Get the free Major Insurance Management

Show details

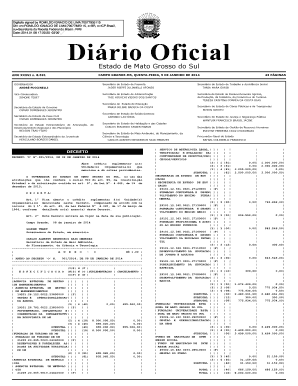

M.B.A. Degree Major: Insurance Management Student Name 2014/2015 Catalog S. SSN/I'd No S. Phone (w) (h) Previous Degree/Date This program plan is valid only if the student registers for, and completes,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign major insurance management

Edit your major insurance management form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your major insurance management form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing major insurance management online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit major insurance management. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out major insurance management

How to fill out major insurance management:

01

Review your insurance policies: Start by gathering all your insurance policies and thoroughly reviewing them. This includes policies for health, property, auto, and any other relevant insurances. Familiarize yourself with the coverage details and terms of each policy.

02

Assess your insurance needs: Understand your current and future insurance needs. Consider factors such as your age, health condition, assets, liabilities, and family situation. Identify any gaps in coverage or areas where you might be over-insured.

03

Consult with insurance professionals: If you are unsure about certain aspects of your insurance management, it is always helpful to seek guidance from insurance professionals. They can provide expert advice tailored to your specific situation and help you make informed decisions.

04

Update your policies: Update your insurance policies based on your assessment and consultations. This may involve making changes to coverage limits, beneficiaries, or adding new policies if necessary. Ensure that all the information provided in your policies is accurate and up to date.

05

Regularly review and adjust: Insurance needs can change over time, so it is important to regularly review your policies and make adjustments as needed. This might involve increasing coverage, decreasing coverage, or switching to a different provider if better options are available.

Who needs major insurance management?

01

Business owners: Entrepreneurs and business owners need major insurance management to protect their assets, employees, and themselves from potential risks and liabilities associated with their business operations.

02

Homeowners: Owning a home comes with various risks such as property damage, theft, or liability claims. Proper insurance management is crucial for homeowners to safeguard their investment and protect themselves financially in case of unexpected events.

03

Families: Families with dependents and financial responsibilities should prioritize major insurance management. Life insurance, health insurance, and disability insurance are essential for providing financial security and protecting loved ones in case of unfortunate circumstances.

04

Individuals with high-value assets: People who own valuable assets like luxury cars, expensive artwork, or high-end jewelry should consider major insurance management to ensure adequate coverage in case of theft, loss, or damage.

05

Those with specific professional risks: Professionals such as doctors, lawyers, or financial advisors may require specialized insurance coverage to protect against malpractice claims, errors and omissions, or other professional liabilities.

Remember, major insurance management is crucial for everyone as it provides financial protection and peace of mind when facing unexpected events or risks. It is important to regularly assess and update your insurance policies to ensure adequate coverage for your needs.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find major insurance management?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the major insurance management in seconds. Open it immediately and begin modifying it with powerful editing options.

Can I create an electronic signature for signing my major insurance management in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your major insurance management and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out the major insurance management form on my smartphone?

On your mobile device, use the pdfFiller mobile app to complete and sign major insurance management. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

What is major insurance management?

Major insurance management involves overseeing the activities related to insurance policies, claims processing, risk assessment, and underwriting in a company or organization.

Who is required to file major insurance management?

Insurance companies, brokers, and agents are required to file major insurance management.

How to fill out major insurance management?

Major insurance management can be filled out by providing detailed information about insurance policies, claims, risks, and underwriting activities within the specified reporting period.

What is the purpose of major insurance management?

The purpose of major insurance management is to ensure compliance with regulatory requirements, track insurance activities, assess risks, and optimize underwriting processes.

What information must be reported on major insurance management?

Information such as policy details, claims data, risk assessment reports, and underwriting decisions must be reported on major insurance management.

Fill out your major insurance management online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Major Insurance Management is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.