Get the free Lessors Risk Supplemental - Underwriters

Show details

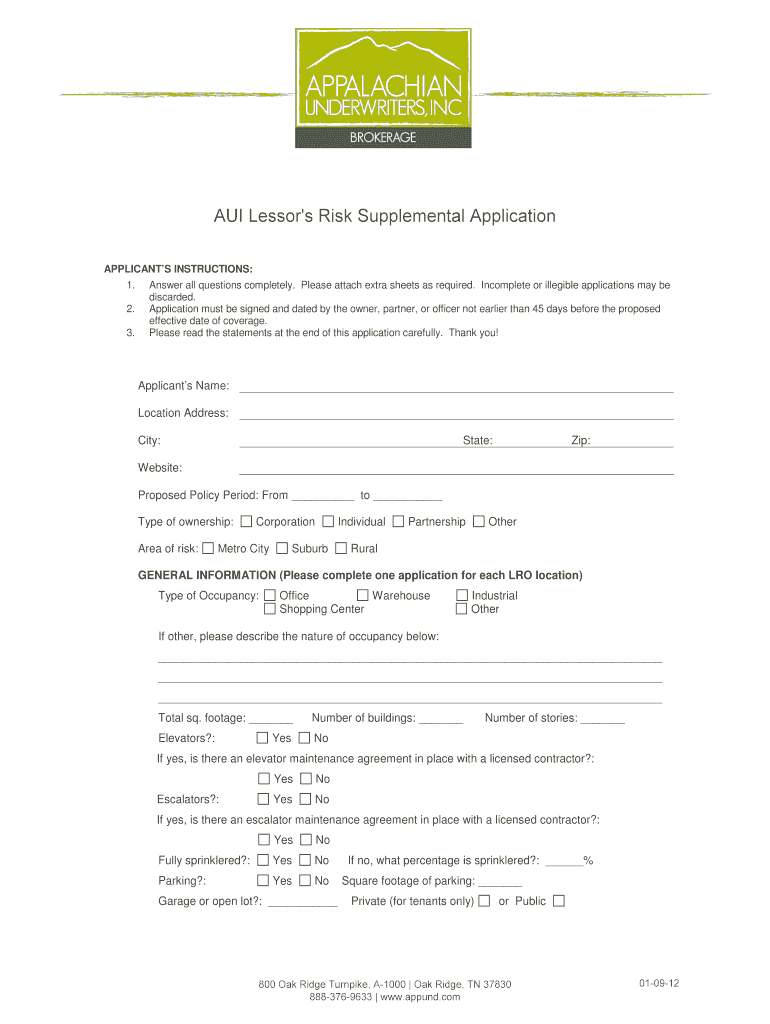

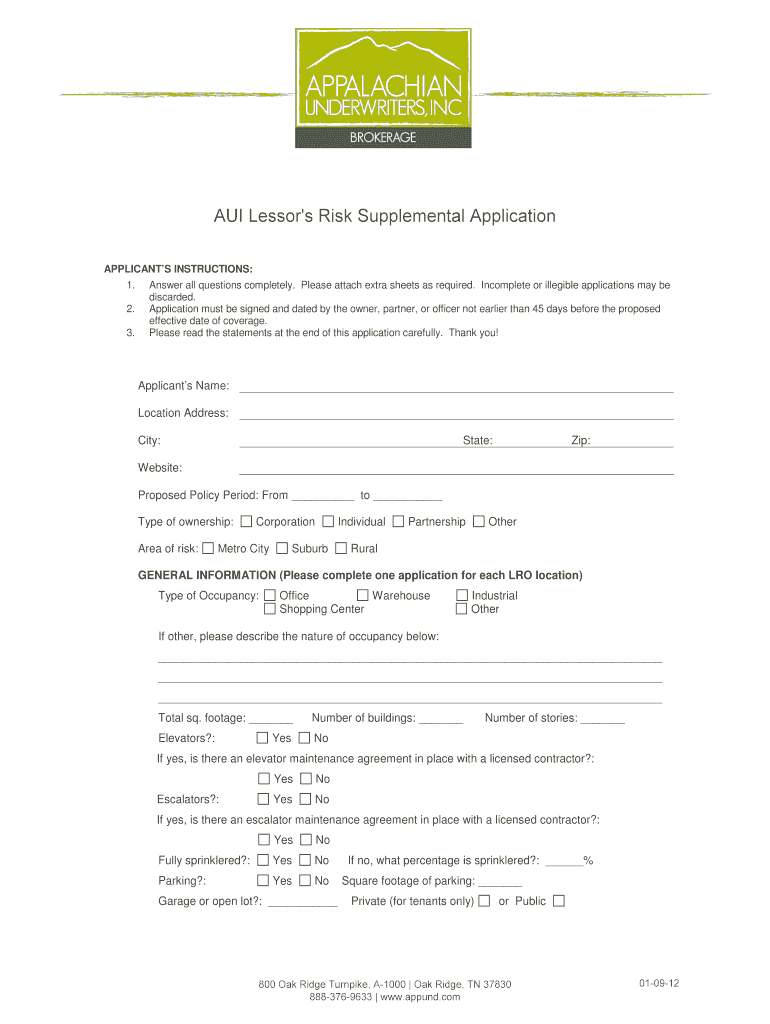

Lessors Risk Supplemental Lessors Risk Supplemental Application 6641 West Broad Street, Suite 300 Application GENERAL CASUALTY Division 6641 West Broad Street, Suite 300 Richmond, VA 23230 GENERAL

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign lessors risk supplemental

Edit your lessors risk supplemental form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your lessors risk supplemental form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit lessors risk supplemental online

Follow the steps below to take advantage of the professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit lessors risk supplemental. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out lessors risk supplemental

How to fill out lessors risk supplemental:

01

Obtain the necessary form: Start by obtaining the lessors risk supplemental form from your insurance provider or download it online.

02

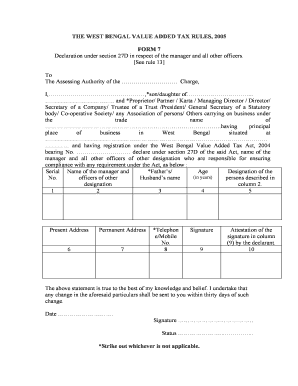

Provide basic information: Begin by providing basic information such as the name and contact details of the lessor, the leased property address, and the effective date of the policy.

03

Describe the property: Enter a detailed description of the property, including its type, construction, occupancy, and any unique characteristics that may affect the risk.

04

State the limit of liability: Specify the desired limit of liability for the property in case of damage or loss.

05

Indicate any additional coverages: If you require any additional coverages, such as business interruption or equipment breakdown coverage, make sure to indicate them in the appropriate section.

06

Provide loss history: Disclose the property's loss history, including any claims made in the past five years. Be sure to accurately report all relevant information.

07

Answer underwriting questions: Respond to the underwriting questions on the form, which may include inquiries about fire protection measures, security systems, and maintenance procedures.

08

Sign and date the form: Once you have completed the necessary sections, sign and date the form to certify its accuracy.

09

Submit the form: After filling out the lessors risk supplemental form, submit it to your insurance provider either electronically or via mail.

Who needs lessors risk supplemental:

01

Property lessors: Any individual or entity that leases a property to tenants may need to fill out a lessors risk supplemental form. This includes landlords, real estate companies, and property management firms.

02

Commercial property owners: Owners of commercial properties, such as office buildings, shopping centers, or warehouses, may need a lessors risk supplemental to insure against property and liability risks related to leasing out their properties.

03

Lessors of special-use properties: If you are leasing out a property with specific risks or unique characteristics, such as a restaurant, a gym, or a manufacturing facility, you may need a lessors risk supplemental to adequately cover the associated risks.

04

Lessors seeking additional coverage: Some lessors may require additional coverages beyond the standard property insurance policy, such as coverage for business interruption, equipment breakdown, or tenant liability. In such cases, a lessors risk supplemental form is typically necessary to customize the insurance coverage according to their specific needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send lessors risk supplemental for eSignature?

Once you are ready to share your lessors risk supplemental, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

Can I edit lessors risk supplemental on an iOS device?

Create, edit, and share lessors risk supplemental from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How can I fill out lessors risk supplemental on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your lessors risk supplemental, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

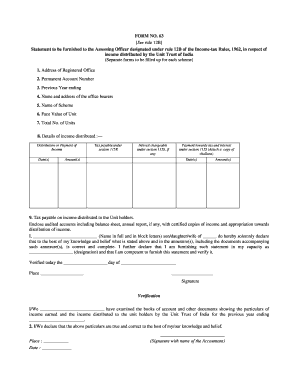

What is lessors risk supplemental?

Lessors risk supplemental is a form used in commercial property insurance to assess additional risks associated with leasing property to tenants.

Who is required to file lessors risk supplemental?

Insurance companies and property owners who lease their property to tenants are required to file lessors risk supplemental.

How to fill out lessors risk supplemental?

Lessors risk supplemental can be filled out by providing detailed information about the property, tenants, and any additional risks associated with leasing.

What is the purpose of lessors risk supplemental?

The purpose of lessors risk supplemental is to assess and mitigate any additional risks associated with leasing property to tenants.

What information must be reported on lessors risk supplemental?

Information such as property details, tenant information, and any additional risks or liabilities must be reported on lessors risk supplemental.

Fill out your lessors risk supplemental online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Lessors Risk Supplemental is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.