Get the free Mortgage-Related Wire Transfer Fraud

Show details

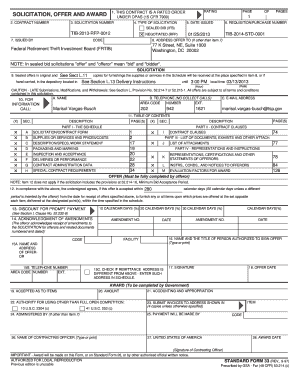

MortgageRelated Wire Transfer Fraud

On Aug. 27, 2015, the FBI released a public service

announcement that advised businesses of the increasing

prevalence of business email compromise (BEC)

schemes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign mortgage-related wire transfer fraud

Edit your mortgage-related wire transfer fraud form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your mortgage-related wire transfer fraud form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit mortgage-related wire transfer fraud online

Follow the guidelines below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit mortgage-related wire transfer fraud. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out mortgage-related wire transfer fraud

01

Start by gathering all relevant documents and information related to the wire transfer fraud. This includes any evidence you have of the fraudulent activity, such as emails or suspicious transactions.

02

Contact your mortgage lender or financial institution to report the fraud. Provide them with all the details and evidence you have collected. They will guide you through the necessary steps to follow in order to resolve the issue.

03

File a police report with your local law enforcement agency. Provide them with a detailed account of the fraud and any supporting evidence. This will help in the investigation and potentially lead to the recovery of lost funds.

04

Notify the Federal Bureau of Investigation (FBI) through their Internet Crime Complaint Center (IC3) website. They specialize in investigating and prosecuting cases involving cybercrime and financial fraud.

05

Consider reaching out to a lawyer who specializes in fraud cases to seek legal advice and assistance. They can help you navigate through the legal procedures and protect your rights.

06

Keep all communication regarding the fraud in writing and document every step you take. This will serve as evidence and help ensure a thorough investigation.

Who needs mortgage-related wire transfer fraud?

Anyone who is a victim of mortgage-related wire transfer fraud needs to address the issue promptly. This can include individuals who have received fraudulent instructions or have unknowingly transferred funds to a fraudulent account during a mortgage transaction.

It is important for victims to take immediate action to prevent further financial loss and potentially recover any stolen funds. Seeking the assistance of financial institutions, law enforcement agencies, and legal professionals can help ensure a swift and thorough resolution to the fraudulent activity.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is mortgage-related wire transfer fraud?

Mortgage-related wire transfer fraud is a type of scam where fraudsters deceive individuals into wiring money for a mortgage or real estate transaction, but the money ends up in the scammer's account instead.

Who is required to file mortgage-related wire transfer fraud?

Anyone who has been a victim of mortgage-related wire transfer fraud or has knowledge of such fraudulent activity is required to file a report with the appropriate authorities.

How to fill out mortgage-related wire transfer fraud?

To fill out a report on mortgage-related wire transfer fraud, individuals need to provide details about the fraudulent transaction, including dates, amounts, and any relevant information about the scammer.

What is the purpose of mortgage-related wire transfer fraud?

The purpose of mortgage-related wire transfer fraud is to deceive individuals into sending money for a mortgage or real estate transaction, with the intention of stealing the funds.

What information must be reported on mortgage-related wire transfer fraud?

Information that must be reported on mortgage-related wire transfer fraud includes details about the fraudulent transaction, such as dates, amounts, and any information about the scammer.

How can I modify mortgage-related wire transfer fraud without leaving Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including mortgage-related wire transfer fraud, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How can I get mortgage-related wire transfer fraud?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific mortgage-related wire transfer fraud and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I fill out mortgage-related wire transfer fraud using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign mortgage-related wire transfer fraud and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

Fill out your mortgage-related wire transfer fraud online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Mortgage-Related Wire Transfer Fraud is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.