Get the free Branch Business Banking Credit Application - Flagstar Bank

Show details

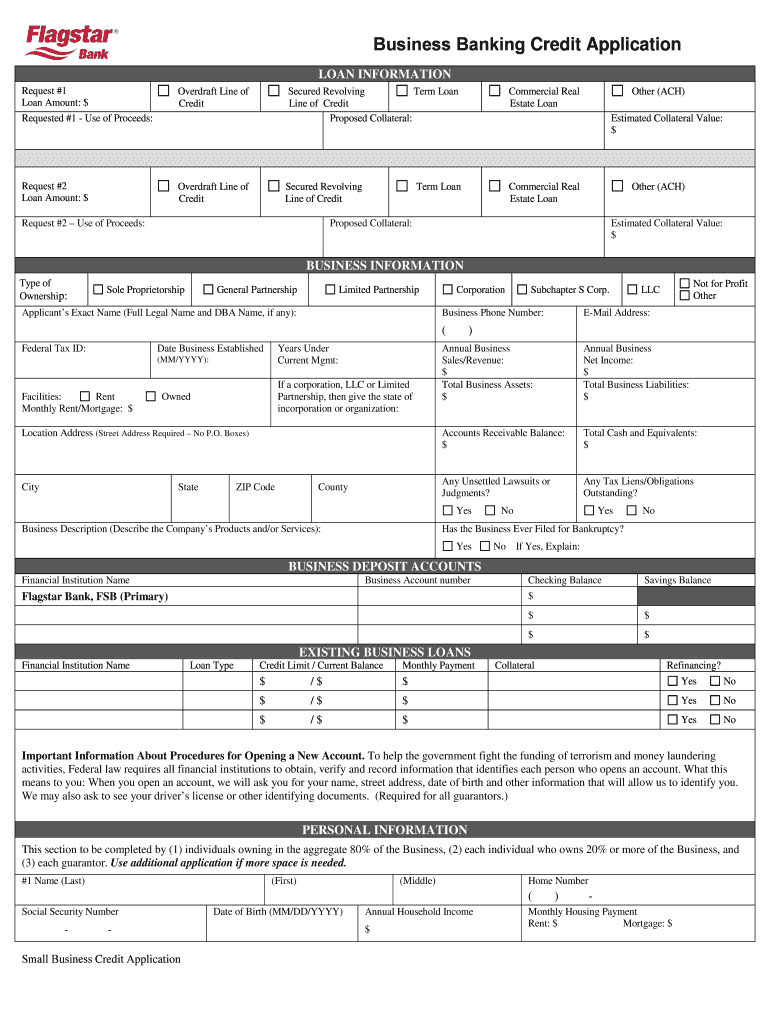

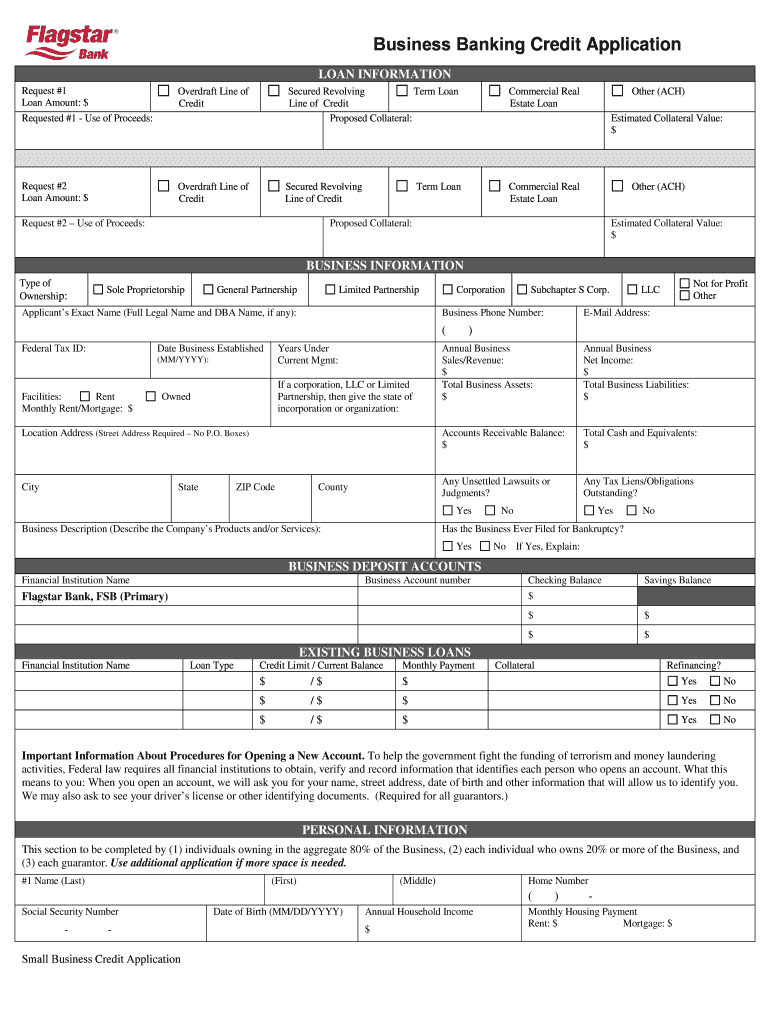

Business Banking Credit Application LOAN INFORMATION Request #1 Loan Amount: $ Requested #1 Use of Proceeds: Overdraft Line of Credit Request #2 Loan Amount: $ Overdraft Line of Credit Secured Revolving

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign branch business banking credit

Edit your branch business banking credit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your branch business banking credit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit branch business banking credit online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit branch business banking credit. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out branch business banking credit

How to fill out branch business banking credit:

01

Gather all necessary documentation: Before filling out the branch business banking credit application, make sure to collect all relevant documents such as financial statements, business plans, tax returns, and identification documents.

02

Understand the requirements: Familiarize yourself with the specific requirements of the branch business banking credit you are applying for. Each financial institution may have its own set of criteria, such as minimum credit score, collateral requirements, or industry-specific qualifications.

03

Complete the application form: Fill out the application form accurately and thoroughly. Provide all requested information, including personal and business details, financial statements, income projections, and any other required data. Double-check for any errors or missing information before submitting.

04

Prepare a business plan: A well-crafted business plan can greatly enhance your chances of obtaining branch business banking credit. Outline your business goals, strategies, financial projections, and repayment plan. Highlight how the credit will contribute to the growth and success of your business.

05

Provide collateral, if necessary: Depending on the type and amount of credit you are seeking, collateral may be required to secure the loan. Prepare the necessary documentation and ensure that the collateral meets the lender's criteria.

06

Review and submit your application: Take the time to review your completed application thoroughly. Ensure that all the information provided is accurate and up to date. Attach any required supporting documents, such as financial statements or business plans. Submit the application through the designated channel, whether it is online, in-person, or via mail.

Who needs branch business banking credit:

01

Small businesses: Branch business banking credit can be particularly beneficial for small businesses that require capital to invest in growth opportunities, purchase equipment or inventory, or manage day-to-day expenses.

02

Startups: Startups often need initial funding to kickstart their operations. Branch business banking credit can provide the necessary capital to cover expenses such as equipment, marketing, and working capital.

03

Established businesses seeking expansion: Established businesses looking to expand into new markets, launch new products or services, or acquire competitors may require branch business banking credit. These funds can help fuel growth initiatives and support strategic plans.

04

Businesses with seasonal cash flow: Some industries experience fluctuations in cash flow due to seasonality. Branch business banking credit can bridge the gap during slower periods and ensure that operations continue smoothly.

05

Businesses facing unexpected expenses: Unforeseen expenses, such as equipment breakdowns, facility repairs, or emergency situations, may require immediate access to funding. Branch business banking credit can provide the needed financial assistance in such circumstances.

06

Businesses aiming to improve cash flow: Branch business banking credit can be used to optimize cash flow management by financing accounts receivable or inventory, consolidating debts, or taking advantage of prompt payment discounts.

07

Business owners looking to establish or strengthen credit history: Successfully managing branch business banking credit can help establish or improve a business's credit history, enabling access to additional financing options in the future.

In conclusion, branch business banking credit can be beneficial for small businesses, startups, established businesses, those facing seasonal fluctuations or unexpected expenses, businesses looking to improve cash flow, and business owners aiming to establish or strengthen credit history.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send branch business banking credit to be eSigned by others?

When you're ready to share your branch business banking credit, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

How do I edit branch business banking credit in Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing branch business banking credit and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

How do I edit branch business banking credit on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share branch business banking credit from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

Fill out your branch business banking credit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Branch Business Banking Credit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.