Get the free Surety Bond Schedule - cyberdriveillinois

Show details

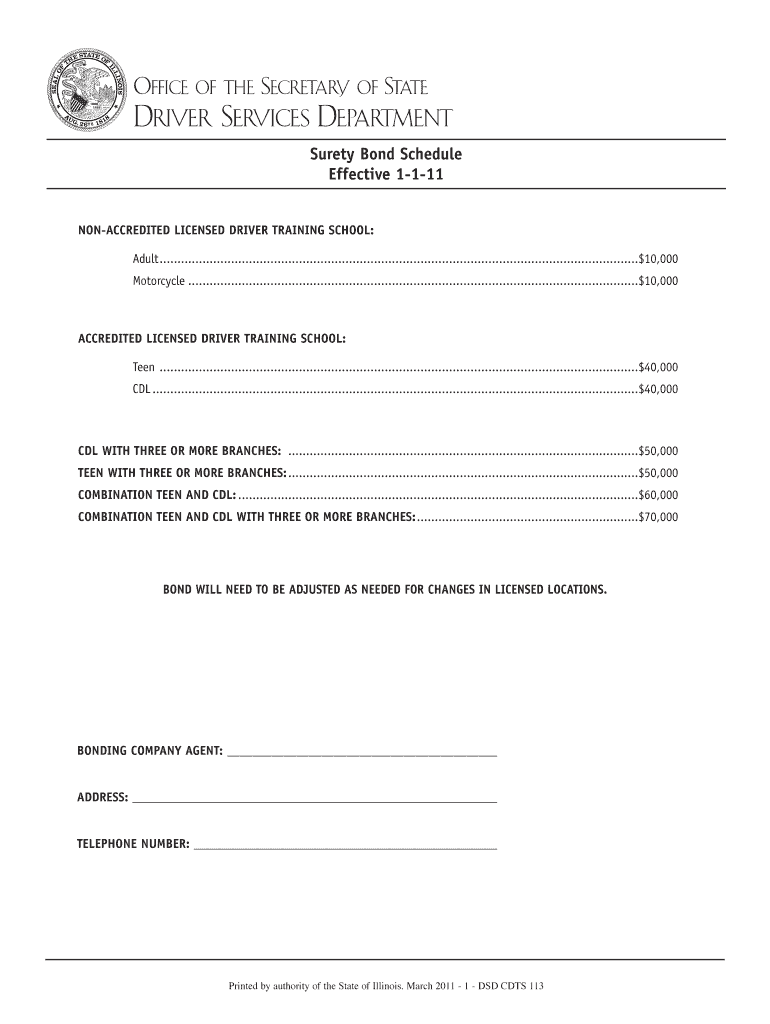

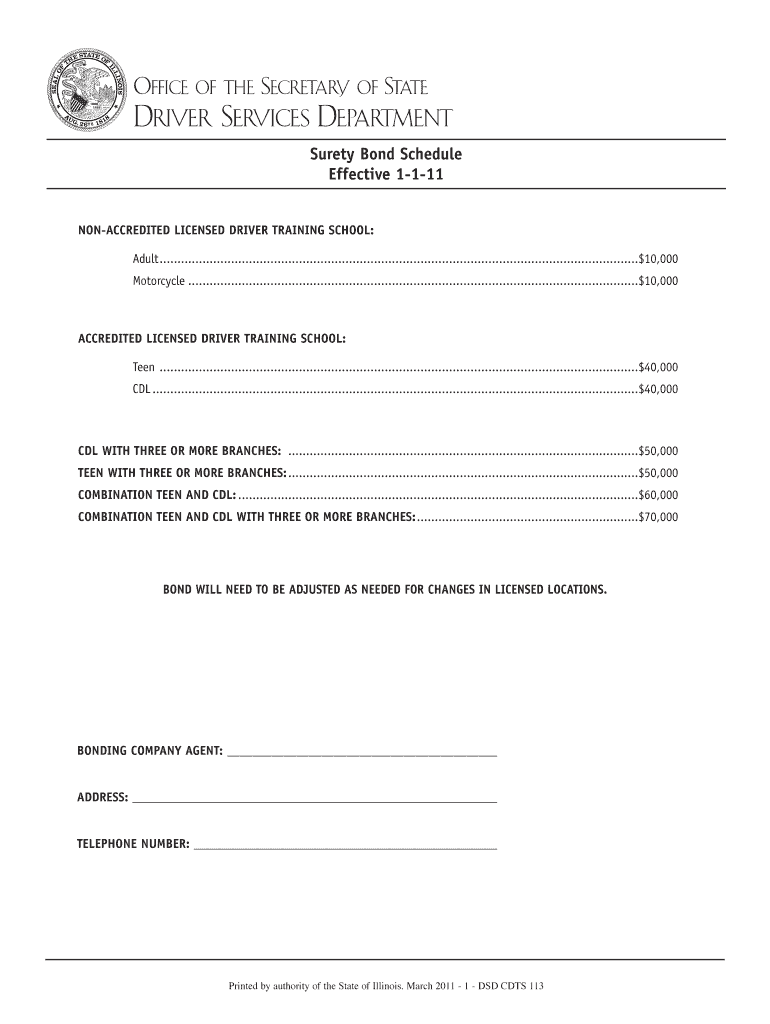

Print Office of the Secretary of State y Driver Services Department Surety Bond Schedule Effective 1111 UNACCREDITED LICENSED DRIVER TRAINING SCHOOL: Adult......................................................................................................................................$10,000

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign surety bond schedule

Edit your surety bond schedule form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your surety bond schedule form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing surety bond schedule online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit surety bond schedule. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out surety bond schedule

How to fill out a surety bond schedule:

01

Start by gathering all the necessary information and paperwork. This may include the bond's identification number, the name and address of the principal (the party responsible for fulfilling the bond's obligations), and the name and address of the obligee (the party protected by the bond).

02

Identify the type of surety bond you are dealing with. There are various types of surety bonds, such as contract bonds, license and permit bonds, and court bonds. Knowing the specific type will help you understand the requirements and information needed for the bond schedule.

03

Review any instructions or guidelines provided by the surety bond company or the obligee. These instructions may provide specific details on how to fill out the bond schedule correctly, including any additional documents or signatures required.

04

Begin filling out the bond schedule form. Typically, this form will ask for information such as the bond amount, effective date, expiration date, and the terms and conditions of the bond. Pay close attention to each section and provide accurate information.

05

Double-check all the information you have entered on the bond schedule. Mistakes or inaccuracies can cause delays in processing the bond or even result in its rejection. Make sure all details are correct and match the information provided by the surety bond company.

06

If required, attach any supporting documentation or paperwork that is requested. This may include financial statements, project specifications, or any other relevant documents needed to support the bond's issuance.

07

Once you have completed the bond schedule, review it one final time to ensure it is accurate and complete. Then, sign the document as required. If multiple parties are involved, make sure all necessary signatures are obtained.

Who needs a surety bond schedule:

01

Contractors: Contractors often need surety bonds as a guarantee that they will fulfill their contractual obligations, such as completing a construction project on time and within budget. A bond schedule helps document the details of the bond and ensures compliance with the project's requirements.

02

Business Owners: Some industries require business owners to obtain surety bonds before they can operate legally. This may include professionals such as insurance agents, mortgage brokers, or auto dealers, who need bonds to protect their clients from financial losses resulting from wrongful acts or violations of industry regulations.

03

Government Agencies: Government agencies often require surety bonds from contractors bidding on public projects to ensure that the project is completed as promised. A bond schedule helps track the details of the bond and provides a reference for the agency and the contractor regarding the terms and conditions of the bond.

In conclusion, filling out a surety bond schedule involves gathering the necessary information, understanding the specific requirements, and accurately completing the form. It is important to pay attention to detail and follow any instructions provided. Various parties, such as contractors, business owners, and government agencies, may require a surety bond schedule depending on their industry and specific project requirements.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get surety bond schedule?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the surety bond schedule in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I make changes in surety bond schedule?

The editing procedure is simple with pdfFiller. Open your surety bond schedule in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I make edits in surety bond schedule without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing surety bond schedule and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

What is surety bond schedule?

Surety bond schedule is a document that outlines the details of a surety bond, including the bond amount, bond type, and other relevant information.

Who is required to file surety bond schedule?

Certain businesses or individuals may be required by law to file a surety bond schedule with the appropriate regulatory authority.

How to fill out surety bond schedule?

To fill out a surety bond schedule, the individual or business must provide the required information accurately and completely, as per the regulations.

What is the purpose of surety bond schedule?

The purpose of a surety bond schedule is to ensure that all parties involved in a surety bond agreement are aware of the terms and conditions of the bond.

What information must be reported on surety bond schedule?

The surety bond schedule may include details such as the name of the principal, the bond amount, the bond type, and other relevant information.

Fill out your surety bond schedule online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Surety Bond Schedule is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.