IL IL-W-5-NR 2009 free printable template

Show details

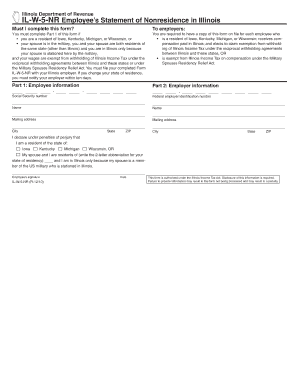

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes. Illinois Department of Revenue ILW5NR Employees Statement of Nonresidence in Illinois Must

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign IL IL-W-5-NR

Edit your IL IL-W-5-NR form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your IL IL-W-5-NR form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit IL IL-W-5-NR online

Follow the steps below to use a professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit IL IL-W-5-NR. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

IL IL-W-5-NR Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out IL IL-W-5-NR

How to fill out IL IL-W-5-NR

01

Obtain the IL IL-W-5-NR form from the Illinois Department of Revenue website or office.

02

Begin by entering your name and address in the designated fields.

03

Fill in your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

04

Indicate your residency status and the reason for completing the form.

05

Provide information about your income sources, including amounts earned in Illinois and other states.

06

Double-check that all required fields are filled accurately and completely.

07

Sign and date the form to certify that the information is correct.

08

Submit the completed form to the Illinois Department of Revenue as instructed.

Who needs IL IL-W-5-NR?

01

Non-residents who earn income in Illinois and need to file state income tax.

02

Individuals who worked temporarily in Illinois but reside in another state.

03

Taxpayers seeking a refund for over-withheld state taxes in Illinois.

Fill

form

: Try Risk Free

People Also Ask about

What does it mean if you are exempt from federal and Illinois income tax withholding?

Exemption From Withholding To qualify for this exempt status, the employee must have had no tax liability for the previous year and must expect to have no tax liability for the current year. A Form W-4 claiming exemption from withholding is valid for only the calendar year in which it's furnished to the employer.

What is the IL W 5 NR form?

What is a IL W 5 NR? The Form IL-W-5-NR (Employee's Statement of Nonresidence in Illinois) must be submitted to Payroll Services to claim the exemption. Upon receipt of Form IL-W-5-NR Payroll Services will withhold state tax for reciprocal state of residence and forward the tax withheld to the proper state agency.

Am I exempt from Illinois income tax withholding?

For tax years beginning January 1, 2022, it is $2,425 per exemption. If someone else can claim you as a dependent and your Illinois income is $2,425 or less, your exemption allowance is $2,425. If income is greater than $2,425, your exemption allowance is 0. For the 2021 tax year, it is $2,375 per exemption.

What is the form for Illinois withholding payments?

Who must complete Form IL- W-4? If you are an employee, you must complete this form so your employer can withhold the correct amount of Illinois Income Tax from your pay. The amount withheld from your pay depends, in part, on the number of allowances you claim on this form.

What is the Illinois withholding tax rate?

Generally, the rate for withholding Illinois Income Tax is 4.95 percent. For wages and other compensation, subtract any exemptions from the wages paid and multiply the result by 4.95 percent.

How do I know if I am exempt from federal and Illinois income tax withholding?

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify IL IL-W-5-NR without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your IL IL-W-5-NR into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I send IL IL-W-5-NR for eSignature?

Once you are ready to share your IL IL-W-5-NR, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How do I edit IL IL-W-5-NR in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your IL IL-W-5-NR, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

What is IL IL-W-5-NR?

IL IL-W-5-NR is a non-resident personal income tax return form used by individuals who earn income in Illinois but do not reside in the state.

Who is required to file IL IL-W-5-NR?

Individuals who are non-residents of Illinois and have earned income from Illinois sources are required to file the IL IL-W-5-NR.

How to fill out IL IL-W-5-NR?

To fill out IL IL-W-5-NR, non-residents must provide their personal information, report the income earned in Illinois, calculate the taxes owed, and submit the form along with any required payments.

What is the purpose of IL IL-W-5-NR?

The purpose of IL IL-W-5-NR is to ensure that non-residents pay taxes on income earned in Illinois while clarifying their tax obligations to the state.

What information must be reported on IL IL-W-5-NR?

The information that must be reported includes name, address, Social Security number, income earned in Illinois, applicable deductions, and the tax amount owed.

Fill out your IL IL-W-5-NR online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

IL IL-W-5-NR is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.