Get the free Giving through Payroll Deduction - concordia csp

Show details

This document serves as an authorization form for employees to donate through payroll deduction to Concordia University.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign giving through payroll deduction

Edit your giving through payroll deduction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your giving through payroll deduction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing giving through payroll deduction online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit giving through payroll deduction. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out giving through payroll deduction

How to fill out Giving through Payroll Deduction

01

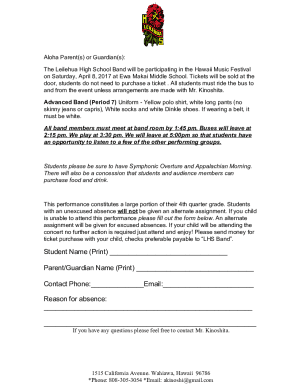

Obtain the Payroll Deduction Form from your HR department or the organization's website.

02

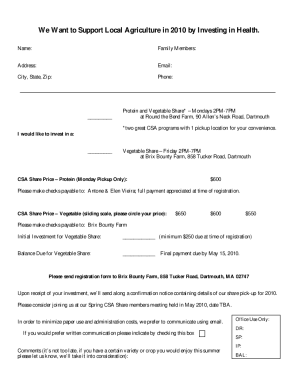

Fill in personal information such as your name, employee ID, and department.

03

Select the amount you wish to donate from each paycheck.

04

Choose the charity or cause that will receive your donations.

05

Sign and date the form to authorize the deductions.

06

Submit the completed form to your HR department for processing.

Who needs Giving through Payroll Deduction?

01

Employees who wish to support charitable causes through automatic payroll deductions.

02

Employers looking to facilitate charitable giving options for their employees.

03

Non-profit organizations seeking regular funding from supportive individuals.

Fill

form

: Try Risk Free

People Also Ask about

What are the three types of donations?

8 Types of Donations That Nonprofits Accept One-Time Donations. Recurring Donations. Legacy Donations. Tribute or Memorial Donations. Stock Donations. Crypto Donations. Physical Property Donations. In-Kind Donations.

What is the payroll answer?

In simple terms, payroll can be defined as the process of paying a company's employees. It includes collecting the list of employees to be paid, tracking the hours worked, calculating the employee's pay, distributing the salary on time, and recording the payroll expense.

What is the payroll giving?

Payroll giving is one of the most tax-effective ways you can give to charity. Donations are taken from your gross pay, or pension, after your National Insurance contributions have been deducted, but before Income Tax is calculated and removed. You receive tax relief on your donation.

What is the meaning of payroll payment?

Payroll is the process of paying a company's employees. It includes tracking hours worked, calculating employees' pay, and distributing payments via direct deposit to employee bank accounts or by check.

How does charitable giving affect taxes in the UK?

Donations by individuals to charity or to community amateur sports clubs ( CASCs ) are tax free. This is called tax relief. This guide is also available in Welsh (Cymraeg). The tax goes to you or the charity.

What is the payroll giving scheme in the UK?

Payroll Giving is a way of giving money to charity without paying tax on it. It must be paid through PAYE from someone's wages or pension.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Giving through Payroll Deduction?

Giving through Payroll Deduction is a method that allows employees to contribute a portion of their salary directly to charitable organizations or causes via automatic deductions from their paychecks.

Who is required to file Giving through Payroll Deduction?

Typically, employees who wish to participate in the program and have payroll deductions set up for charitable contributions are required to fill out the necessary forms to initiate and manage these deductions.

How to fill out Giving through Payroll Deduction?

To fill out Giving through Payroll Deduction, employees usually need to complete a designated form provided by their employer, indicating the amount to be deducted, the charity or organization to receive the funds, and any other required information.

What is the purpose of Giving through Payroll Deduction?

The purpose of Giving through Payroll Deduction is to simplify the process of charitable giving for employees, making it easier for them to support causes they care about while promoting philanthropy within the workplace.

What information must be reported on Giving through Payroll Deduction?

The information that must be reported includes the employee's name, employee ID, the amount to be deducted per pay period, the name of the charitable organization, and possibly the purpose of the contribution.

Fill out your giving through payroll deduction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Giving Through Payroll Deduction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.