UK PE3 2006 free printable template

Show details

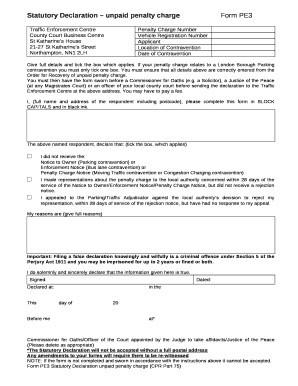

Guidance Notes for Completion of the Application to file a Statutory Declaration Out of Time and

Statutory Declaration

Penalty Charge No: Please quote your penalty charge number(s) in the top box

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign UK PE3

Edit your UK PE3 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your UK PE3 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit UK PE3 online

Follow the steps below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit UK PE3. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

UK PE3 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out UK PE3

How to fill out UK PE3

01

Obtain the UK PE3 form from the official website or your local tax office.

02

Fill in your personal details, including your name, address, and National Insurance number.

03

Provide information regarding your income, including details of employment and any other sources.

04

Complete sections related to deductions and allowances you may be eligible for.

05

Review the completed form to ensure all information is accurate and complete.

06

Sign and date the form at the bottom.

07

Submit the form to HM Revenue and Customs by mail or electronically as instructed.

Who needs UK PE3?

01

Individuals who have received a tax calculation from HMRC and need to adjust their tax position.

02

People who wish to appeal against a decision made by HMRC regarding their tax.

03

Taxpayers who have been informed about changes in their tax liabilities.

Fill

form

: Try Risk Free

People Also Ask about

What is the form 2210 underpayment penalty?

Form 2210 Underpayment of Estimated Tax, is used to calculate any penalties incurred due to underpayment of taxes over the course of the year. Form 2210 is typically used by taxpayers when they owe more than $1,000 to the IRS on their federal tax return.

What form is penalty IRS?

Use Form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax.

What is the form 6721?

IRC 6721 provides for a penalty when an information return or statement is not timely and/or correctly filed by the due date of the return. IRC 6722 provides for a penalty when a payee statement is not timely and/or correctly furnished.

How do I get penalty proof for taxes?

Taxpayers want to penalty proof themselves during the tax year by updating withholdings for changes that may occur in your life (marriage, divorce, children, second jobs, side business, etc.) and by calculating estimated tax payments for income received not subject to withholding.

What triggers IRS underpayment penalty?

The Underpayment of Estimated Tax by Individuals Penalty applies to individuals, estates and trusts if you don't pay enough estimated tax on your income or you pay it late. The penalty may apply even if we owe you a refund.

What is the 2210 form?

Purpose of Form Use Form 2210 to see if you owe a penalty for underpaying your estimated tax. The IRS will generally figure your penalty for you and you should not file Form 2210. You can, however, use Form 2210 to figure your penalty if you wish and include the penalty on your return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send UK PE3 for eSignature?

When your UK PE3 is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I make edits in UK PE3 without leaving Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your UK PE3, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I edit UK PE3 on an Android device?

You can make any changes to PDF files, like UK PE3, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is UK PE3?

UK PE3 is a specific form used by UK taxpayers to report information related to certain income sources or tax relief claims.

Who is required to file UK PE3?

Individuals or entities that have to report specific income sources or claim tax relief are required to file the UK PE3.

How to fill out UK PE3?

To fill out UK PE3, taxpayers should provide personal details, include all relevant income information, and calculate any applicable tax relief before submitting the form to HM Revenue and Customs.

What is the purpose of UK PE3?

The purpose of UK PE3 is to ensure accurate reporting of tax information, allowing HM Revenue and Customs to assess tax obligations properly.

What information must be reported on UK PE3?

The information that must be reported on UK PE3 includes taxpayer's identification details, income sources, tax reliefs being claimed, and any other relevant financial information.

Fill out your UK PE3 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

UK pe3 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.