FAFSA Verification Worksheet V1 - Dependent Student 2015 free printable template

Show details

201516 Dependent Verification Worksheets

Your application has been selected for review in a process called Verification. In this process, the information from your Free

Application for Federal Student

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign federal worksheet - furman

Edit your federal worksheet - furman form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your federal worksheet - furman form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing federal worksheet - furman online

To use our professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit federal worksheet - furman. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FAFSA Verification Worksheet V1 - Dependent Student Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out federal worksheet - furman

How to fill out FAFSA Verification Worksheet V1 - Dependent Student

01

Obtain the FAFSA Verification Worksheet V1 form from your school's financial aid office or website.

02

Fill out the personal information section, including your name, Social Security number, and date of birth.

03

Provide information about your parents, including their names and Social Security numbers.

04

Report your household size; include everyone in your household who lives with you and will receive more than half of their support from your parents.

05

List the names of the colleges you are applying to, if required by your institution.

06

If applicable, complete the part regarding your parents' adjusted gross income (AGI) from their tax returns.

07

If your parents did not file taxes, include the information needed regarding income that they earned, bank accounts, and assets.

08

Sign and date the form where indicated. Make sure your parents also sign if required.

09

Submit the completed worksheet to your school’s financial aid office by the deadline.

Who needs FAFSA Verification Worksheet V1 - Dependent Student?

01

Dependent students who have been selected for verification by their school after submitting the FAFSA.

02

Students whose application has discrepancies or missing information that must be clarified.

03

Families that receive financial aid and must verify income and household size.

Fill

form

: Try Risk Free

People Also Ask about

What is the meaning of tax projection?

A tax projection uses current income and expenses to project taxable income for the entire year. This allows an estimate of tax due. While this service helps set aside money for future taxes owed, it does nothing to actually help save money on taxes.

What form do you fill out for federal withholding?

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4 each year and when your personal or financial situation changes.

What is a form W 2 worksheet?

A W-2 tax form shows important information about the income you've earned from your employer, amount of taxes withheld from your paycheck, benefits provided and other information for the year. You use this form to file your federal and state taxes.

What is a federal tax projection worksheet?

Answer. The Tax Projection Worksheet carries forward a taxpayer's 2022 return data and recalculates income based on next year's law.

How do I prepare a tax projection?

An easy way to conduct year-end tax planning is to print last year's return and write in your estimate of this year's numbers in the margins. You can do a ballpark estimate by comparing this year's numbers to last year's. You can control how detailed you get by adding more or less information on each line entry.

How to fill out a withholding allowance worksheet?

Here's a quick overview of to fill out a Form W-4 in 2023. Step 1: Enter your personal information. Fill in your name, address, Social Security number and tax-filing status. Step 2: Account for multiple jobs. Step 3: Claim dependents, including children. Step 4: Refine your withholdings. Step 5: Sign and date your W-4.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify federal worksheet - furman without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including federal worksheet - furman. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How do I edit federal worksheet - furman in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing federal worksheet - furman and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

Can I edit federal worksheet - furman on an iOS device?

You certainly can. You can quickly edit, distribute, and sign federal worksheet - furman on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

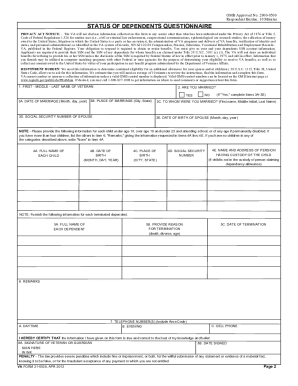

What is FAFSA Verification Worksheet V1 - Dependent Student?

The FAFSA Verification Worksheet V1 - Dependent Student is a form used by students and their parents to verify the information submitted on the Free Application for Federal Student Aid (FAFSA) when selected for verification by the financial aid office.

Who is required to file FAFSA Verification Worksheet V1 - Dependent Student?

Students who are classified as dependent and who have been selected for verification by their college or university financial aid office are required to file the FAFSA Verification Worksheet V1 - Dependent Student.

How to fill out FAFSA Verification Worksheet V1 - Dependent Student?

To fill out the FAFSA Verification Worksheet V1 - Dependent Student, provide the required personal information, report the parent and student income, household size, and number of dependents in college. Make sure to complete all sections fully and sign where indicated.

What is the purpose of FAFSA Verification Worksheet V1 - Dependent Student?

The purpose of the FAFSA Verification Worksheet V1 - Dependent Student is to collect accurate financial information to ensure that the aid awarded is based on verified data, which helps to prevent errors and fraud in the student aid process.

What information must be reported on FAFSA Verification Worksheet V1 - Dependent Student?

The information that must be reported includes the student's and parents' income from the previous tax year, household size, number of family members attending college, and other relevant financial details as required by the financial aid office.

Fill out your federal worksheet - furman online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Federal Worksheet - Furman is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.