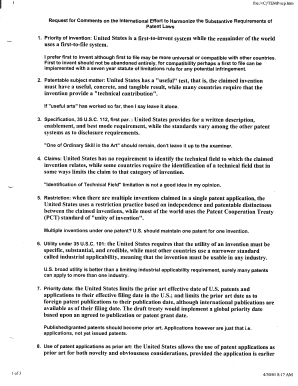

Get the free Independent Contractor Form - Central State University

Show details

Independent Contractor (IC) Instructional Checklist Prior to the start of a project, departments and independent contractors must sign the university's Professional Services Agreement (PSA). To be

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign independent contractor form

Edit your independent contractor form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your independent contractor form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing independent contractor form online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit independent contractor form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out independent contractor form

How to fill out an independent contractor form:

01

Start by obtaining the necessary form: You can usually find independent contractor forms on the websites of government agencies or through professional organizations. You may also obtain them from the individuals or companies that are hiring your services.

02

Understand the information required: Read through the form carefully to understand the information you need to provide. Common details include your name, contact information, nature of work, payment terms, and tax-related information.

03

Gather your personal information: Collect all the necessary personal information, such as your full name, address, phone number, and email address. Ensure that this information is accurate and up to date.

04

Provide your business information: If you operate your own business, include the name, address, and contact details of your company. If you don't have a registered business, leave this section blank.

05

State the nature of your work: Clearly describe the type of services you will be providing as an independent contractor. Be specific and include any relevant details about the scope of work, specialties, or expertise you bring to the job.

06

Specify the payment terms: Clearly outline how and when you will be paid for your services. Include details on hourly rates, fixed fees, or any other agreed-upon payment arrangements. If you have any additional terms regarding payment, such as late fees or discounts, include those as well.

07

Review and sign the form: Once you have filled out all the necessary information, carefully review the form for any errors or missing details. Make sure everything is accurate and complete before signing the form. By signing, you acknowledge that the information you provided is true and that you understand and agree to the terms outlined in the form.

Who needs an independent contractor form?

01

Businesses hiring independent contractors: Companies or organizations that engage the services of independent contractors need to have these forms filled out by the contractors they hire. This helps establish the nature of the working relationship and provides necessary details for tax and legal purposes.

02

Freelancers and self-employed individuals: Independent contractors who provide services to clients as part of their business operations are also required to fill out these forms. It ensures that they are properly classified and distinguishes them from regular employees.

03

Government agencies and tax authorities: Independent contractor forms are important for government agencies and tax authorities to monitor and regulate the proper classification of workers. These forms assist in determining taxation liabilities, following labor laws, and preventing misclassification of employees.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit independent contractor form in Chrome?

Install the pdfFiller Google Chrome Extension to edit independent contractor form and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I edit independent contractor form straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing independent contractor form.

Can I edit independent contractor form on an iOS device?

You certainly can. You can quickly edit, distribute, and sign independent contractor form on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

What is independent contractor form?

Independent contractor form is a form used by businesses to report payments made to non-employees for services rendered.

Who is required to file independent contractor form?

Businesses are required to file independent contractor forms if they have paid an independent contractor $600 or more for services during the tax year.

How to fill out independent contractor form?

To fill out an independent contractor form, you will need the contractor's name, address, tax identification number, and the total amount paid to them during the tax year. This information is typically reported on Form 1099-NEC or Form 1099-MISC.

What is the purpose of independent contractor form?

The purpose of the independent contractor form is to report income paid to non-employees for tax purposes.

What information must be reported on independent contractor form?

The independent contractor form must include the contractor's name, address, tax identification number, and the total amount paid to them during the tax year.

Fill out your independent contractor form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Independent Contractor Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.