Get the free Peer to Peer Lending - Research and Markets

Show details

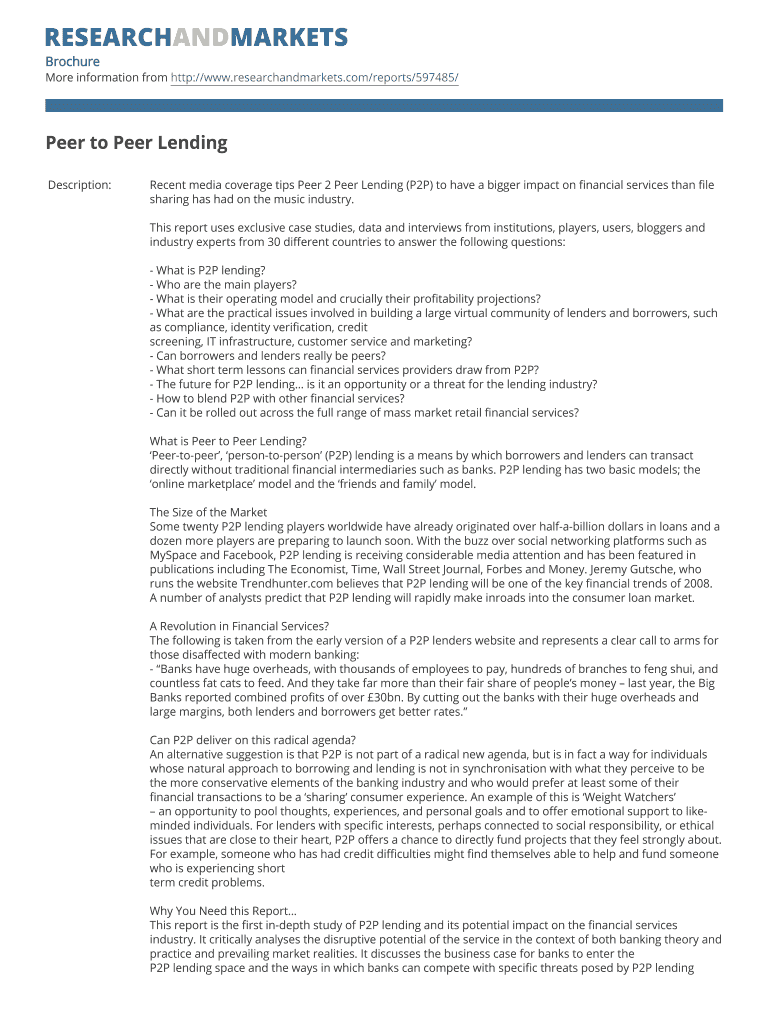

Brochure More information from http://www.researchandmarkets.com/reports/597485/ Peer to Peer Lending Description: Recent media coverage tips Peer 2 Peer Lending (P2P) to have a bigger impact on financial

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign peer to peer lending

Edit your peer to peer lending form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your peer to peer lending form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit peer to peer lending online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit peer to peer lending. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out peer to peer lending

How to Fill Out Peer to Peer Lending:

01

Research and Choose a Platform: Start by researching different peer to peer lending platforms and choose one that best aligns with your financial goals and preferences. Consider factors such as interest rates, loan terms, fees, and platform reputation.

02

Create an Account: Once you have selected a platform, sign up and create an account. Provide the required personal information, such as your name, contact details, and financial information. Some platforms may require further verification, such as providing proof of income or identity documents.

03

Determine Loan Purpose and Amount: Before filling out the loan application, determine the purpose of the loan and the specific amount you need to borrow. Peer to peer lending provides funding for various purposes like debt consolidation, home improvement, or small business financing.

04

Fill Out Loan Application: Each platform will have its own loan application form to be completed. Provide accurate information, such as your employment details, income, expenses, and loan purpose. Be thorough and transparent in your application to increase your chances of approval.

05

Submit Required Documents: Depending on the platform and loan amount, you may be required to provide additional documentation. This could include bank statements, tax returns, or proof of address. Ensure all documents are accurate and up to date before submitting them.

06

Wait for Loan Approval: After submitting your application and documents, the platform will evaluate your profile and determine whether to approve your loan. This process may take a few days. Some platforms use automated systems while others involve manual underwriting by individuals.

07

Review Terms and Conditions: If your loan is approved, carefully review the terms and conditions presented to you. Pay close attention to interest rates, loan repayment schedule, fees, and any other relevant details. Make sure you understand the obligations and responsibilities associated with the loan before accepting it.

08

Accept the Loan: If you are satisfied with the terms and conditions, accept the loan offer. By doing so, you agree to the terms set by the peer to peer lending platform and become legally bound to fulfill your repayment obligations.

Who Needs Peer to Peer Lending:

01

Small Business Owners: Small business owners often have difficulty obtaining traditional bank loans due to various reasons such as limited credit history or insufficient collateral. Peer to peer lending provides them with an alternative source of financing to support their business growth or cover working capital needs.

02

Individuals with Low Credit Scores: People with less-than-perfect credit scores may find it challenging to secure loans from traditional financial institutions. Peer to peer lending platforms often consider other factors, such as employment history and income stability, making it a viable option for individuals with lower credit scores.

03

Borrowers Seeking Competitive Interest Rates: Peer to peer lending can offer competitive interest rates compared to traditional financial institutions, especially for borrowers with good credit scores. By cutting out the intermediaries and connecting lenders directly with borrowers, peer to peer lending platforms eliminate additional costs, resulting in potentially better interest rates.

04

Individuals in Need of Quick Funding: Peer to peer lending can be an excellent choice for individuals in urgent need of funds. Compared to the lengthy approval processes of traditional banks, peer to peer lending platforms often offer faster loan approvals and fund disbursements, enabling borrowers to access the needed funds quickly.

05

Investors Seeking Diversification: Not only borrowers benefit from peer to peer lending, but it also presents an opportunity for investors. Many platforms allow individuals to invest their money and earn passive income by funding loans. Investors looking to diversify their investment portfolio may find peer to peer lending attractive due to its potentially higher returns compared to traditional savings accounts or bond investments.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my peer to peer lending in Gmail?

peer to peer lending and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I edit peer to peer lending from Google Drive?

You can quickly improve your document management and form preparation by integrating pdfFiller with Google Docs so that you can create, edit and sign documents directly from your Google Drive. The add-on enables you to transform your peer to peer lending into a dynamic fillable form that you can manage and eSign from any internet-connected device.

How do I complete peer to peer lending on an iOS device?

Download and install the pdfFiller iOS app. Then, launch the app and log in or create an account to have access to all of the editing tools of the solution. Upload your peer to peer lending from your device or cloud storage to open it, or input the document URL. After filling out all of the essential areas in the document and eSigning it (if necessary), you may save it or share it with others.

What is peer to peer lending?

Peer to peer lending is a method of debt financing that enables individuals to borrow and lend money without the use of an official financial institution as an intermediary.

Who is required to file peer to peer lending?

Individuals or businesses who engage in peer to peer lending activities are required to file the necessary financial documents with the appropriate regulatory bodies.

How to fill out peer to peer lending?

To fill out peer to peer lending, individuals or businesses must provide detailed information about the lending activities, including the amount borrowed or lent, interest rates, terms of the loan, and any other relevant details.

What is the purpose of peer to peer lending?

The purpose of peer to peer lending is to provide an alternative source of financing for individuals and businesses who may not qualify for traditional bank loans or who prefer a more streamlined borrowing process.

What information must be reported on peer to peer lending?

Information that must be reported on peer to peer lending includes the amount borrowed or lent, interest rates, terms of the loan, any fees involved, and the identities of the lenders and borrowers.

Fill out your peer to peer lending online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Peer To Peer Lending is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.