Get the free household income statement

Show details

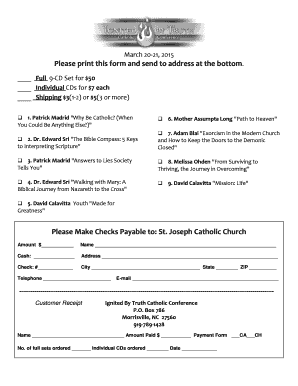

HOUSEHOLD INCOME STATEMENT INCOME SOURCE INCOME AMOUNT FREQUENCY MONTHLY TOTAL Family Support Gifts Net Pay from Jobs Tips Scholarships Stipend/Allowance Interest Earned Other Other Other Total Monthly

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign household income statement

Edit your household income statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your household income statement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit household income statement online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit household income statement. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out household income statement

Point by point on how to fill out household income statement:

01

Gather all necessary financial documents: Start by collecting all relevant financial documents such as pay stubs, employment contracts, bank statements, investment records, rental income statements, and any other sources of income.

02

Calculate your total income: Add up all your sources of income to determine your total household income. This includes salaries, wages, bonuses, tips, dividends, interest, rental income, alimony, and any other forms of income.

03

Deduct allowable deductions: Identify any deductions that you are eligible for and subtract them from your total income. These deductions may include business expenses, self-employment taxes, retirement account contributions, student loan interest, alimony paid, or any other applicable deductions.

04

Determine your adjusted gross income (AGI): Subtract the total deductions from your total income to determine your AGI. This is an important figure used to calculate your tax liability and eligibility for certain tax credits or benefits.

05

Report other relevant financial information: Along with your income, you may need to provide additional financial details on your household income statement. This may include information on your spouse's income if applicable, any government assistance received, or other sources of financial support.

06

Update relevant personal information: Ensure that all personal details such as your name, address, social security number, and other identifying information are accurate and up to date.

Who needs a household income statement?

01

Individuals applying for financial assistance: Many government agencies, educational institutions, or non-profit organizations require a household income statement as part of their application process for financial assistance programs. This may include scholarships, grants, loans, or other forms of aid.

02

Individuals applying for housing: When applying for rental properties or seeking mortgage loans, landlords and lenders may request a household income statement to assess your ability to meet rent or mortgage payments.

03

Individuals applying for certain benefits or subsidies: Some individuals may need to provide a household income statement to qualify for certain benefits or subsidies like food stamps, healthcare programs, or energy assistance programs.

04

Individuals filing taxes: While not a standalone document, the information gathered for a household income statement is vital when filing taxes. It helps accurately report your income, claim deductions, and determine your tax liability or eligibility for tax credits.

In summary, a household income statement is needed by individuals applying for financial assistance, housing, benefits, subsidies, or when filing taxes. It is important to gather all relevant financial documents, calculate total income, deduct allowable deductions, determine AGI, report other financial information, and update personal details when filling out a household income statement.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my household income statement in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your household income statement and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send household income statement to be eSigned by others?

When you're ready to share your household income statement, you can send it to other people and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail. You can also notarize your PDF on the web. You don't have to leave your account to do this.

Can I create an eSignature for the household income statement in Gmail?

It's easy to make your eSignature with pdfFiller, and then you can sign your household income statement right from your Gmail inbox with the help of pdfFiller's add-on for Gmail. This is a very important point: You must sign up for an account so that you can save your signatures and signed documents.

What is household income statement?

A household income statement is a financial document that summarizes the total income earned by all members of a household over a specific period. It includes various sources of income such as wages, salaries, benefits, and any other income.

Who is required to file household income statement?

Typically, individuals or families seeking financial assistance, benefits, or housing support are required to file a household income statement. This may include applicants for government assistance programs, loans, or tax credits.

How to fill out household income statement?

To fill out a household income statement, gather all sources of income for every household member, including pay stubs, tax returns, and statements from benefits. Complete the form by listing each source of income and the corresponding amounts, ensuring that all information is accurate and up to date.

What is the purpose of household income statement?

The purpose of a household income statement is to provide a clear overview of the financial situation of a household, which is essential for determining eligibility for assistance programs, loans, and other financial services.

What information must be reported on household income statement?

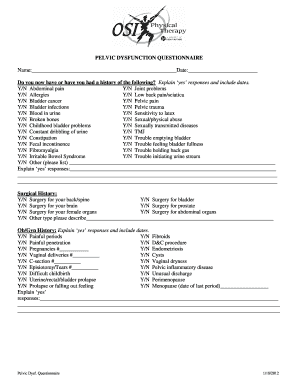

The household income statement must report total income from all sources such as wages, salaries, self-employment income, rental income, unemployment benefits, child support, social security benefits, and any other relevant income. It should also include details such as household size and the relationship of each income earner.

Fill out your household income statement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Household Income Statement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.