Get the free Fiduciary Estimated Tax Payment M70 - formupack

Show details

Fiduciary Estimated Tax Payment M70 IMPORTANT: Type in the required information while this form is on the screen and print a copy. A personalized scan line will be printed on the voucher using the

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign fiduciary estimated tax payment

Edit your fiduciary estimated tax payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your fiduciary estimated tax payment form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing fiduciary estimated tax payment online

To use the professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit fiduciary estimated tax payment. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out fiduciary estimated tax payment

How to fill out fiduciary estimated tax payment:

01

Obtain the necessary forms: To fill out a fiduciary estimated tax payment, you will need to obtain Form 1041-ES, which is the estimated income tax form for estates and trusts. You can find this form on the official website of the Internal Revenue Service (IRS).

02

Calculate the estimated tax liability: Begin by calculating the estimated tax liability for the estate or trust for the current tax year. This typically involves assessing the income, deductions, and credits applicable to the fiduciary entity. It is recommended to consult with a tax professional to ensure accurate calculations.

03

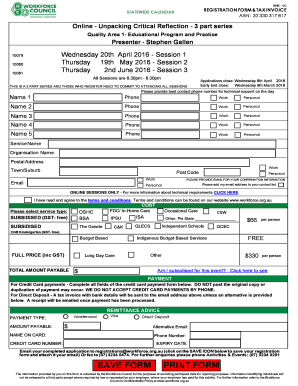

Determine the payment schedule: The IRS requires estimated tax payments to be made in four equal installments throughout the tax year. The due dates for these payments are usually April 15th, June 15th, September 15th, and January 15th of the following year. However, if any of these dates fall on a weekend or a holiday, the deadline is extended to the next business day.

04

Complete Form 1041-ES: On Form 1041-ES, you will need to provide information such as the taxpayer's name, address, tax identification number, and the estimated tax amount for the current tax year. Fill in the requested details accurately to avoid any delays or errors in processing your payment.

05

Submit the payment: After completing Form 1041-ES, you will need to submit it along with your payment to the IRS. Payments can be made electronically through the Electronic Federal Tax Payment System (EFTPS) or by mailing a check or money order together with the form. Make sure to include the tax year, the taxpayer's name, and the tax identification number on the payment.

Who needs fiduciary estimated tax payment:

01

Estates: If you are the executor or administrator of a deceased individual's estate, you may be required to make fiduciary estimated tax payments. This applies if the estate has an estimated tax liability of $1,000 or more for the current tax year.

02

Trusts: Trustees are generally responsible for making fiduciary estimated tax payments on behalf of the trust. Trusts that generate income or have a potential tax liability of $1,000 or more for the current tax year may need to make these estimated tax payments.

03

Complex estates and trusts: Complex estates and trusts, such as those with significant investment income or multiple beneficiaries, often require fiduciary estimated tax payments. The specific criteria for determining whether estimated tax payments are necessary can be complex, so it is advisable to consult with a tax professional to assess your particular situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify fiduciary estimated tax payment without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including fiduciary estimated tax payment, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How can I send fiduciary estimated tax payment for eSignature?

When your fiduciary estimated tax payment is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

Can I create an electronic signature for the fiduciary estimated tax payment in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your fiduciary estimated tax payment in minutes.

What is fiduciary estimated tax payment?

Fiduciary estimated tax payment is a tax payment made by an individual or entity acting as a fiduciary, such as an executor, administrator, or trustee, on behalf of a beneficiary or estate.

Who is required to file fiduciary estimated tax payment?

Any fiduciary responsible for managing the finances of an estate or trust that meets certain income thresholds may be required to file fiduciary estimated tax payments.

How to fill out fiduciary estimated tax payment?

To fill out fiduciary estimated tax payments, the fiduciary must calculate the total income, deductions, and credits of the estate or trust, determine the estimated tax due, and submit the payment using Form 1041-ES.

What is the purpose of fiduciary estimated tax payment?

The purpose of fiduciary estimated tax payment is to ensure that taxes are paid throughout the year on income earned by estates and trusts, rather than waiting until the end of the year to pay a lump sum.

What information must be reported on fiduciary estimated tax payment?

Fiduciary estimated tax payments must include information regarding the income, deductions, credits, and tax liability of the estate or trust for the current tax year.

Fill out your fiduciary estimated tax payment online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Fiduciary Estimated Tax Payment is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.