuity. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tiaa-cref supplemental retirement annuity

How to fill out TIAA-CREF SUPPLEMENTAL RETIREMENT ANNUITY (SRA) PROGRAM

01

Obtain the TIAA-CREF Supplemental Retirement Annuity (SRA) program application form from the TIAA-CREF website or your employer's HR department.

02

Carefully read the instructions provided with the form to understand the requirements.

03

Fill out your personal information, including your name, address, Social Security number, and contact details.

04

Indicate your employment information, including your employer's name and your job title.

05

Select the type of contributions you wish to make (e.g., pre-tax or Roth after-tax contributions).

06

Determine your contribution amount, ensuring it complies with IRS limits and any employer-specific guidelines.

07

Review the investment options available to you within the SRA program and select your preferred allocation.

08

Complete any required beneficiary designation forms to specify who will receive benefits in the event of your death.

09

Sign and date the application form, confirming all provided information is accurate to the best of your knowledge.

10

Submit the completed form to TIAA-CREF or your employer's HR department as instructed.

Who needs TIAA-CREF SUPPLEMENTAL RETIREMENT ANNUITY (SRA) PROGRAM?

01

Individuals looking to supplement their retirement savings beyond standard employer-sponsored plans.

02

Employees of educational institutions or non-profit organizations who want additional tax-advantaged retirement savings options.

03

People seeking flexible investment options to align with their retirement goals and risk tolerance.

04

Those who wish to take advantage of both pre-tax and after-tax contribution opportunities for their retirement planning.

Fill

form

: Try Risk Free

People Also Ask about

What is a disadvantage of a retirement annuity?

While annuities offer benefits such as guaranteed income, tax-deferred growth, and protection against outliving savings, they also come with drawbacks like high fees, limited liquidity and potentially lower returns compared to other investments.

What is the TIAA controversy?

On August 5, three Named Plaintiffs sued TIAA and Morningstar in the S.D.N.Y., claiming Defendants engaged in a “scheme to enhance corporate profits” by counseling participants to invest in two of TIAA's most lucrative investment vehicles. Plaintiffs target ERISA and non-ERISA plans.

What is the difference between TIAA and TIAA CREF?

What is the difference between TIAA and CREF? Though you often hear them used together, TIAA and CREF are different things. TIAA is our company name, while CREF is a variable annuity that we created and provide to our customers. Because we made CREF, you may hear people refer to it as TIAA CREF.

Are TIAA and TIAA-CREF the same?

What is the difference between TIAA and CREF? Though you often hear them used together, TIAA and CREF are different things. TIAA is our company name, while CREF is a variable annuity that we created and provide to our customers. Because we made CREF, you may hear people refer to it as TIAA CREF.

What is a TIAA SRA?

For Supplemental Retirement Annuity (SRA) contracts, TIAA Traditional guarantees your principal and a 3% minimum annual interest rate for all premiums remitted since 1979. The account also offers the opportunity for additional amounts in excess of the guaranteed rate.

Is TIAA-CREF now just TIAA?

The Teachers Insurance and Annuity Association of America-College Retirement Equities Fund (TIAA, formerly TIAA-CREF) is an American financial services organization that is a private provider of financial retirement services in the academic, research, medical, cultural and governmental fields.

What does cref mean in TIAA?

In 1952 TIAA introduced the College Retirement Equities Fund (CREF), the first-ever variable annuity, to help savers keep pace with inflation and take advantage of market growth.

What is the new name for TIAA-CREF?

Nuveen market commentary Effective 01 May 2024, the Funds' name changed from TIAA-CREF Lifestyle Funds to Nuveen Lifestyle Funds.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is TIAA-CREF SUPPLEMENTAL RETIREMENT ANNUITY (SRA) PROGRAM?

The TIAA-CREF Supplemental Retirement Annuity (SRA) Program is a retirement savings plan designed to provide additional financial security for individuals, allowing them to invest a portion of their earnings in tax-deferred annuities to supplement their retirement income.

Who is required to file TIAA-CREF SUPPLEMENTAL RETIREMENT ANNUITY (SRA) PROGRAM?

Individuals participating in the TIAA-CREF SRA program who are seeking to contribute additional funds to their retirement savings are required to file, as well as employers facilitating the plan.

How to fill out TIAA-CREF SUPPLEMENTAL RETIREMENT ANNUITY (SRA) PROGRAM?

To fill out the TIAA-CREF SRA program forms, individuals must provide personal information, select contribution amounts, specify investment choices, and sign the application to confirm participation in the program.

What is the purpose of TIAA-CREF SUPPLEMENTAL RETIREMENT ANNUITY (SRA) PROGRAM?

The purpose of the TIAA-CREF SRA program is to help individuals build a larger retirement nest egg through additional tax-deferred contributions, thereby enhancing their financial security during retirement.

What information must be reported on TIAA-CREF SUPPLEMENTAL RETIREMENT ANNUITY (SRA) PROGRAM?

Information that must be reported includes personal identification details, contribution amounts, choices of investment options, and any changes to employment status affecting the program.

Fill out your tiaa-cref supplemental retirement annuity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tiaa-Cref Supplemental Retirement Annuity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.