Get the free Rental Amt - snhu

Show details

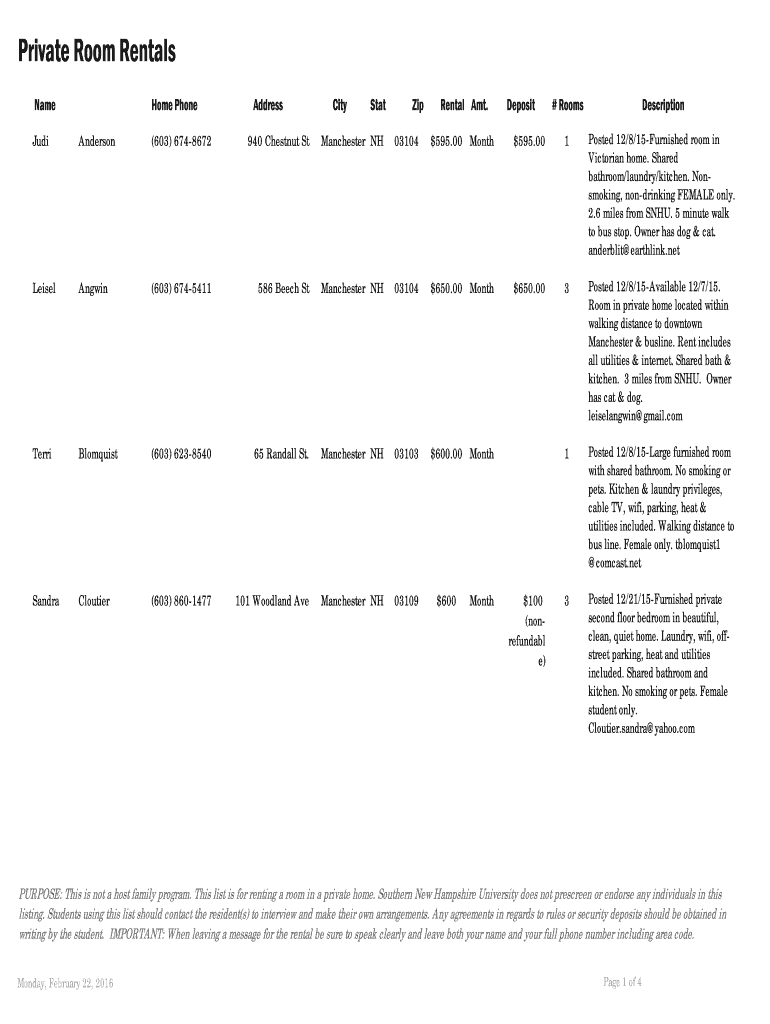

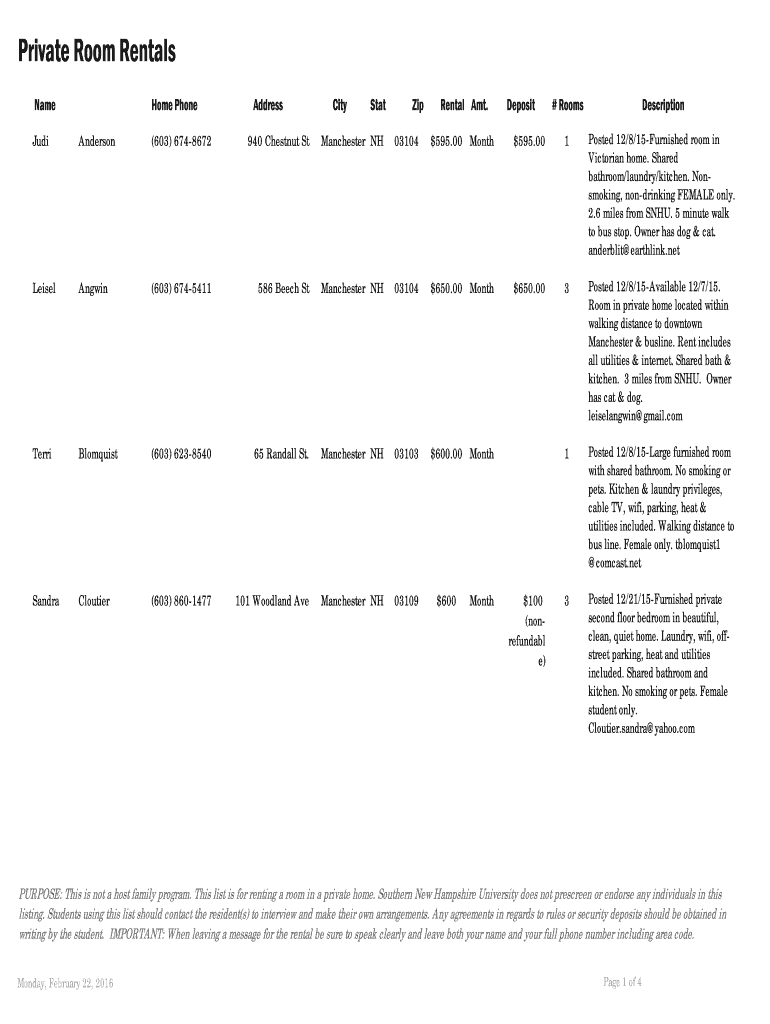

Private Room Rentals Name Home Phone Address City Stat Zip Rental Amt. Deposit # Rooms Description Audi Anderson (603) 6748672 940 Chestnut St Manchester NH $03104595.00 Month $595.00 1 Posted 12/8/15Furnished

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rental amt - snhu

Edit your rental amt - snhu form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rental amt - snhu form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rental amt - snhu online

To use the services of a skilled PDF editor, follow these steps below:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit rental amt - snhu. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rental amt - snhu

How to fill out rental amt:

01

Start by entering the date of the rental agreement. This is important for record-keeping purposes.

02

Next, indicate the names of the parties involved in the rental agreement. This includes the landlord and the tenant(s).

03

Specify the property address for which the rental agreement is being created. This ensures that both parties are on the same page regarding the location of the rental property.

04

Determine the duration of the rental agreement. This includes the start and end dates of the lease period.

05

Include the rental amount that the tenant is obligated to pay. This should be clearly stated in both numerical and written formats to avoid any confusion.

06

Specify the frequency of rental payments. This could be monthly, quarterly, or any other agreed-upon interval.

07

Outline any additional fees or charges associated with the rental agreement. This may include security deposits, late payment penalties, or pet fees.

08

Include any special terms or conditions that both parties have agreed upon. This could include restrictions on subletting, pet policies, or maintenance responsibilities.

09

Sign and date the rental agreement. This indicates that both the landlord and tenant have read and agreed to the terms stated.

Who needs rental amt:

01

Landlords: Rental amt is essential for landlords as it helps them determine the amount of rent to charge their tenants. It also serves as a legal document that outlines the terms and conditions of the rental agreement.

02

Tenants: Rental amt is beneficial for tenants as it states the exact amount they need to pay for rent. It provides clarity on their financial obligations and helps them plan their budget accordingly.

03

Property managers: Rental amt is essential for property managers as they are responsible for overseeing rental properties on behalf of the landlord. They need rental amt to accurately calculate and collect rent payments from tenants.

04

Real estate agents: Rental amt is relevant for real estate agents who assist landlords and tenants in finding suitable rental properties. They need to understand the rental amt to help their clients make informed decisions.

05

Legal professionals: Rental amt can be useful for legal professionals, such as lawyers or paralegals, who deal with rental disputes or assist in drafting rental agreements. They need rental amt to ensure all legal requirements are met and to protect the rights of their clients.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get rental amt - snhu?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific rental amt - snhu and other forms. Find the template you want and tweak it with powerful editing tools.

How do I fill out rental amt - snhu using my mobile device?

Use the pdfFiller mobile app to complete and sign rental amt - snhu on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I edit rental amt - snhu on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share rental amt - snhu on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is rental amt?

Rental amount is the payment made by a tenant to a landlord in exchange for the use of a property or space.

Who is required to file rental amt?

Individuals or businesses who receive rental income are required to report it on their tax return.

How to fill out rental amt?

Rental income should be reported on Schedule E of Form 1040.

What is the purpose of rental amt?

The purpose of reporting rental income is to ensure proper income tax is paid on the earnings.

What information must be reported on rental amt?

The amount of rental income received, any expenses related to the rental property, and depreciation should be reported.

Fill out your rental amt - snhu online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rental Amt - Snhu is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.