Get the free Annual Giving Payroll Deduction - Pacific University - pacificu

Show details

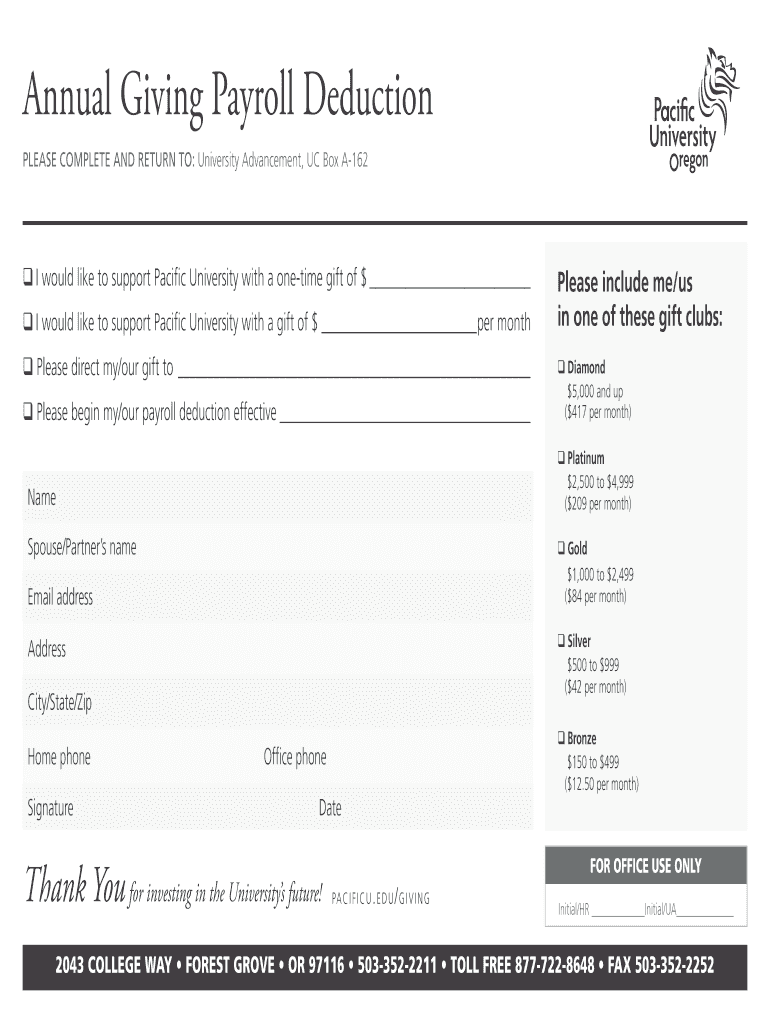

Annual Giving Payroll Deduction PLEASE COMPLETE AND RETURN TO: University Advancement, UC Box A162 I would like to support Pacific University with a onetime gift of $ I would like to support Pacific

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual giving payroll deduction

Edit your annual giving payroll deduction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual giving payroll deduction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annual giving payroll deduction online

To use the services of a skilled PDF editor, follow these steps below:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit annual giving payroll deduction. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual giving payroll deduction

How to Fill Out Annual Giving Payroll Deduction:

01

Obtain the payroll deduction form: Contact your HR department or visit the company's intranet to access the form. It may also be available on the annual giving website.

02

Fill in personal information: Provide your name, employee ID number, department, and contact details. This information is necessary for identification and record-keeping purposes.

03

Select your donation amount: Decide how much you would like to contribute to the annual giving campaign. You may choose a fixed amount or a percentage of your salary.

04

Determine the donation frequency: Specify how often you would like the deduction to be made from your paycheck. Options may include monthly, bi-weekly, or annually.

05

Designate the fund or campaign: Indicate the specific fund or campaign you wish to support through your donation. This could include scholarships, research initiatives, community outreach programs, etc.

06

Sign and date the form: Read through the terms and conditions of the payroll deduction process, and provide your signature and the date to certify your agreement.

07

Submit the form: Return the completed form to the designated HR representative or follow the instructions provided on the form itself.

Who Needs Annual Giving Payroll Deduction:

01

Employees: Annual giving payroll deduction is beneficial for employees who wish to make regular donations to support a cause or campaign important to them. It allows for convenient and consistent contributions directly from their paychecks.

02

Employers/Organizations: Annual giving payroll deduction programs benefit employers as they provide an opportunity to engage employees in philanthropy and create a positive workplace culture. It also offers an efficient way for organizations to collect and distribute charitable donations.

03

Charitable Causes: Annual giving payroll deduction helps support various charitable causes, such as education, healthcare, environmental initiatives, and social services. These funds aid in advancing important missions and making a positive impact in communities.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find annual giving payroll deduction?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the annual giving payroll deduction in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit annual giving payroll deduction straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing annual giving payroll deduction right away.

Can I edit annual giving payroll deduction on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share annual giving payroll deduction on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

Fill out your annual giving payroll deduction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Giving Payroll Deduction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.