Get the free Journal Entry (JE) Request Form for Salaries/Fringes - chants coastal

Show details

This document is used to request journal entries for the transfer of salary and fringe accounts in payroll processing.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign journal entry je request

Edit your journal entry je request form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your journal entry je request form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing journal entry je request online

To use the professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit journal entry je request. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

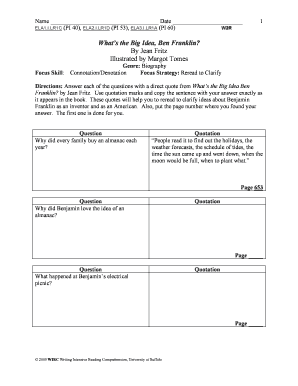

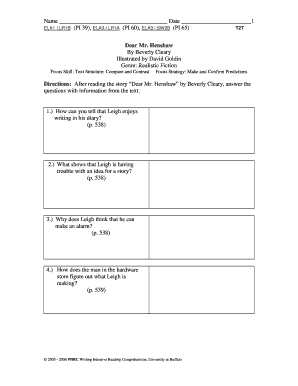

How to fill out journal entry je request

How to fill out Journal Entry (JE) Request Form for Salaries/Fringes

01

Obtain the Journal Entry (JE) Request Form for Salaries/Fringes from the designated source.

02

Fill out the date of the request in the appropriate field.

03

Provide a detailed description of the transaction, including salary amounts and applicable fringe benefits.

04

Indicate the correct account codes for the salaries and fringes being recorded.

05

Specify the period for which the salaries/fringes apply.

06

List the names of the employees involved in the transaction.

07

Provide any supporting documentation as required, such as payroll reports or contracts.

08

Ensure all necessary signatures are obtained from relevant parties for approval.

09

Submit the completed form to the finance department for processing.

Who needs Journal Entry (JE) Request Form for Salaries/Fringes?

01

HR personnel responsible for payroll.

02

Finance department team members overseeing accounting.

03

Managers or supervisors who need to allocate expenses.

04

Employees who have salary adjustments or related reimbursements.

Fill

form

: Try Risk Free

People Also Ask about

How to pass salary due journal entry?

Salaries paid journal entry records the payment of salaries to employees. When salaries are paid, the salary expense journal entry is debited, reflecting the business expense. Simultaneously, the cash or bank account is credited, indicating the reduction in business funds due to the payment.

What is the journal entry for salaries yet to be paid?

So, the answer to what is the outstanding salary journal entry is: debit salary expense and credit outstanding salary or salary payable. This journal entry helps match salary expenses with the right accounting period, even if the payment is not made immediately.

Is paying accounts payable a debit or credit?

Accounts payable is a liability account, which represents the amount of money a company owes to its vendors or suppliers for goods or services purchased on credit. Since a liability account is recorded as a credit in accounting, accounts payable is a credit account.

What is the journal entry for accounts payable payment?

To record accounts payable, the business needs to pass a journal entry that debits the expense or asset account and credits the accounts payable account. The debit amount is the purchase cost, whereas the credit amount represents the obligation to make the supplier.

What is the journal entry for paying accounts payable?

To record accounts payable, the business needs to pass a journal entry that debits the expense or asset account and credits the accounts payable account. The debit amount is the purchase cost, whereas the credit amount represents the obligation to make the supplier.

What is the journal entry for salaries?

A journal entry for wages is a record of the gross pay earned by an employee during a pay period, before any deductions are taken out. The entry typically involves debiting the wage expense account and crediting the payroll clearing account.

What is the entry for bills payable paid?

Bills payable are accounted for in the accounts payable account as a credit entry. Accounts payable record the short-term debt that your business owes to its vendors for the goods and services they've provided. Each accounts payable entry, including bills payable, has a payment term associated with it.

What is the journal entry to write off an account payable?

For example, if $4,000 is to be canceled, the journal entry looks like this: Debit Accounts Payable balance: $4,000. Credit Other income: $4,000. The entry writes off the balance that the creditor cancels from the company balance sheet. The impact is visible on both the balance sheet and income statement.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Journal Entry (JE) Request Form for Salaries/Fringes?

The Journal Entry (JE) Request Form for Salaries/Fringes is a document used to request adjustments to salary and fringe benefit expenses in the accounting records of an organization.

Who is required to file Journal Entry (JE) Request Form for Salaries/Fringes?

Employees or departments responsible for processing payroll and managing financial records within an organization are typically required to file the Journal Entry (JE) Request Form for Salaries/Fringes.

How to fill out Journal Entry (JE) Request Form for Salaries/Fringes?

To fill out the Journal Entry (JE) Request Form, one should provide information such as the date of the entry, account numbers, descriptions of the expenses, amounts to be debited and credited, and any necessary approvals from relevant authorities.

What is the purpose of Journal Entry (JE) Request Form for Salaries/Fringes?

The purpose of the Journal Entry (JE) Request Form for Salaries/Fringes is to ensure accurate financial reporting and to facilitate necessary adjustments to salary and fringe benefit expenses to reflect the true financial position of the organization.

What information must be reported on Journal Entry (JE) Request Form for Salaries/Fringes?

The information that must be reported on the Journal Entry (JE) Request Form includes the date of the entry, the accounts affected, amounts debited and credited, descriptions of the transactions, authorizations, and any supporting documentation.

Fill out your journal entry je request online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Journal Entry Je Request is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.