Get the free Bank Guarantee Letter Form

Show details

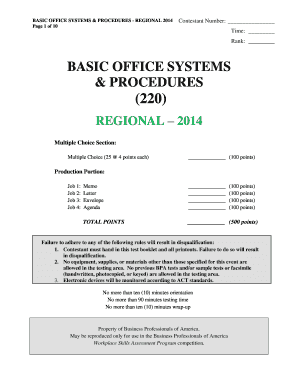

Bank Guarantee Letter Form Communications and Information Technology Commission King Fahad Road, Riyadh 11588 Kingdom of Saudi Arabia Date Applicant's Name. Dear Sir, Re: Please Insert Service Name

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign bank guarantee letter form

Edit your bank guarantee letter form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your bank guarantee letter form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit bank guarantee letter form online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit bank guarantee letter form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out bank guarantee letter form

How to fill out a bank guarantee letter form?

01

Start by carefully reading the instructions: Before filling out the bank guarantee letter form, it is important to thoroughly read the accompanying instructions. These instructions usually provide guidance on how to complete each section accurately.

02

Enter your personal information: Begin by providing your personal details such as your full name, address, contact information, and any other required identifiers. Ensure that this section is complete and accurate.

03

Identify the beneficiary: Indicate the name and contact information of the beneficiary, i.e., the individual or entity who will receive the guarantee. This could be a vendor, landlord, or other party for whom the guarantee is being issued.

04

Specify the purpose and amount: Clearly state the purpose for which the bank guarantee is being issued. This could involve guaranteeing payment, performance, or the completion of a specific obligation. Additionally, enter the exact amount being guaranteed in the appropriate section.

05

Provide supporting documentation, if required: In some cases, the bank may require supporting documents to accompany the bank guarantee letter form. This can include financial statements, project details, or other relevant paperwork. Attach these documents as directed.

06

Sign and date the form: Ensure that all necessary signatures are provided in the designated areas. This may involve signatures from both the account holder and the authorized bank representative. Additionally, remember to date the form to establish when the guarantee is issued.

Who needs a bank guarantee letter form?

01

Businesses engaged in international trade: Companies involved in import-export activities often require bank guarantees to ensure the timely fulfillment of their contractual obligations. This can help provide assurance to their international partners.

02

Contractors and vendors: Construction firms, suppliers, and service providers may need a bank guarantee to secure contracts and demonstrate their financial stability. This can give confidence to clients and help secure business opportunities.

03

Landlords and real estate agents: Individuals or organizations renting out properties may ask tenants to provide bank guarantees. This helps protect against potential non-payment of rent or damages to the property.

04

Government agencies and public organizations: Government entities often require bank guarantees when awarding contracts or permits. This ensures that the chosen vendor or contractor will meet their contractual obligations.

In conclusion, filling out a bank guarantee letter form involves carefully following instructions, providing personal and beneficiary details, specifying the purpose and amount, attaching supporting documents if necessary, and signing and dating the form. This form is commonly needed by businesses engaged in international trade, contractors, vendors, landlords, real estate agents, and government agencies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is bank guarantee letter form?

The bank guarantee letter form is a document issued by a bank on behalf of a customer, guaranteeing that the customer will fulfill a contractual obligation.

Who is required to file bank guarantee letter form?

Any individual or organization who needs to provide a financial guarantee for a specific transaction or contract.

How to fill out bank guarantee letter form?

The bank guarantee letter form usually requires the applicant to provide personal and financial information, details of the guarantee being issued, and signatures from authorized parties.

What is the purpose of bank guarantee letter form?

The purpose of the bank guarantee letter form is to provide assurance to the beneficiary that the obligations specified in a contract will be fulfilled, even if the customer fails to meet them.

What information must be reported on bank guarantee letter form?

The bank guarantee letter form typically requires details on the applicant's identity, the beneficiary of the guarantee, the amount guaranteed, and the terms and conditions of the guarantee.

How do I modify my bank guarantee letter form in Gmail?

You can use pdfFiller’s add-on for Gmail in order to modify, fill out, and eSign your bank guarantee letter form along with other documents right in your inbox. Find pdfFiller for Gmail in Google Workspace Marketplace. Use time you spend on handling your documents and eSignatures for more important things.

How do I edit bank guarantee letter form online?

With pdfFiller, the editing process is straightforward. Open your bank guarantee letter form in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I sign the bank guarantee letter form electronically in Chrome?

You certainly can. You get not just a feature-rich PDF editor and fillable form builder with pdfFiller, but also a robust e-signature solution that you can add right to your Chrome browser. You may use our addon to produce a legally enforceable eSignature by typing, sketching, or photographing your signature with your webcam. Choose your preferred method and eSign your bank guarantee letter form in minutes.

Fill out your bank guarantee letter form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Bank Guarantee Letter Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.