Get the free Credit Card Payment Processing - cwi colostate

Show details

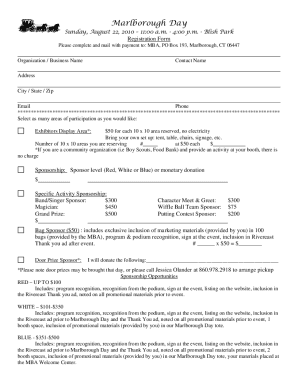

This document is for processing credit card payments for the Colorado Water Institute registration in 2010. It includes fields for personal information and credit card details.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign credit card payment processing

Edit your credit card payment processing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your credit card payment processing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing credit card payment processing online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit credit card payment processing. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out credit card payment processing

How to fill out Credit Card Payment Processing

01

Gather necessary information including your credit card number, expiration date, CVV, and billing address.

02

Visit the payment processing platform's website or application.

03

Select the option to make a payment and enter the required credit card information.

04

Confirm the payment amount and any additional details.

05

Review the terms and conditions before proceeding.

06

Submit the payment and wait for confirmation of processing.

Who needs Credit Card Payment Processing?

01

Businesses that sell products or services online.

02

Retailers who want to accept credit card payments in-store.

03

Freelancers and service providers that require payment from clients.

04

E-commerce platforms and marketplaces that facilitate transactions.

05

Non-profit organizations collecting donations.

Fill

form

: Try Risk Free

People Also Ask about

What is the process of payment of credit card?

Basic Payment process Step-1 Initiation: The cardholder initiates the process by giving the retailer their credit card details. Step-2 Request for Authorisation: The merchant notifies their payment processor with the details. Step-3 Check for Approval: The payment processor contacts the card issuer to obtain approval.

What is the 2/3/4 rule for credit cards?

The 2/3/4 rule: ing to this rule, applicants are limited to two new cards in 30 days, three new cards in 12 months and four new cards in 24 months.

How to write off credit card processing fees?

Fees related to personal credit cards are generally not tax deductible. If you use a card for business purposes, you can deduct fees on those cards that the IRS deems “ordinary” and “necessary” for tax purposes.

How do I tell customers of credit card processing fees?

How to Notify Customers about Convenience Fees In-person: “There will be a $3 flat fee for online payments and credit cards. Online: “By selecting 'credit,' you agree to pay a $3 convenience fee.” Over the phone: “I'm happy to process your credit card payment, but please be aware there is a $3 convenience fee.”

How do you explain credit card processing fees?

The card issuers partner with networks such as Visa, Discover, American Express, and Mastercard on credit and debit cards. For each card transaction, the card issuer charges a merchant a commission for the ability to accept the card — typically, a percentage of the transaction amount plus a flat fee.

How to word credit card processing fee?

A standard wording could be: “A credit card convenience fee of [percentage or flat amount] will be applied to all transactions. This fee is charged to cover the processing costs associated with credit card payments. Please note that this fee does not apply to other payment forms such as cash or debit cards.”

What is the process of credit card processing?

Credit card processing is the series of steps that enable a business to securely and efficiently accept credit card payments. The process includes authorization, clearing and settlement phases and involves multiple parties, including cardholders, businesses, financial institutions and credit card networks.

How to word credit card processing fees?

A standard wording could be: “A credit card convenience fee of [percentage or flat amount] will be applied to all transactions. This fee is charged to cover the processing costs associated with credit card payments. Please note that this fee does not apply to other payment forms such as cash or debit cards.”

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Credit Card Payment Processing?

Credit Card Payment Processing is the method through which merchants accept payments through credit or debit cards. It involves a series of steps including authorization, capturing funds, and settling the transaction with the bank.

Who is required to file Credit Card Payment Processing?

Businesses that accept credit card payments are required to file Credit Card Payment Processing. This includes retail stores, online businesses, and any service providers who invoice customers using credit cards.

How to fill out Credit Card Payment Processing?

To fill out Credit Card Payment Processing, one must provide the merchant’s identification details, transaction amounts, credit card information, and relevant authorizations as required by the payment processor.

What is the purpose of Credit Card Payment Processing?

The purpose of Credit Card Payment Processing is to facilitate the secure and efficient transaction of funds from the cardholder's account to the merchant’s account, enabling businesses to accept payments conveniently.

What information must be reported on Credit Card Payment Processing?

Information that must be reported includes the transaction date, transaction amount, cardholder details, merchant details, and transaction identification numbers, along with any applicable fees or charges.

Fill out your credit card payment processing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Credit Card Payment Processing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.