Get the free TX Title Insurance Guaranty Association Notice Revised Policy Guaranty Fee Remittanc...

Show details

Texas Title Insurance Guaranty Association 500 W. 5TH ST., STE 1150 AUSTIN, TEXAS 787013835 Reed L. Bates Paralegal (512) 4805120 FAX (512) 4805183 email: rates mwlaw.com Bernie Burner General Counsel

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tx title insurance guaranty

Edit your tx title insurance guaranty form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tx title insurance guaranty form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing tx title insurance guaranty online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tx title insurance guaranty. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

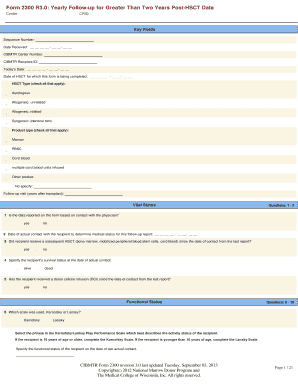

How to fill out tx title insurance guaranty

01

To fill out the TX title insurance guaranty, start by gathering all the necessary documents. These may include the property's title report, deed, mortgage information, and any other relevant paperwork.

02

Review the title report carefully to ensure there are no outstanding liens, encumbrances, or other issues that could affect the validity of the title. If there are any discrepancies or concerns, contact the title insurance company for guidance.

03

Fill out the necessary forms provided by the title insurance company. This may include an application form, disclosure forms, and any other required paperwork. Be sure to provide accurate and complete information to avoid any delays or complications.

04

If there is a mortgage involved, work closely with the lender to fulfill any additional requirements they may have for the title insurance guaranty process. This may include submitting mortgage documentation, payoffs, or other relevant information.

05

Schedule an appointment with a licensed escrow officer or closing agent to finalize the title insurance guaranty. During the appointment, carefully review all the documents and ensure that everything is accurate and in line with your expectations.

06

Pay the necessary fees associated with the title insurance guaranty. These fees can vary depending on the value of the property and the specific insurance policy chosen. It's important to budget for these expenses accordingly.

Who needs TX title insurance guaranty?

01

Homebuyers: Anyone purchasing a property in Texas can benefit from obtaining title insurance. It provides protection against any potential title defects or hidden risks that may arise after the property purchase.

02

Lenders: Most lenders require borrowers to obtain title insurance to protect their investment. This ensures that in case any title issues arise, the lender's interests are adequately protected.

03

Real Estate Investors: Investors who buy and sell properties frequently can greatly benefit from title insurance. It safeguards their investments and minimizes the risks associated with unforeseen title issues.

04

Sellers: Sellers may also need title insurance to protect themselves against any future claims or disputes arising from the property's title. It provides peace of mind and can help speed up the closing process.

Note: It's important to consult with a qualified title insurance professional or attorney to fully understand the specific requirements and processes related to filling out the TX title insurance guaranty. This answer serves as a general guide and should not be considered legal advice.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete tx title insurance guaranty online?

Easy online tx title insurance guaranty completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I make changes in tx title insurance guaranty?

pdfFiller allows you to edit not only the content of your files, but also the quantity and sequence of the pages. Upload your tx title insurance guaranty to the editor and make adjustments in a matter of seconds. Text in PDFs may be blacked out, typed in, and erased using the editor. You may also include photos, sticky notes, and text boxes, among other things.

How do I complete tx title insurance guaranty on an Android device?

Use the pdfFiller Android app to finish your tx title insurance guaranty and other documents on your Android phone. The app has all the features you need to manage your documents, like editing content, eSigning, annotating, sharing files, and more. At any time, as long as there is an internet connection.

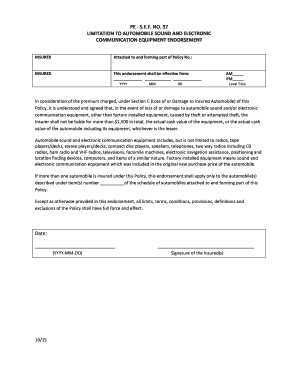

What is tx title insurance guaranty?

TX title insurance guaranty is a type of insurance that protects lenders or homeowners against defects in a property's title.

Who is required to file tx title insurance guaranty?

Lenders or homeowners who want to ensure the protection of their property title are required to file TX title insurance guaranty.

How to fill out tx title insurance guaranty?

To fill out TX title insurance guaranty, you need to provide information about the property, the parties involved, and any existing title issues.

What is the purpose of tx title insurance guaranty?

The purpose of TX title insurance guaranty is to provide financial protection in case of title defects that were not discovered during the property purchase.

What information must be reported on tx title insurance guaranty?

Information such as property address, owner's name, lender's name, and any known title issues must be reported on TX title insurance guaranty.

Fill out your tx title insurance guaranty online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tx Title Insurance Guaranty is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.