Get the free Application for HST 499H

Show details

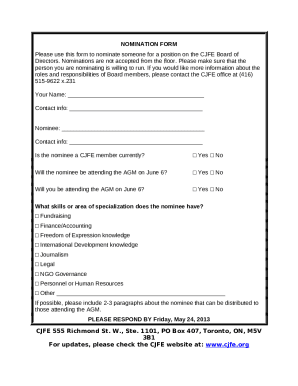

This document is an application form for a specific course (HST 499H) at Michigan State University's Department of History, requiring the completion of various sections before approval signatures

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for hst 499h

Edit your application for hst 499h form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for hst 499h form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for hst 499h online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for hst 499h. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for hst 499h

How to fill out Application for HST 499H

01

Obtain the Application for HST 499H form from the university website or departmental office.

02

Fill in your personal details including name, student ID, and contact information.

03

Provide a brief description of your proposed research project or topic.

04

List any relevant courses or experiences that qualify you for HST 499H.

05

Obtain the required signatures from your faculty supervisor and any other necessary parties.

06

Review your application for completeness and accuracy.

07

Submit the application by the specified deadline to the appropriate office or online portal.

Who needs Application for HST 499H?

01

Undergraduate students seeking to enroll in the HST 499H research course.

02

Students who have completed the prerequisites for HST 499H.

03

Individuals looking to conduct independent research projects under faculty supervision.

Fill

form

: Try Risk Free

People Also Ask about

How to apply for HST rebate on new home in Ontario?

To recover the GST or federal part of the HST, fill out Form GST191, GST/HST New Housing Rebate Application for Owner-Built Houses and Form GST191-WS, Construction Summary Worksheet. To recover the provincial part of the HST (if your house is in Ontario), fill out Form RC7191 ON, GST191 Ontario Rebate Schedule.

How to claim VAT in Canada?

How to get a VAT refund in 3 simple steps? Application form. Get a Tax Refund Application Form from the retailer. Customs check. At customs, present your passport, VAT form(s), VAT invoice(s) and the tax-free goods. Refund approved. If all the criteria is met, customs will approve your form.

How much does it cost to get a HST number in Ontario?

Registration is free. It never expires, unless you want to close a business number account. GST/HST registrants will be required to collect 13% HST (in Ontario) on all sales and services. This money must be forwarded to the CRA.

How do I get my HST back from Canada?

If you are a Canadian resident and you file an annual tax return (even if you don't have any income to report) you will be automatically considered for the GST/HST credit. If you are a newcomer to Canada, you will have to fill out a form and submit it to a local tax centre.

Can tourists claim back GST in Canada?

If you are a non-resident visitor to Canada, you cannot claim a rebate of the GST/HST that you paid for purchases made in Canada.

How to claim HST Canada?

How to claim the GST/HST credit If you have children, you'll need the Canada Child Benefits Application, or Form RC66. If you do not have children, you'll need the GST/HST Credit Application for Individuals Who Become Residents of Canada, or Form RC151.

How to apply for an Ontario sales tax credit?

Ontario sales tax credit (OSTC) You do not need to apply for the OSTC when you file your tax return. The Canada Revenue Agency will determine your eligibility and tell you if you are entitled to receive the credit. For more information about the OSTC , see Booklet RC4210, GST/HST Credit.

Is HST recoverable in Canada?

Input tax credit (ITC) means a credit that GST/HST registrants can claim to recover the GST/HST paid or payable for property or services they acquired, imported into Canada, or brought into a participating province for use, consumption, or supply in the course of their commercial activities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for HST 499H?

The Application for HST 499H is a form used to apply for a health service tax exemption in certain jurisdictions.

Who is required to file Application for HST 499H?

Individuals or businesses providing specific health services or products may be required to file the Application for HST 499H to claim an exemption from the health service tax.

How to fill out Application for HST 499H?

To fill out the Application for HST 499H, you will need to provide your personal information, details about the services/products offered, and any required supporting documentation.

What is the purpose of Application for HST 499H?

The purpose of the Application for HST 499H is to allow eligible entities to apply for a tax exemption pertaining to health services so that they can reduce their tax burden.

What information must be reported on Application for HST 499H?

The information that must be reported on the Application for HST 499H includes the applicant's name, contact information, nature of the services/products, and any relevant tax identification numbers.

Fill out your application for hst 499h online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Hst 499h is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.