Get the free WHY I/WE HAVE NOT FILED A 2011 TAX RETURN - cumc columbia

Show details

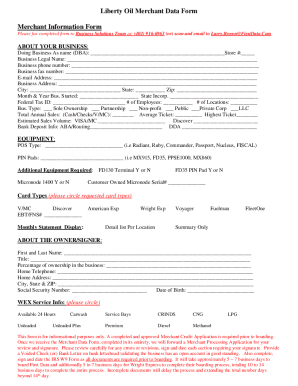

This document serves to verify that an individual did not file a 2011 tax return due to total income being below the required threshold for filing.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign why iwe have not

Edit your why iwe have not form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your why iwe have not form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit why iwe have not online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit why iwe have not. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out why iwe have not

How to fill out WHY I/WE HAVE NOT FILED A 2011 TAX RETURN

01

Gather all necessary documentation that explains your circumstances for not filing.

02

Provide a clear and concise explanation for each year you did not file a tax return.

03

Include any relevant financial information that supports your situation, such as proof of income or lack thereof.

04

Make sure to address any misunderstandings about your income level, tax status, or changes in your life that contributed to not filing.

05

Be honest and straightforward in your narrative to avoid any potential legal issues.

06

Keep your response organized and professional in presentation.

Who needs WHY I/WE HAVE NOT FILED A 2011 TAX RETURN?

01

Individuals who did not file a tax return for the year 2011 and need to explain their situation to the IRS.

02

Taxpayers who are under audit or inquiry regarding their missing tax returns.

03

People seeking to resolve issues related to their tax history for clarity or compliance.

Fill

form

: Try Risk Free

People Also Ask about

Why do I not have my tax return?

There are many reasons why the IRS may be holding your refund. You have unfiled or missing tax returns for prior tax years. Your refund was applied to a debt you owe to the IRS or another federal or state agency. Why has my tax return not been processed 2020? In 2020, the IRS closed its offices due to the pandemic.

What's the longest you can go without filing taxes?

There is no hard limit on how many years you can file back taxes. However, to be in “good standing” with the IRS, you should have filed tax returns for the last six years. If you're due a refund or tax credits, you must file the return within three years of the original due date to claim it.

What happens if I don't file my taxes in the USA?

What happens if you refuse to file taxes? If penalties and interest aren't motivating enough and you outright refuse to file taxes, the IRS can enforce tax liens against your property or even pursue civil or criminal litigation against you until you pay.

How many years can you go without filing taxes in the US?

Additionally, the IRS may take legal action against delinquent taxpayers, such as levying bank accounts, garnishing wages, or obtaining federal tax liens against property. 2. How long can I go without filing taxes? Technically, there is no limit on how many years a taxpayer can go without filing taxes.

What happens if income tax return is not filed?

Prosecution for failing to file your Income Tax Return If you fail to furnish your ITR and your income tax liability is more than Rs. 25,000 you shall be punishable with rigorous imprisonment minimum of 6 months up to 7 years and with a fine.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is WHY I/WE HAVE NOT FILED A 2011 TAX RETURN?

WHY I/WE HAVE NOT FILED A 2011 TAX RETURN is a form or statement that individuals use to explain the reasons for not submitting their federal income tax return for the year 2011.

Who is required to file WHY I/WE HAVE NOT FILED A 2011 TAX RETURN?

Individuals who did not file their 2011 tax return and are seeking to resolve their tax situation with the IRS may be required to file this statement.

How to fill out WHY I/WE HAVE NOT FILED A 2011 TAX RETURN?

To fill out the form, individuals need to provide their personal information, explain the reasons for not filing, and offer any supporting documents that justify their circumstances.

What is the purpose of WHY I/WE HAVE NOT FILED A 2011 TAX RETURN?

The purpose is to inform the IRS of the reasons behind the failure to file and to provide a basis for potential penalties or collection actions to be reconsidered.

What information must be reported on WHY I/WE HAVE NOT FILED A 2011 TAX RETURN?

Information that must be reported typically includes the taxpayer's name, Social Security number, the specific reasons for not filing, and any relevant documentation to support their claims.

Fill out your why iwe have not online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Why Iwe Have Not is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.