Get the free Canadian Credit Card Setup Application - Unitec Inc

Show details

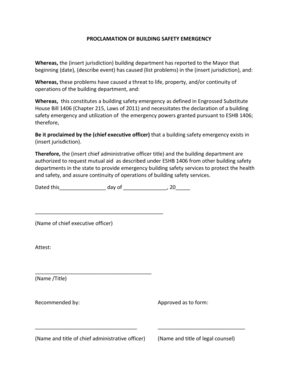

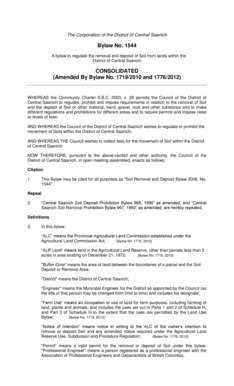

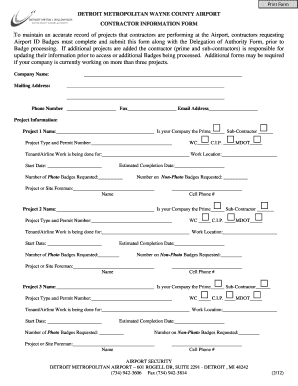

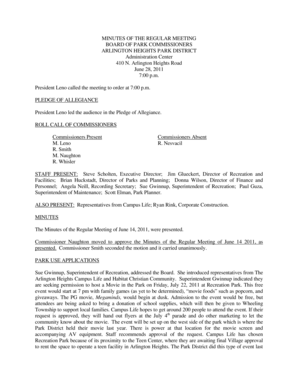

Credit Card Setup Application Canadian Accounts Only This document contains the information needed to set up your Merchant Account. For a Merchant Service Provider, feel free to choose your own bank,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign canadian credit card setup

Edit your canadian credit card setup form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your canadian credit card setup form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit canadian credit card setup online

Follow the steps below to use a professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit canadian credit card setup. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out canadian credit card setup

How to Fill Out Canadian Credit Card Setup:

Start by gathering the required documents and information:

01

Valid identification (e.g., passport, driver's license)

02

Social Insurance Number (SIN) or Individual Tax Number (ITN)

03

Proof of Canadian address (e.g., utility bill, lease agreement)

3.1

Research and compare credit card options offered by different Canadian banks or financial institutions. Consider factors such as annual fees, interest rates, rewards programs, and benefits to find the most suitable card for your needs.

3.2

Once you have chosen a credit card provider, visit their website or a local branch to begin the application process. Look for the "Apply Now" or "Credit Card Application" option.

3.3

Provide your personal information in the application form, including your full name, date of birth, contact details, and employment information. Ensure accuracy and double-check for any errors.

3.4

Enter your Canadian address information, including your residential address, city, province, and postal code. This information is crucial for verification.

3.5

Enter your Social Insurance Number (SIN) or Individual Tax Number (ITN). This is required for credit assessment and confirming your identity.

3.6

Include your financial details, such as your employment status, annual income, and other sources of income. These details help the credit card provider assess your financial standing and creditworthiness.

3.7

Review the terms and conditions of the credit card agreement thoroughly. Pay attention to interest rates, fees, repayment terms, and any promotional offers. Ensure you understand all the terms before proceeding further.

3.8

Submit your completed application form. If applying online, review all the information for accuracy before clicking the "Submit" button.

3.9

Await the credit card approval process. This may take a few business days or longer, depending on the issuer. If approved, you will receive your new credit card by mail.

Who Needs Canadian Credit Card Setup:

01

Residents of Canada who want to establish a credit history: Having a Canadian credit card can help build a positive credit history, which is important for various financial matters like obtaining loans, mortgages, or even renting a home.

02

Individuals who frequently travel within or outside Canada: Canadian credit cards often provide travel-related benefits like travel insurance, airport lounge access, foreign transaction fee waivers, and reward points that can be redeemed for travel expenses.

03

People who prefer cashless transactions and convenient payment options: Credit cards offer a convenient way to make purchases both online and offline, without the need for physical cash. They also provide security features like fraud protection, purchase protection, and extended warranties.

04

Customers who want to take advantage of rewards and perks: Many Canadian credit cards offer rewards programs, such as cashback, airline miles, or points that can be redeemed for merchandise or gift cards. These rewards can help save money on everyday expenses or provide unique experiences.

05

Business owners or entrepreneurs: Having a credit card dedicated to business expenses can simplify bookkeeping, manage cash flow, and offer benefits tailored to specific business needs (e.g., business expense tracking, employee cards, higher credit limits).

Remember, it's essential to use credit cards responsibly and pay off balances in full or on time to avoid high interest charges and maintain a healthy credit score.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is canadian credit card setup?

Canadian credit card setup refers to the process of setting up a credit card account in Canada.

Who is required to file canadian credit card setup?

Any individual or business that wants to open a credit card account in Canada is required to file canadian credit card setup.

How to fill out canadian credit card setup?

To fill out canadian credit card setup, you will need to provide personal or business information, financial details, and agree to the terms and conditions set by the credit card issuer.

What is the purpose of canadian credit card setup?

The purpose of canadian credit card setup is to enable individuals and businesses to access credit card services and make purchases or payments using the credit card.

What information must be reported on canadian credit card setup?

Information such as name, address, contact details, financial information, and identification documents may need to be reported on canadian credit card setup.

How do I fill out the canadian credit card setup form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign canadian credit card setup. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I complete canadian credit card setup on an iOS device?

pdfFiller has an iOS app that lets you fill out documents on your phone. A subscription to the service means you can make an account or log in to one you already have. As soon as the registration process is done, upload your canadian credit card setup. You can now use pdfFiller's more advanced features, like adding fillable fields and eSigning documents, as well as accessing them from any device, no matter where you are in the world.

How do I complete canadian credit card setup on an Android device?

On Android, use the pdfFiller mobile app to finish your canadian credit card setup. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your canadian credit card setup online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Canadian Credit Card Setup is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.