Get the free Our personal lines market reference guide - Morstan General bb

Show details

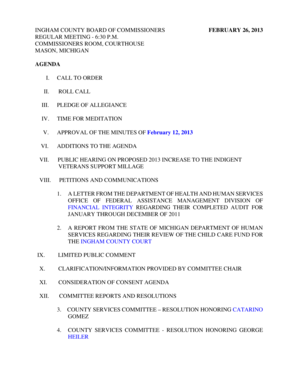

Dwelling Maximum Did. R/C Available Maximum Schedule No Limit ACE PRIVATE RISK SERVICES Maximum CPL $$10,000,00050,000 Yes No Limit CS Fire Alarm $1m + CS Fire/Burglar $2m + All Risk/ Protection credit/

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign our personal lines market

Edit your our personal lines market form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your our personal lines market form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing our personal lines market online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit our personal lines market. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you can have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out our personal lines market

How to fill out our personal lines market:

01

Conduct market research: Start by conducting thorough market research to understand the needs, preferences, and demographics of potential customers. This will help in tailoring products and services that meet their specific requirements.

02

Develop competitive products: Create a range of personal lines insurance products that cater to various needs such as auto insurance, home insurance, renters insurance, etc. Ensure that the coverage options, pricing, and benefits are competitive compared to other offerings in the market.

03

Build strong relationships with insurance agents: Collaborate with insurance agents and brokers who specialize in personal lines insurance. Provide them with proper training and necessary resources to effectively sell and promote the products to their clients.

04

Focus on customer experience: Provide exceptional customer service and support throughout the entire customer journey – from purchasing the insurance policies to handling claims. Enhance the user experience by offering online tools, easy policy management, and quick response times.

05

Leverage digital marketing strategies: Utilize digital marketing channels, such as social media, search engine optimization, and online advertising, to increase brand awareness and attract potential customers. Create engaging content that educates customers about the importance and benefits of personal lines insurance.

06

Collaborate with strategic partners: Form partnerships with related businesses, like car dealerships, real estate agencies, or property management companies, to promote your personal lines insurance products. This can be done through joint marketing efforts, referral programs, or special offers for their customers.

07

Monitor and adapt: Regularly monitor the market trends, industry regulations, and customer feedback. Stay updated with the evolving needs of customers and adapt the products and services accordingly.

Who needs our personal lines market?

01

Individuals and families: Personal lines insurance is essential for individuals and families who want to protect their assets, properties, and vehicles. It provides financial security by covering damages, liability, and loss in various situations.

02

Homeowners: Homeowners insurance is crucial for those who own a house or condominium. It covers damages caused by fire, theft, natural disasters, and other risks, ensuring that homeowners can recover their losses and rebuild their lives.

03

Renters: Renters insurance is necessary for individuals or families living in rental properties. It protects their personal belongings from theft, fire, or damage, and also provides liability coverage in case of accidents or injuries.

04

Vehicle owners: Auto insurance is a legal requirement in many jurisdictions. It is necessary for individuals who own cars, motorcycles, or other vehicles to protect against accidents, theft, and property damage on the road.

05

Business owners: Personal lines insurance also caters to entrepreneurs and business owners who want to protect their assets, such as office space, equipment, and vehicles used for business purposes.

06

High net worth individuals: Wealthy individuals with significant assets and valuable possessions may require personal lines insurance to ensure comprehensive coverage against potential risks to their property and lifestyle.

Overall, by following the mentioned steps and understanding the target market, we can effectively fill out our personal lines market and cater to the needs of individuals and families seeking insurance coverage for their homes, vehicles, and personal belongings.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is our personal lines market?

Our personal lines market refers to the insurance products and services we offer to individuals for their personal needs, such as auto, home, and life insurance.

Who is required to file our personal lines market?

The insurance company or provider is required to file our personal lines market with the appropriate regulatory bodies.

How to fill out our personal lines market?

To fill out our personal lines market, the insurance company must gather all relevant data on policies, premiums, claims, and other relevant information and submit it to the regulatory authorities.

What is the purpose of our personal lines market?

The purpose of our personal lines market is to provide insurance coverage and financial protection to individuals for their personal assets and liabilities.

What information must be reported on our personal lines market?

The information that must be reported on our personal lines market includes the number of policies issued, premium amounts collected, claims made, and any other relevant data as required by the regulators.

How do I make changes in our personal lines market?

With pdfFiller, it's easy to make changes. Open your our personal lines market in the editor, which is very easy to use and understand. When you go there, you'll be able to black out and change text, write and erase, add images, draw lines, arrows, and more. You can also add sticky notes and text boxes.

How do I edit our personal lines market in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing our personal lines market and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I fill out our personal lines market on an Android device?

On an Android device, use the pdfFiller mobile app to finish your our personal lines market. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

Fill out your our personal lines market online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Our Personal Lines Market is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.