Get the free Ex A Mortgage Creditor Checklist

Show details

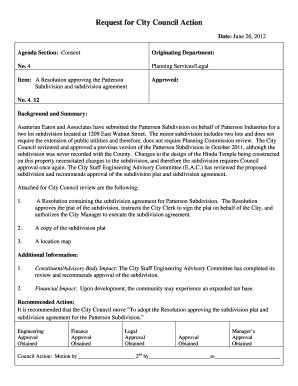

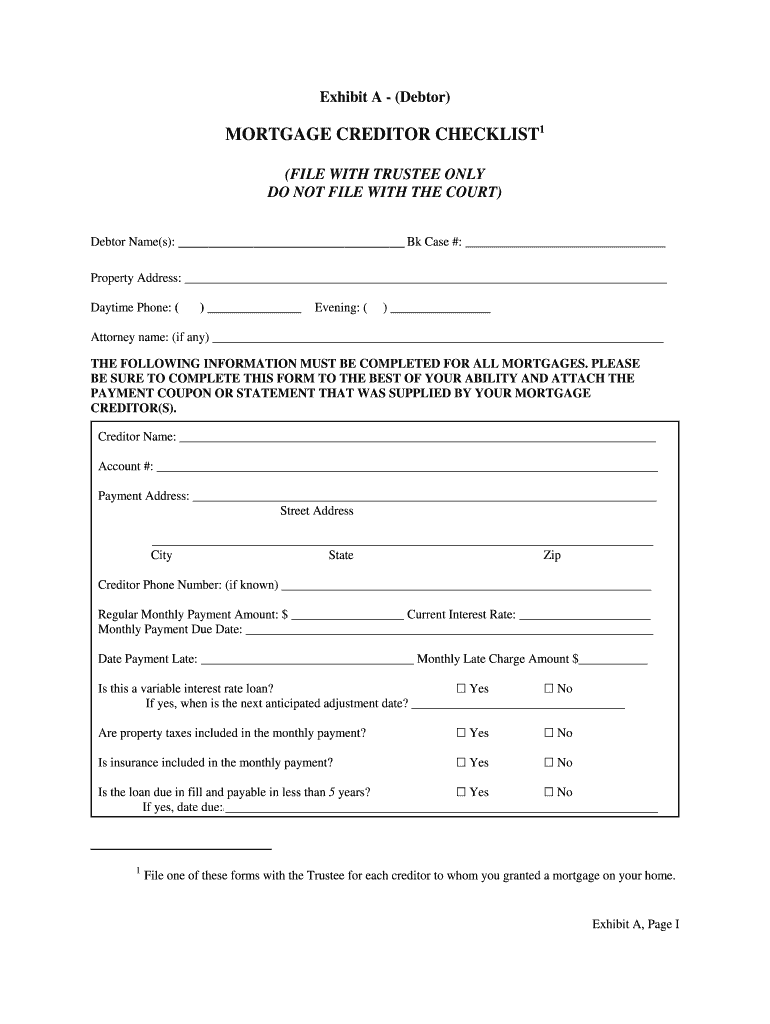

Exhibit A (Debtor) MORTGAGE CREDITOR CHECKLIST1 (FILE WITH TRUSTEE ONLY DO NOT FILE WITH THE COURT) Debtor Name(s): Bk Case #: Property Address: Daytime Phone: () Evening: () Attorney name: (if any)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ex a mortgage creditor

Edit your ex a mortgage creditor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ex a mortgage creditor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit ex a mortgage creditor online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit ex a mortgage creditor. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ex a mortgage creditor

How to fill out a mortgage creditor and who needs it:

01

Gather all relevant financial information: Before filling out a mortgage creditor, it is crucial to collect all the necessary financial information. This includes current income, employment details, any debts or loans, and other assets or savings.

02

Research and select a mortgage creditor: Explore different mortgage creditors and find one that best suits your needs. Look for factors such as interest rates, repayment terms, customer reviews, and eligibility criteria. It is important to carefully consider all the options and choose a creditor that aligns with your financial goals.

03

Complete the application form: Once you have chosen a mortgage creditor, proceed to fill out the application form. This typically includes personal information, financial details, employment history, and property information. Make sure to provide accurate and up-to-date information to avoid any delays or complications during the approval process.

04

Submit the necessary documents: Along with the application form, you will usually be required to submit supporting documents. These may include identification proof, income statements, bank statements, tax returns, and property-related documents. Ensure that all the documents are properly organized and legible to facilitate a smooth review by the mortgage creditor.

05

Review and double-check: Before finalizing the application, carefully review all the information provided. Make sure there are no errors or missing details that could hinder the approval process. Double-check all the documents, signatures, and supporting papers to ensure accuracy and completeness.

06

Submit the application: Once you are confident that everything is in order, it's time to submit the completed application and supporting documents to the mortgage creditor. This can usually be done online, via mail, or by visiting a local branch, depending on the creditor's preferred method of submission.

07

Wait for the approval process: After submitting the application, the mortgage creditor will review all the information and documents provided. This process may take some time, so it's important to be patient. If any additional information is required, the creditor may reach out to you for clarification or further documentation.

08

Receive the decision: Once the mortgage creditor has reviewed your application, you will receive a decision regarding your mortgage approval. If approved, you will be notified of the loan terms, interest rates, and repayment schedule. If not approved, the creditor will provide reasons for the denial, allowing you to explore alternative options or address any issues that may have contributed to the rejection.

Who needs a mortgage creditor:

01

Homebuyers: Individuals or families looking to purchase a property often need a mortgage creditor to finance their home purchase. They rely on mortgage loans to bridge the gap between the property price and their available funds.

02

Property investors: Investors who wish to buy real estate properties for rental income or future resale also require mortgage creditors to secure the necessary funds for their investment.

03

Homeowners seeking to refinance: Homeowners may need a mortgage creditor to refinance their existing mortgage loan. Refinancing can help homeowners obtain a better interest rate, lower monthly payments, or access equity for other financial needs.

04

Individuals planning to build or renovate a property: Construction or renovation projects require substantial funds, and many individuals turn to mortgage creditors to finance these projects. These loans allow them to cover the costs of materials, labor, and other associated expenses.

05

Individuals looking to consolidate debts: Some individuals may opt to take out a mortgage loan to consolidate their debts. By using their property as collateral, they can secure a loan at a potentially lower interest rate and pay off multiple debts with a single monthly payment.

In conclusion, filling out a mortgage creditor involves gathering financial information, selecting a suitable creditor, completing the application form accurately, submitting the required documents, and patiently waiting for the approval process. Various individuals, including homebuyers, property investors, homeowners seeking to refinance, those planning construction or renovation, and individuals looking to consolidate debts, may require a mortgage creditor to fulfill their specific financial needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get ex a mortgage creditor?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the ex a mortgage creditor in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I create an eSignature for the ex a mortgage creditor in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your ex a mortgage creditor and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I fill out ex a mortgage creditor on an Android device?

Use the pdfFiller mobile app and complete your ex a mortgage creditor and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is ex a mortgage creditor?

Ex a mortgage creditor is a party that holds a mortgage on a property.

Who is required to file ex a mortgage creditor?

The mortgage creditor or their authorized representative is required to file ex a mortgage creditor.

How to fill out ex a mortgage creditor?

Ex a mortgage creditor form should be filled out with accurate and detailed information about the mortgage creditor and the property.

What is the purpose of ex a mortgage creditor?

The purpose of ex a mortgage creditor is to report the details of the mortgage creditor and the mortgage on a property.

What information must be reported on ex a mortgage creditor?

Information such as the name of the mortgage creditor, address, contact information, and details of the mortgage must be reported on ex a mortgage creditor.

Fill out your ex a mortgage creditor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ex A Mortgage Creditor is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.