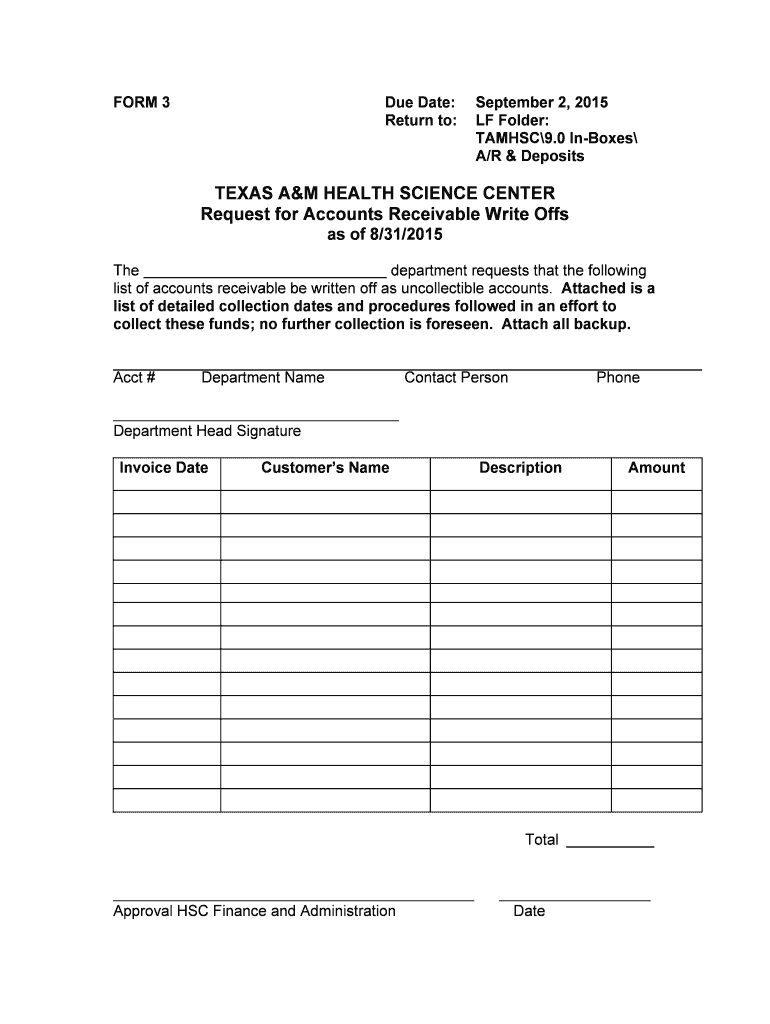

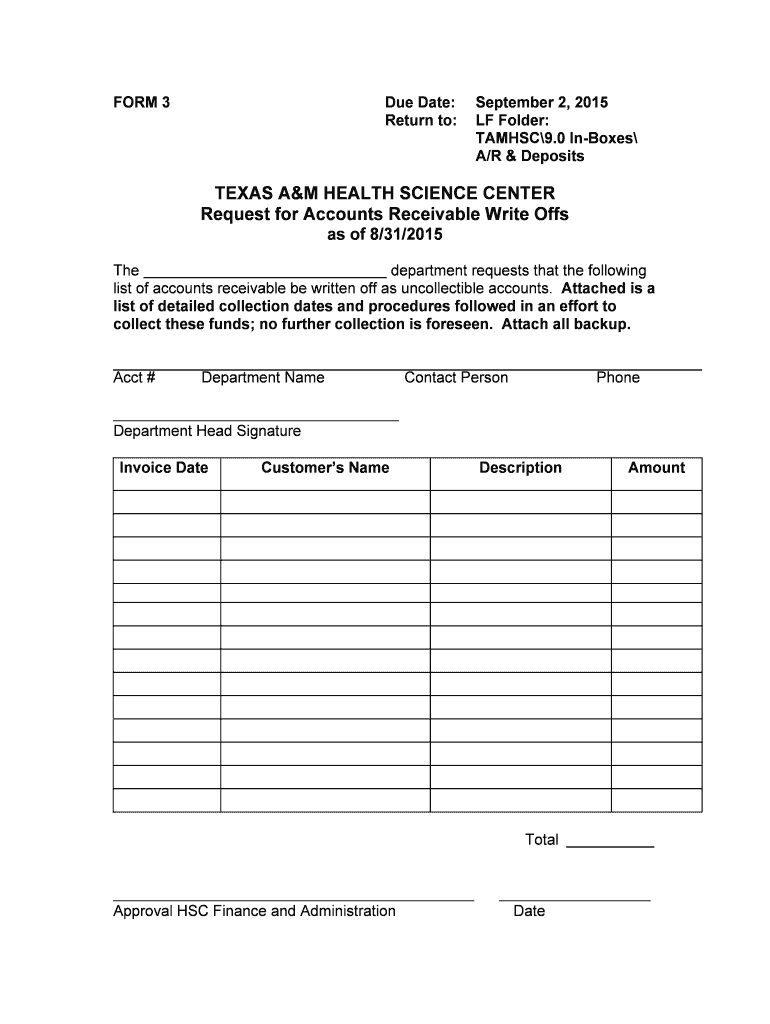

Get the free Accounts Receivable Write Off Accounts Receivable Write Off - tamhsc

Show details

Title: Accounts Receivable Write Off Author: merchant Subject: Accounts Receivable Write Off Keywords: Accounts Receivable Write Off Created Date: 7/16/2015 11:37:08 AM

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounts receivable write off

Edit your accounts receivable write off form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounts receivable write off form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit accounts receivable write off online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit accounts receivable write off. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounts receivable write off

How to fill out accounts receivable write off:

01

Start by gathering all relevant information: Before filling out the accounts receivable write off form, make sure to gather all necessary information related to the outstanding invoice or debt. This may include the customer's name, invoice number, amount owed, and any supporting documentation such as emails or communication records.

02

Verify the validity of the debt: Before proceeding with writing off the accounts receivable, it's important to verify the validity of the debt. Ensure that all attempts to collect the outstanding amount have been made, and there are no more feasible options for recovering the debt.

03

Determining the amount to be written off: The next step is to determine the amount that needs to be written off. This is usually the outstanding balance that the customer is unable or unwilling to pay. Consult with the finance department or relevant individuals to determine the appropriate amount to be written off.

04

Complete the necessary paperwork: Fill out the accounts receivable write off form with accurate and detailed information. Include the customer's name, invoice number, date, and the amount being written off. Be sure to follow any specific instructions provided by your organization or accounting department.

05

Obtain necessary approvals: Depending on the organization's policies and procedures, you may need to seek approvals for the accounts receivable write off. This could involve getting approval from a supervisor, manager, or finance department. Be sure to follow the internal guidelines and regulations set by your organization.

06

Documentation and record-keeping: After completing the accounts receivable write off form, make copies for your records and submit the original to the appropriate department or individual. Keep a record of all the documentation related to the write-off for future reference and audit purposes.

07

Follow-up and reconciliation: After the accounts receivable write off has been processed, it's important to follow up and reconcile any remaining balances or discrepancies. Ensure that the write-off is properly reflected in the company's financial statements and reports.

Who needs accounts receivable write off:

01

Businesses and organizations: Businesses of all sizes and industries may encounter situations where they need to write off accounts receivable. This can include unpaid invoices, bad debts, or uncollectible debts. Properly documenting and writing off these accounts is essential for maintaining accurate financial records.

02

Accounting and finance departments: Accounting and finance departments are primarily responsible for managing accounts receivable and writing off any uncollectible amounts. They ensure that the proper procedures are followed and that the write-offs are accurately recorded in the organization's financial statements.

03

Auditors and regulatory bodies: Auditors and regulatory bodies may review an organization's accounts receivable write off policies and procedures to ensure compliance with accounting standards and regulations. They rely on accurate and transparent financial reporting, which includes appropriately handling uncollectible debts.

Overall, accounts receivable write off is a necessary process for businesses to maintain accurate financial records, manage bad debts, and ensure compliance with accounting standards and regulations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete accounts receivable write off online?

With pdfFiller, you may easily complete and sign accounts receivable write off online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

How do I make edits in accounts receivable write off without leaving Chrome?

Install the pdfFiller Google Chrome Extension to edit accounts receivable write off and other documents straight from Google search results. When reading documents in Chrome, you may edit them. Create fillable PDFs and update existing PDFs using pdfFiller.

How do I complete accounts receivable write off on an Android device?

Complete accounts receivable write off and other documents on your Android device with the pdfFiller app. The software allows you to modify information, eSign, annotate, and share files. You may view your papers from anywhere with an internet connection.

Fill out your accounts receivable write off online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounts Receivable Write Off is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.