Get the free Federal Perkins Loan Application - secure colostate-pueblo

Show details

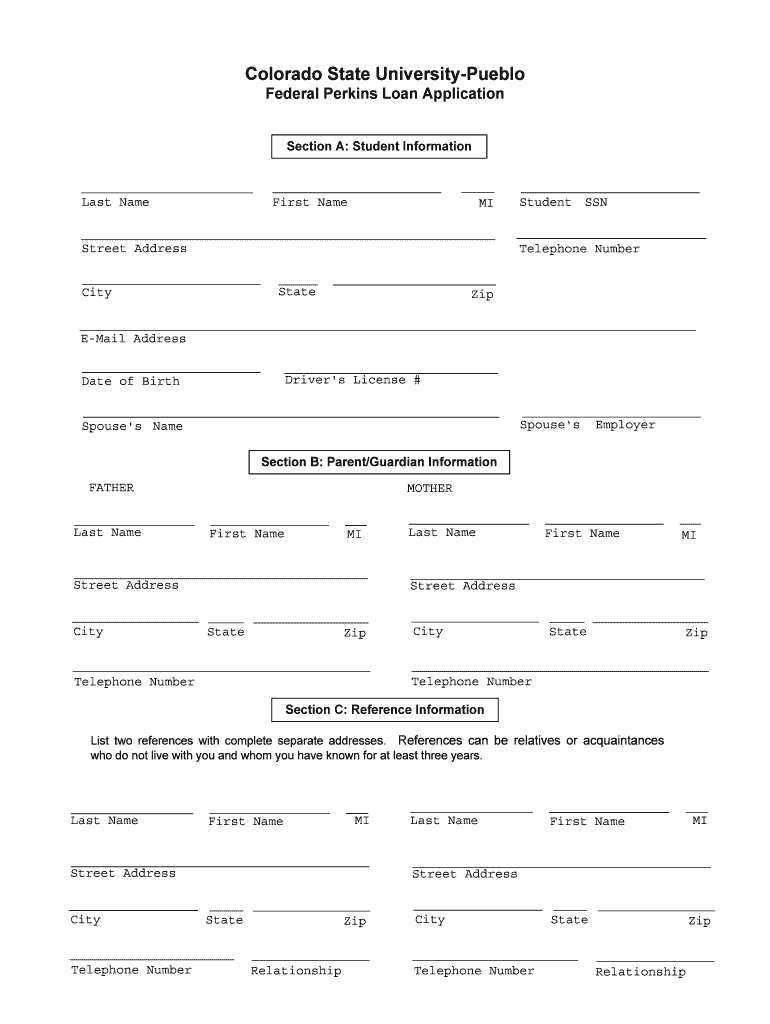

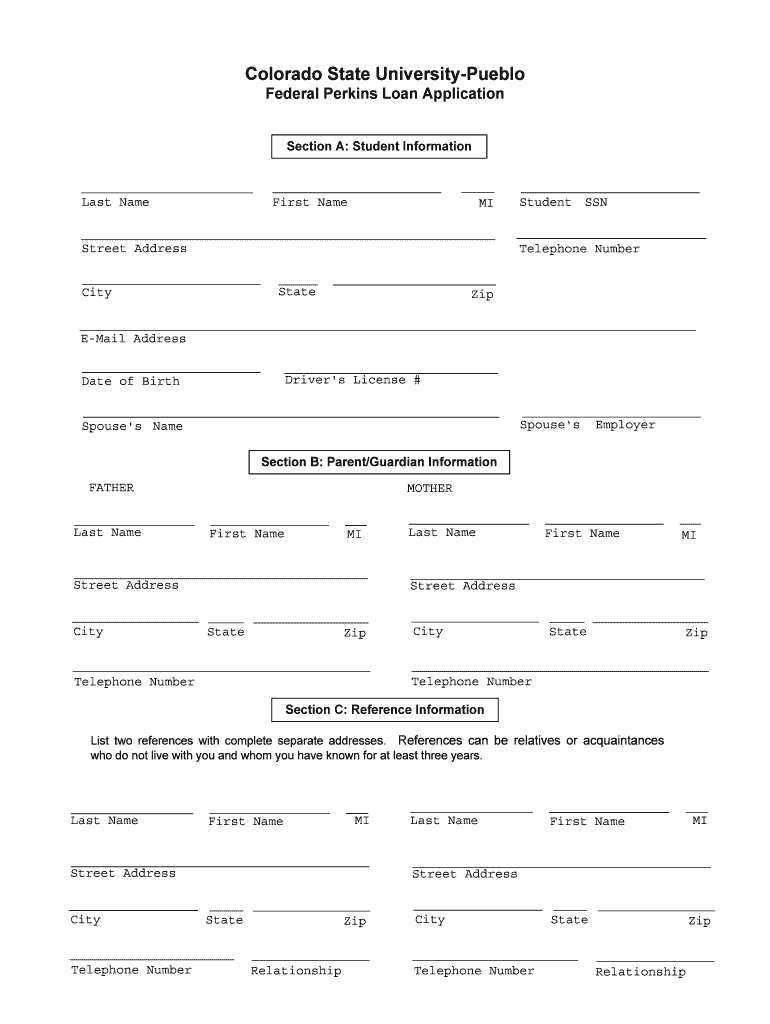

This document is an application for the Federal Perkins Loan at Colorado State University-Pueblo, gathering necessary student, parent, and reference information and providing disclosure about loan

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign federal perkins loan application

Edit your federal perkins loan application form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal perkins loan application form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing federal perkins loan application online

To use our professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit federal perkins loan application. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out federal perkins loan application

How to fill out Federal Perkins Loan Application

01

Obtain the Federal Perkins Loan Application form from your school's financial aid office or the school's website.

02

Fill in your personal information including your name, Social Security number, and contact details.

03

Provide details about your financial situation, including income and assets.

04

Indicate your enrollment status and the program you are applying for.

05

Sign and date the application to certify that the information you provided is accurate.

06

Submit the completed application to your school's financial aid office before the deadline.

Who needs Federal Perkins Loan Application?

01

Students who are enrolled in a degree or certificate program at a college or university.

02

Undergraduate and graduate students who demonstrate exceptional financial need.

03

Students who are U.S. citizens or eligible non-citizens and are in good academic standing.

Fill

form

: Try Risk Free

People Also Ask about

Do Perkins Loans qualify for forgiveness?

Key takeaways. Perkins Loans borrowers in the public sector who meet the requirements may qualify to get up to 100 percent of the debt forgiven. Contact the school that originally made the Perkins Loan or the student loan servicer that handles your loan account to get the forgiveness forms.

How do I apply for a Federal Perkins Loan?

To apply for a Perkins loan, complete a Free Application for Federal Student Aid (FAFSA). By completing this application, you'll also find out if you're eligible for other types of federal financial aid such as Stafford loans.

What is considered a Perkins Loan?

Loans made through the Federal Perkins Loan Program, often called Perkins Loans, are low-interest federal student loans for undergraduate and graduate students with exceptional financial need.

Who qualifies for Perkins Loan forgiveness?

You may be eligible for up to 100% loan cancellation for five years of service if you are a full-time employee carrying out the educational part of a Head Start, pre-kindergarten, or child-care program providing services for high-risk children and families in a low-income community, or supervising the provision of such

What is the difference between a Perkins Loan and a direct loan?

Direct Loans are issued by the U.S. Department of Education, while indirect loans are made by colleges and universities. Federal Family Education Loans (FFEL) and Perkins Loans are two common types of indirect loans. These loans were made by private lenders and guaranteed by the federal government.

What is considered a direct loan?

Federal Direct Unsubsidized Loans are loans for both undergraduate and graduate students that are not based on financial need. Eligibility is determined by your cost of attendance minus other financial aid (such as grants or scholarships). Interest is charged during in-school, deferment, and grace periods.

Are federal Perkins Loans still available?

Perkins loans are no longer offered, but borrowers who still hold one must repay the loan. As of 2023, other federal loans are available to students, including direct subsidized loans, direct unsubsidized loans, direct plus loans, and direct consolidation loans. Congressional Research Service.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Federal Perkins Loan Application?

The Federal Perkins Loan Application is a financial aid application used to apply for the Federal Perkins Loan Program, which offers low-interest loans to students with exceptional financial need to help cover educational expenses.

Who is required to file Federal Perkins Loan Application?

Students who demonstrate financial need and wish to receive a Federal Perkins Loan must file the Federal Perkins Loan Application as part of their financial aid process.

How to fill out Federal Perkins Loan Application?

To fill out the Federal Perkins Loan Application, students typically need to provide personal information, financial details, and information about their school. The application may be submitted through their school's financial aid office.

What is the purpose of Federal Perkins Loan Application?

The purpose of the Federal Perkins Loan Application is to assess a student's financial situation and determine their eligibility for receiving federal funds in the form of a Perkins Loan.

What information must be reported on Federal Perkins Loan Application?

The Federal Perkins Loan Application requires reporting information such as the student's financial status, family income, number of dependents, cost of attendance, and other relevant financial assets.

Fill out your federal perkins loan application online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Perkins Loan Application is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.