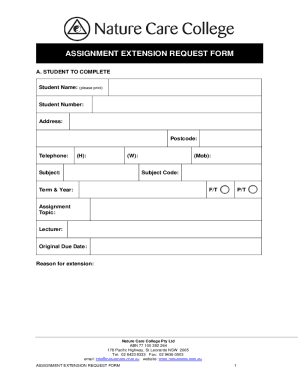

Get the free Voluntary AD&D Insurance Enrollment & Change Form - hrs colostate

Show details

A form for employees to enroll or make changes to their Accidental Death and Dismemberment insurance coverage, including beneficiary designations and coverage amounts.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign voluntary add insurance enrollment

Edit your voluntary add insurance enrollment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your voluntary add insurance enrollment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing voluntary add insurance enrollment online

To use our professional PDF editor, follow these steps:

1

Sign into your account. It's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit voluntary add insurance enrollment. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out voluntary add insurance enrollment

How to fill out Voluntary AD&D Insurance Enrollment & Change Form

01

Obtain the Voluntary AD&D Insurance Enrollment & Change Form from your HR department or the insurance provider's website.

02

Read the instructions carefully to understand the requirements for filling out the form.

03

Provide your personal information, including your full name, date of birth, and Social Security number.

04

Indicate the coverage amount you wish to enroll in or change, ensuring it meets the minimum and maximum limits set by the provider.

05

List any dependents you wish to enroll in the coverage, including their names, dates of birth, and relationship to you.

06

Check the appropriate boxes for any additional options or riders you may wish to include in your policy.

07

Sign and date the form to confirm that all information is accurate to the best of your knowledge.

08

Submit the completed form to your HR department or the designated insurance representative before the enrollment deadline.

Who needs Voluntary AD&D Insurance Enrollment & Change Form?

01

Employees who want additional financial protection in case of accidental death or dismemberment.

02

Those who have dependents and wish to provide coverage for them in the event of an accident.

03

Individuals looking to change their existing Voluntary AD&D insurance coverage due to life changes, such as marriage or the birth of a child.

04

Anyone seeking to take advantage of employer-sponsored Voluntary AD&D insurance offerings.

Fill

form

: Try Risk Free

People Also Ask about

What's the difference between life insurance and ad&d insurance?

The biggest difference between life and AD&D insurance is that an AD&D policy pays out only for a death or dismemberment caused by an accident, while a life insurance policy typically pays out regardless of the cause of death. Here's a quick rundown of each type of policy and what's covered.

Is it worth it to get insurance with Ad&D?

Is AD&D insurance worth it? Because AD&D insurance is generally very inexpensive, you might like to have it for peace of mind. However, having life insurance and health insurance will provide far more financial protection due to AD&D's limited coverage and exclusions.

Can you claim both life insurance and ad&d without?

Do AD&D and life insurance both pay out? Your beneficiaries can collect both life insurance and AD&D benefits if both policies cover the cause of your death. If the accident does not fall within your AD&D coverage, your beneficiaries can still receive the applicable life insurance benefit.

Can you convert term insurance to permanent insurance?

Term life insurance policies usually include a conversion option that allows you to switch to a permanent policy such as whole life. Conversion typically has a time window, such as within the first five to 10 years of owning the policy.

What is voluntary AD&D insurance?

Voluntary group accidental death and dismemberment (AD&D) insurance is a simple way for employees to supplement their life insurance coverage with additional protection if they or a family member dies or is dismembered as a result of a covered accident.

Do I need both life insurance and ad&d?

If you already have life insurance, you probably do not need AD&D as well, unless your job has a high rate of dismembering accidents. There are other ways you can protect yourself and your family. Disability insurance, which covers both accidents and illnesses, is an alternative to AD&D.

Is ad&d insurance worth it?

It really depends on your individual needs and lifestyle. If your life insurance policy offers adequate coverage for you in the case of death or accidental dismemberment, AD&D may be an unnecessary additional cost. If you're in a high-risk profession, however, it may be worth consideration.

Can you convert ad&d insurance?

AD&D coverage is not eligible for conversion. If the group policy is terminated or amended to reduce or eliminate coverage while the insured employee is still employed, he or she may be eligible to convert a portion of their coverage if the insured was covered under the policy for a specific period of time.

Who can change the beneficiary on an ad&d policy?

The only person who can change the beneficiary is the policyholder.

What is group term life insurance AD&D?

Many employers provide group term life insurance for their employees. When group life insurance coverage is provided, each employee receives a specified amount of term life and accidental death and dismemberment (AD&D) insurance. Benefits typically range from $50,000 flat, 1x earnings, or 2x earnings.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Voluntary AD&D Insurance Enrollment & Change Form?

The Voluntary AD&D Insurance Enrollment & Change Form is a document used by individuals to enroll or make changes to their Accidental Death and Dismemberment (AD&D) insurance coverage on a voluntary basis.

Who is required to file Voluntary AD&D Insurance Enrollment & Change Form?

Employees who wish to enroll in or change their existing Voluntary AD&D insurance coverage are required to file the Voluntary AD&D Insurance Enrollment & Change Form.

How to fill out Voluntary AD&D Insurance Enrollment & Change Form?

To fill out the form, individuals should provide personal details such as their name, employee ID, and contact information, select the type of enrollment or change they are requesting, and sign the form for authorization.

What is the purpose of Voluntary AD&D Insurance Enrollment & Change Form?

The purpose of the form is to facilitate voluntary enrollment in AD&D insurance and to document any changes to existing coverage, ensuring that employees have the appropriate protection in place.

What information must be reported on Voluntary AD&D Insurance Enrollment & Change Form?

The form must report the individual's full name, employee identification number, coverage selections, beneficiary information, and any relevant changes to existing policies.

Fill out your voluntary add insurance enrollment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Voluntary Add Insurance Enrollment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.