Get the free rental car vs mileage reimbursement calculator

Show details

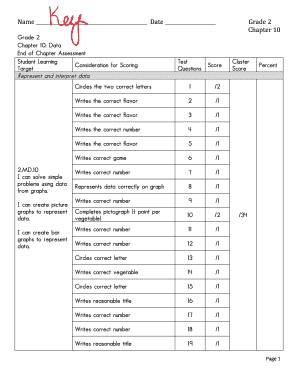

Car Rental vs. Mileage Reimbursement Calculator Input Variables Total Miles to be Traveled 350 2 Total Days in Trip Vehicle Selection (from Dropdown list) * * $49.14 Daily Rate in Effect $3.20 * Cost

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rental car vs mileage

Edit your rental car vs mileage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rental car vs mileage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rental car vs mileage online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rental car vs mileage. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rental car vs mileage

How to fill out rental car vs mileage:

01

Start by gathering all the necessary information, including the initial mileage of the rental car and the date and time of pickup.

02

Determine whether the rental car company charges for mileage or offers unlimited mileage. This will affect how you track and report the mileage.

03

During your rental period, keep track of the mileage each time you use the car. You can do this manually by writing down the starting and ending mileage for each trip or by using a mileage tracking app.

04

If the rental car company charges for mileage, make sure to calculate and record the total mileage for each trip or day.

05

When returning the rental car, note the final mileage and the date and time of return. This will be used to calculate the total mileage for the rental period.

06

Fill out any necessary forms or paperwork provided by the rental car company regarding mileage. This may include indicating the starting mileage, ending mileage, and any additional fees incurred.

07

Finally, make sure to return the rental car on time to avoid any late fees or additional charges.

Who needs rental car vs mileage:

01

Individuals who are renting a car for personal use and want to keep track of the mileage for their own record-keeping purposes.

02

Business professionals who need to report their mileage for reimbursement or tax purposes.

03

Companies that provide rental cars for their employees and need to track the mileage for budgeting and accounting purposes.

04

Car rental companies that offer different mileage options to their customers and need to accurately bill for the mileage used.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the rental car vs mileage electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your rental car vs mileage in seconds.

How do I edit rental car vs mileage straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing rental car vs mileage.

How do I complete rental car vs mileage on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your rental car vs mileage. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is rental car vs mileage?

Rental car vs mileage refers to the comparison between using a rental car for transportation versus calculating the mileage of a personal vehicle.

Who is required to file rental car vs mileage?

Individuals who use both rental cars and personal vehicles for business or official purposes are required to file rental car vs mileage.

How to fill out rental car vs mileage?

To fill out rental car vs mileage, individuals need to keep track of the usage of both rental cars and personal vehicles for business or official purposes and compare the costs and mileage.

What is the purpose of rental car vs mileage?

The purpose of rental car vs mileage is to determine the most cost-effective and efficient mode of transportation for business or official purposes.

What information must be reported on rental car vs mileage?

Information such as the dates of usage, cost of rental cars, mileage of personal vehicles, and the purpose of transportation must be reported on rental car vs mileage.

Fill out your rental car vs mileage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rental Car Vs Mileage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.